FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

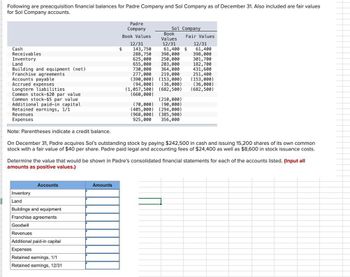

Transcribed Image Text:Following are preacquisition financial balances for Padre Company and Sol Company as of December 31. Also included are fair values

for Sol Company accounts.

Cash

Receivables

Inventory

Land

Building and equipment (net)

Franchise agreements

Accounts payable

Accrued expenses

Longterm liabilities

Common stock-$20 par value

Common stock-$5 par value

Additional paid-in capital

Retained earnings, 1/1

Revenues

Expenses

Note: Parentheses indicate a credit balance.

Padre

Company

Book

Book Values

Sol Company

Fair Values

Values

12/31

12/31

12/31

$

143,750

61,400 $

61,400

288,750

398,000

398,000

625,000 250,000

301,700

655,000 203,000

182,700

730,000

364,000

431,600

277,000

(390,000) (153,000)

(94,000)

219,000

251,400

(153,000)

(36,000)

(36,000)

(682,500)

(1,057,500) (682,500)

(660,000)

(210,000)

(70,000) (90,000)

(405,000) (294,000)

(968,000) (385,900)

925,000 356,000

On December 31, Padre acquires Sol's outstanding stock by paying $242,500 in cash and issuing 15,200 shares of its own common

stock with a fair value of $40 per share. Padre paid legal and accounting fees of $24,400 as well as $8,600 in stock issuance costs.

Determine the value that would be shown in Padre's consolidated financial statements for each of the accounts listed. (Input all

amounts as positive values.)

Accounts

Inventory

Land

Buildings and equipment

Franchise agreements

Goodwill

Revenues

Additional paid-in capital

Expenses

Retained earnings, 1/1

Retained earnings, 12/31

Amounts

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 9 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Solar Electric Inc. Balance Sheet 32 Marks ACB As at December 31, 2023 Account Title Debit Credit Assets Current Assets Cash 100,649 Accounts Receivable 35,860 Interest Rceivable 9,113 Prepaid Insurance 7,370 Short-Term Investment- Citi Inc 237,000 Short-Term Investment- Bonds 135,000 Inventory 90,640 Valuation Allowance for Fair Value Adjustment 50,700 Total Current Assets 666,332 Non-current Assets Investment in HSBC Inc. Common Shares 503,840 Long-Term Investment- Bond 145,000 Property, Plant & Equipment 280,000 Accumulated Depreciation 86,000 Total Non-Current Assets 842,840 Total Assets 1,509,172 Liabilities Current Liabilities Accounts Payable 212,400 Interest Payable 31,167 Unearned Revenue 21,000 Total Current Liabilities 264,567 Long-Term Liabilities Bonds Payable 340,000 Discount on Bonds Payable 15,741 Bank Loan 225,000 Total-Long Term Liabilities 549,259 Total Liabilities 813,826 Shareholders Equity Common Shares 362,000 Preferred Shares 80,000 Retained Earnings 348,385…arrow_forwardPrivett Company Line Item Description Amount Accounts payable $27,815 Accounts receivable 70,978 Accrued liabilities 6,525 Cash 22,970 Intangible assets 43,640 Inventory 74,446 Long-term investments 100,209 Long-term liabilities 78,528 Marketable securities 34,768 Notes payable (short-term) 25,264 Prepaid expenses 2,065 Property, plant, and equipment 646,687 Based on the data for Privett Company, what is the amount of working capital? a. $205,227 b. $995,763 c. $128,716 d. $145,623arrow_forwardRequired: Compute the asset turnover ratio for 2021. (Re Asset turnover ratioarrow_forward

- The following financial statements apply to Adams Company: ADAMS COMPANY Income Statements for the Years Ending December 31 Year 1 $180,400 Revenues Expenses Cost of goods sold Selling expenses General and administrative expenses Interest expense Income tax expense Total expenses Net income Assets Current assets Cash Marketable securities Accounts receivable Inventories Prepaid expenses Total current assets Plant and equipment (net) Intangibles Total assets Liabilities and Stockholders Equity Liabilities Current liabilities Accounts payable Other Total current liabilities Bonds payable Total liabilities $ 220,800 Stockholders equity Common stock (49,000 shares) 124, 600 20,200 10,000 2.100 20,400 177,300 $ 43,500 ADAMS COMPANY Balance Sheets As of December 31 F Retained earnings Total stockholders equity Total liabilities and stockholders' equity 102, 100 18.200 9,000 2,100 17,600 149,000 $ 31,400 $ 5,100 1,800 36,000 101, 200 4,800 148,900 107,000 20,600 $ 276,500 $38,200 16,500…arrow_forwardHarding Company Accounts payable $34,411 Accounts receivable 74,965 Accrued liabilities 6,258 Cash 21,193 Intangible assets 37,609 Inventory 78,910 Long-term investments 111,094 Long-term liabilities 73,297 Notes payable (short-term) 28,248 Property, plant, and equipment 613,888 Prepaid expenses 2,504 Temporary investments 36,411 Based on the data for Harding Company, what is the amount of quick assets?arrow_forward3arrow_forward

- The balance sheet of RS Corp. as at December 31, 1979 contained the following current assets: Cash 96, 578 Accounts receivable 452,800 Inventories 376,300 925,678 An examination of the accounts disclosed that the accounts receivable consisted of the following items: Trade customers’ accounts 357,742 Due from employees – current 43,658 Equity in 50,000 of uncollected accounts receivable assigned under guaranty 16,000 Selling price of merchandise on consignment at 140% of cost and not sold 50,400 Allowance for doubtful accounts…arrow_forwardPrivett Company Accounts payable $26,195 Accounts receivable 62,336 Accrued liabilities 6,328 Cash 23,939 Intangible assets 37,985 Inventory 74,958 Long-term investments 107,215 Long-term liabilities 74,188 Marketable securities 32,601 Notes payable (short-term) 26,240 Property, plant, and equipment 660,621 Prepaid expenses 1,525 Based on the data for Privett Company, what is the quick ratio, rounded to one decimal point? Oa. 2 Оb. 17 Ос. 1 Od. 3.3arrow_forwardDhapaarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education