FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

For the past year, WOOLCORP has experimented with his third product, extra thick rug yarn. The company wishes to consider whether to continue or discontinue manufacturing and selling this product. You decide to prepare a differential analysis of the income related to all three products. To begin your analysis you review the following condensed income statement. Complete the following table using the data in the preceding income statement to compare the effects of dropping the rug yarn line of products.

Transcribed Image Text:### WoolCorp Production Analysis

WoolCorp purchases sheep’s wool from farmers. The company began operations in January of this year and is currently making decisions on product offerings, pricing, and vendors. A production manager has been hired to evaluate the method of assigning overhead to products.

#### Product Lines

WoolCorp manufactures three products:

1. Raw wool for stuffing or insulation.

2. Wool yarn for use in the textile industry.

3. Extra-thick yarn for use in rugs.

Upper management is seeking recommendations on whether to continue or discontinue their existing and proposed product lines.

#### Continue/Discontinue Analysis

Over the past year, WoolCorp experimented with producing extra-thick rug yarn. Management is considering its continuation based on financial performance. A differential analysis is required to evaluate the income related to all three products. As part of this process, a condensed income statement for the year ending December 31, 20Y8, has been prepared.

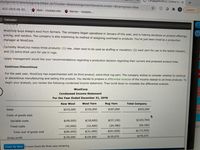

#### WoolCorp Condensed Income Statement

**For the Year Ended December 31, 20Y8**

| Product | Raw Wool | Wool Yarn | Rug Yarn | Total Company |

|-----------------|----------|-----------|----------|---------------|

| **Sales** | $210,000 | $155,000 | $187,000 | $552,000 |

| **Costs of Goods Sold:** | | | | |

| Variable Costs | $(48,000)| $(18,600) | $(37,150)| $(103,750) |

| Fixed Costs | $(32,000)| $(12,400) | $(24,780)| $(69,180) |

| **Total Cost of Goods Sold** | $(80,000)| $(31,000) | $(61,930)| $(172,930) |

| **Gross Profit**| $130,000 | $124,000 | $125,070 | $379,070 |

The income statement outlines the sales, variable costs, and fixed costs for each product, providing insights into the gross profit earned from each product line. Management is advised to use this data in their decision-making process regarding the continuation of the rug yarn product.

Transcribed Image Text:**Title: Analyzing Cost and Profitability for Rug Yarn Product Line**

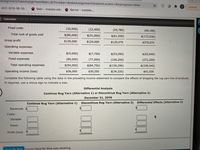

### Income Statement Overview

The table below summarizes the financial data for three different product lines as well as the total company:

- **Product Lines**:

- A

- B

- C

- **Metrics Provided**:

- Fixed Costs

- Total Cost of Goods Sold

- Gross Profit

- Operating Expenses (Variable and Fixed)

- Total Operating Expenses

- Operating Income (Loss)

#### Product Line Financial Summary

1. **Line A**:

- Fixed Costs: $(32,000)

- Total Cost of Goods Sold: $(80,000)

- Gross Profit: $130,000

- Variable Expenses: $(5,000)

- Fixed Expenses: $(89,000)

- Total Operating Expenses: $(94,000)

- Operating Income: $36,000

2. **Line B**:

- Fixed Costs: $(12,400)

- Total Cost of Goods Sold: $(31,000)

- Gross Profit: $124,000

- Variable Expenses: $(7,750)

- Fixed Expenses: $(77,000)

- Total Operating Expenses: $(84,750)

- Operating Income: $39,250

3. **Line C**:

- Fixed Costs: $(24,780)

- Total Cost of Goods Sold: $(61,930)

- Gross Profit: $125,070

- Variable Expenses: $(53,090)

- Fixed Expenses: $(106,200)

- Total Operating Expenses: $(159,290)

- Operating Income: $(34,220)

4. **Total for Company**:

- Fixed Costs: $(69,180)

- Total Cost of Goods Sold: $(172,930)

- Gross Profit: $379,070

- Variable Expenses: $(65,840)

- Fixed Expenses: $(272,200)

- Total Operating Expenses: $(338,040)

- Operating Income: $41,030

### Differential Analysis: Decision Making for Rug Yarn Line

The following table is meant for analyzing the impact of either continuing or discontinuing the Rug Yarn product line using data as of December 31, 2018.

