FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

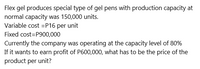

Transcribed Image Text:Flex gel produces special type of gel pens with production capacity at

normal capacity was 150,000 units.

Variable cost =P16 per unit

Fixed cost=P900,000

Currently the company was operating at the capacity level of 80%

If it wants to earn profit of P600,000, what has to be the price of the

product per unit?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A company that manufactures monitors has fixed costs of $82,000 per annum. The variable costs are 30% of sales and the profit is $63,000. When the selling price was reduced by 10%, the sales volume increased by 25%. a. What was the original sales revenue? Round to the nearest cent b. What were the original variable costs? -> -> SAVE PROGRESS SUBMIT ASSI acerarrow_forwardBeckett Corporation has nexus with States A and B. Apportionable income for the year totals $1,190,000 . Beckett's apportionment factors for the year use the following data. Compute Beckett's B taxable income for the year; B uses a three-factor apportionment formula with a double-weighted sales factor. State AState BTotalSales$1,428,000$856,800$2,284,800Property$238,000$0 $238,000Payroll$357,000$0 $357,000arrow_forwardHelp me pleasearrow_forward

- Clockmaker Ltd. makes a product called wallet. Managers from Clockmaker Ltd. want to achieve a profit of £82, 800. The wallet price equals £82 per unit. Each unit of wallet has a cost of £36 and annual total fixed costs equal £147, 200. Considering this information, which of the following statements is true? O a. To achieve the desired profit, Clockmaker Ltd. needs to sell 5, 000 units of wallet. O b. Clockmaker Ltd. would need to sell more than 3, 200 units of wallet to have positive profits. O c. Contribution per unit equals £46. O d. All the answers are true.arrow_forwardNictus Limited produces electrical blankets. The blankets are sold for R 750 per unit and variable costs per unit are R350. Total fixed costs amount to R 500 000. The company expects to produce and sell 3000 units. Total net profit is: A. R1 200000 B. R700000 C. R500000 D. R2 250000 Clear my - choicearrow_forwardHH Aaron Company is planning to sell Product X for $80 per unit. Variable costs are $50 a unit and fixed costs are $ 150,000. What must total sales be in order to break even? 800,000 500,000 400,000 900,000arrow_forward

- Blue, Inc. produces and sells a product that has a variable cost per unit of $6. The company's total fixed costs are $76,000. Blue is considering setting the sales price at $12 per unit. Approximately how many units does Blue need to sell to earn $2 net income per unit? O 17,667 O 17,850 16,000 O 19,000 None of the abovearrow_forwardSolomon company has total fixed cost of $15,000, variable cost per unit of $6, and a price of $8. If Solomon wants to earn a target profit of $3,600, how many units must be sold? 2,500 7,500 9,300 18,600 18,750arrow_forwardCan you help me with CVP Drill #14?arrow_forward

- Witrox Bhd sells two models of smartphone, the Oppo and the Xiaomi. Oppo RM 60.0 35.0 25.0 Sales price per unit Variable cost per unit Contribution margin per unit Witrox has determined that it would break even at an annual sales volume of 50,000 units, of which 75% would be Oppo. Required: a) What are the contribution margin ratios for each product and the company? b) What is the amount of Witrox's estimated annual fixed costs? Xiaomi RM 85.0 54.0 31.0 c) What is the sales mix? d) Prepare a product line income statement with operating income of RM500,000. Fixed production costs will increase RM45,000 and fixed administrative costs will increase RM22,500 to support the increase in volume.arrow_forwardRhine Inc. make a single product with a selling price of £35 per unit. Fixed costs are £40,000 and variable costs per unit are £19. Rhine Inc. have a profit target of £15,000. How many units must be produced and sold to achieve that target?arrow_forwardDivision X makes a part with the following characteristics: Production capacity.. 25,000 units $18 Selling price to outside customers. Variable cost per unit. $11 Fixed cost, total. $100,000 Division Y of the same company would like to purchase 10,000 units each period from Division X. Division Y now purchases the part from an outside supplier at a price of $17 each. Suppose that Division X is operating at capacity and can sell all of its output to outside customers. If Division X sells the parts to Division Y at $17 per unit, the company as a whole will be: Select one: a. better off by $10,000 each period. b. worse off by $20,000 each period. C. worse off by $10,000 each period. d. There will be no change in the status of the company as a whole.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education