FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

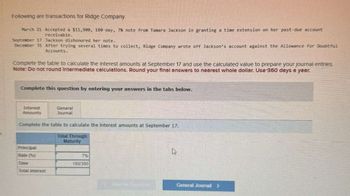

Transcribed Image Text:Following are transactions for Ridge Company.

March 21 Accepted a $11,900, 180-day, 7 % note from Tamara Jackson in granting a time extension on her past-due account

receivable.

September 17 Jackson dishonored her note.

December 31 After trying several times to collect, Ridge Company wrote off Jackson's account against the Allowance for Doubtful

Accounts.

Complete the table to calculate the Interest amounts at September 17 and use the calculated value to prepare your journal entries.

Note: Do not round Intermediate calculations. Round your final answers to nearest whole dollar. Use 360 days a year.

Complete this question by entering your answers in the tabs below.

Interest

Amounts

General

Journal

Complete the table to calculate the interest amounts at September 17.

Total Through

Principal

Maturity

Rate (%)

7%

Time

180/360

Total interest

4

General Journal >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On August 2, Jun Co. receives a $7,300, 90-day, 12% note from customer Ryan Albany as payment on his $7,300 account. 1. Compute the maturity date for the above note. multiple choice October 29 October 30 October 31 November 1 November 2 2. Prepare Jun’s journal entry for August 2. 1 Record receipt of note on account.arrow_forwardHaresharrow_forwardThe activity date, company, and amount for a credit card bill are shown below. The due date of the bill is July 10. On June 10, there was an unpaid balance of $987.81. Find the finance charge if the interest rate is 1.9% per month. (Round your answer to the nearest cent.) $ X Activity Date June 10 June 11 June 12 June 15 June 16 June 20 June 22 June 28 June 30 July 2 July 8 Company Unpaid balance Jan's Surf Shop Albertson's The Down Shoppe NY Times Sales Cardiff Delicatessen The Olde Golf Mart Lee's Hawaiian Restaurant City Food Drive Credit card payment Safeway Stores Amount 987.81 156.33 45.61 59,84 18.54 23.09 126.92 41.78 100.00 -1000.00 161.38 4arrow_forward

- On May 10, 20X1, Washington Company received a 90-day, 8 percent, $8,400 interest-bearing note from Whitehead Company in settlement of Whitehead's past-due account. On June 30, Washington discounted this note at City Bank and Trust. The bank charged a discount rate of 13 percent. On August 8, Washington received a notice that Whitehead had paid the note and the interest on the due date. Required: Prepare the entries in general journal form to record these transactions. Analyze: If the company prepared a balance sheet on July 31, 20X1, how should Notes Receivable-Discounted be presented on the statement?arrow_forwardOn December 1, 2017, Marin, Inc. assigns $ 3,380,000 of its accounts receivable to Sweet Acacia Bank as collateral for a $ 2,028,000 note. The bank assesses a finance charge of 2% of the receivables assigned and interest on the note of 8%. Prepare the December 1 journal entries for both Marin and Sweet Acacia. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Date Account Titles and Explanation Debit Credit Marin, Inc. December 1 Sweet Acacia Bank December 1arrow_forwardProvide Answerarrow_forward

- Selkirk Company obtained a $24,000 note receivable from a customer on January 1, 2021. The note, along with interest at 8%, is due on July 1, 2021. On February 28, 2021, Selkirk discounted the note at Unionville Bank. The bank's discount rate is 10%. Required: Prepare the journal entries required on February 28, 2021, to accrue interest and to record the discounting for Selkirk. Assume that the discounting is accounted for as a sale. (do not round intermediate calculations. If no entry is required for a transaction/event, select "No journal entry required" in the first account field.). Tab 1) Record the accrued interest earned. Tab 2) Record the discounting of note receivable. Date General Journal Debit Credit February 28, 2021 ____________________________ ___________ ____________ _____________________________ ____________ ____________…arrow_forwardanswer in text form please (without image), Note: .Every entry should have narration pleasearrow_forwardJames Company uses the allowance method for uncollectible accounts. James Company accepted a $8,500, 6%, 90-day note dated May 16, from Davis Company in exchange for its past-due account receivable. Make the necessary general journal entries for James Company on May 16 and the August 14 maturity date, assuming that the: a. Note is honored. b. Note is dishonored.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education