#### Analysis Comparison Table

- **Metrics**:

- Revenues

- Costs (Variable and

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Help determine the selling price to retailers in 2020. And answer the more info section after finding the selling price please.arrow_forwardMohave Corp. is considering eliminating a product from its Sand Trap line of beach umbrellas. This collection is aimed at people who spend time on the beach or have an outdoor patio near the beach. Two products, the Indigo and Verde umbrellas, have impressive sales. However, sales for the Azul model have been dismal. Mohave’s information related to the Sand Trap line is shown below. Segmented Income Statement for Mohave’s Sand Trap Beach Umbrella Products Indigo Verde Azul Total Sales revenue $ 60,000 $ 60,000 $ 30,000 $ 150,000 Variable costs 34,000 31,000 26,000 91,000 Contribution margin $ 26,000 $ 29,000 $ 4,000 $ 59,000 Less: Direct fixed costs 1,900 2,500 2,000 6,400 Segment margin $ 24,100 $ 26,500 $ 2,000 $ 52,600 Common fixed costs* 17,840 17,840 8,920 44,600 Net operating income (loss) $ 6,260 $ 8,660 $ (6,920 ) $ 8,000 *Allocated based on total…arrow_forwardHi, I tried to answer a question for a second time but the response is that I can't get the answer the first time because the question have been unclear and now it have been complex...what exacly that mean? I don't understand why the expert can't solve the question?arrow_forward

- Golden Tours, Inc., operates tours throughout the United States. A study has indicated that some of the tours are not profitable, and consideration is being given to dropping these tours to improve the company’s overall operating performance. One such tour is a two-day Historic Mansions bus tour conducted in the southern states. An income statement from a typical Historic Mansions tour is given below: Ticket revenue (110 seat capacity × 45% occupancy × $60 ticket price per person) $ 2,970 100 % Variable expenses ($18 per person) 891 30 % Contribution margin $ 2,079 70 % Tour expenses: Tour promotion $ 650 Salary of bus driver 330 Fee, tour guide 690 Fuel for bus 130 Depreciation of bus 330 Liability insurance, bus 180 Overnight parking fee, bus 50 Room and meals,…arrow_forwardWhat is the impact on profit for the year if Nardin Outfitters accepts the special order? (Enter your answers in thousands rounded to 1 decimal place. (i.e., 5, 400, 400 should be entered as 5, 400.4). Select option "higher" or "lower", keeping Status Quo as the base. Select "none" if there is no effect.) Nardin Outfitters has a capacity to produce 18, 500 of their special arctic tents per year. The company is currently producing and selling 5,000 tents per year at a selling price of $ 1,550 per tent. The cost of producing and selling one tent follows: Variable manufacturing costs $ 570 Fixed manufacturing costs 155 Variable selling and administrative costs 145 Fixed selling and administrative costs 115 Total costs $ 985 The company has received a special order for 1,800 tents at a price of $730 per tent from Chipman Outdoor Center. It will not have to pay any sales commission on the special order, so the variable selling and administrative costs would be only $58 per tent. The special…arrow_forwardYou are a newly hired accountant for Sushi Beeber, Inc., a retail company specializing in apparel for small pets. The company would like to expand its apparel line to include sweaters for cats. Sushi Beeber has found several manufacturers that offer competitive prices to ensure cost of goods sold is low. Because the company receives merchandise from different manufacturers and the cat sweaters will be commoditized, the company needs to develop an internal accounting system to keep track of inventory cost. You think that the weighted average cost method may help the company stay up-to-date with the inventory cost as purchase cost changes over time. Your task is to create a spreadsheet that can calculate the inventory cost based on purchases and sales for the month. See attached spreadsheet. nventory Weighted Date Purchase/Sale Total Cost Average Cost 1-Oct Purchase 1-Oct Sale 3-Oct Purchase 4-Oct Sale 4-Oct Sale 4-Oct Purchase 7-Oct Sale…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education