ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

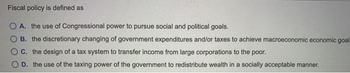

Transcribed Image Text:Fiscal policy is defined as

OA. the use of Congressional power to pursue social and political goals.

B. the discretionary changing of government expenditures and/or taxes to achieve macroeconomic economic goal

C. the design of a tax system to transfer income from large corporations to the poor.

OD. the use of the taxing power of the government to redistribute wealth in a socially acceptable manner.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- explain when and how the government intervenes in the economyarrow_forwardh. A $1,200 stimulus check sent to households by the government as COVID reliefarrow_forwardWhich of the following is an example of a progressive tax?a. The excise tax on cigarettesb. The federal tax on gasolinec. The federal personal income tax d. All of the above answers are correctarrow_forward

- c. A progressive tax d. A regressive tax QUESTION 3 Corporate profits are a. taxed to pay for Medicare. b. exempt from taxes. c. included in payroll taxes. d. taxed twice, once as profit and once as dividends. QUESTION 4 A value-added tax or VAT is a tax on a. retail purchases only. b. pollution. c. all stages of production of a good. d. wholesale purchases only. QUESTION 5 Table 12-17 INCOME $50,000 100,000 200,000 AMOUNT OF TAX $12,500 (25%) $25,000 (25%) $50,000 (25%) TAX Aarrow_forward3. Question 3 options: Economic policies that involve government spending and taxes are known as .arrow_forwardSuppose that before tax was imposed 400 million gallons of gasoline was supplied at $3.00 per gallon.a. What happens when government imposes a tax of 60 cents per gallon on sellers? b. How would such a tax affect the market for gasoline i.e. what is the new equilibrium? c. On whom does the incidence of the tax fall more heavily? d. How much government revenue will be generated by the excise tax? e. What happens when government imposes a tax of 60 cents per gallon on buyers? f. How would such a tax affect the market for gasoline i.e. what is the new equilibrium?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education