FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

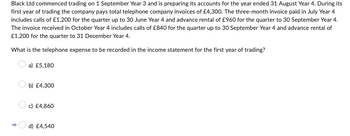

Transcribed Image Text:Black Ltd commenced trading on 1 September Year 3 and is preparing its accounts for the year ended 31 August Year 4. During its

first year of trading the company pays total telephone company invoices of £4,300. The three-month invoice paid in July Year 4

includes calls of £1,200 for the quarter up to 30 June Year 4 and advance rental of £960 for the quarter to 30 September Year 4.

The invoice received in October Year 4 includes calls of £840 for the quarter up to 30 September Year 4 and advance rental of

£1,200 for the quarter to 31 December Year 4.

What is the telephone expense to be recorded in the income statement for the first year of trading?

D

a) £5,180

b) £4,300

c) £4,860

d) £4,540

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On October 29, Lobo Company began operations by purchasing razors for resale. The razors have a 90-day warranty. When a razor is returned, the company discards it and mails a new one from Merchandise Inventory to the customer. The company's cost per new razor is $13 and its retail selling price is $60. The company expects warranty costs to equal 8% of dollar sales. The following transactions occurred. November 11 Sold 70 razors for $4,200 cash. November 30 Recognized warranty expense related to November sales with an adjusting entry. December 9 Replaced 14 razors that were returned under the warranty. December 16 Sold 210 razors for $12,600 cash. December 29 Replaced 28 razors that were returned under the warranty. December 31 Recognized warranty expense related to December sales with an adjusting entry. January 5 Sold 140 razors for $8,400 cash. January 17 Replaced 33 razors that were returned under the warranty. January 31 Recognized warranty expense related to January sales with an…arrow_forwardSawchuk's Home and Garden Centre in Toronto files monthly HST returns. The purchases on which it paid the HST and the sales on which it collected the HST for the last four months were as follows: (assume HST in Toronto is 13%) Month Purchases ($) Sales ($) May 176,730 313,245 Based on an HST rate of 13%, calculate the HST remittance or refund due for each month Calculate the difference between GST Collected on Sales and GST Paid on Purchases?arrow_forwardA nine months, 15% note for $9000 dated April 15 is reciebed for a customer. The maturity value of the note is what?arrow_forward

- On January 2nd, Mobile Sales borrows $20,000 cash on a note payable from Ethical Lenders with terms 90 days, 5%. Mobile Sales and Ethical Lenders uses a 360-day year for interest calculations. Mobile Sales makes adjusting entries at the end of each calendar quarter. Journalize the initiation of the loan, the recognition of interest expense for the quarter and the payment of the note on its due date (round to the even dollar).arrow_forwardAn automotive dealer borrowed $8200.00 from the Bank of Montreal on a demand note on May 8. Interest on the loan, calculated on the daily balance, is charged to the dealer's current account on the 8th of each month. The automotive dealer made a payment of $2300 on July 12, a payment of $3900 on October 1, and repaid the balance on December 1. The rate of interest on the loan on May 8 was 8% per annum. The rate was changed to 8.6% on August 1 and to 8.95% on October 1. What was the total interest cost for the loan?arrow_forwardJournal Entries for Accounts and Notes Payable Simon Company had the following transactions: Apr. 15 Issued a $6,000, 60-day, 8 percent note payable in payment of an account with Marion Company. May 22 Borrowed $45,000 from Sinclair Bank, signing a 60-day note at nine percent. Jun. 14 Paid Marion Company the principal and interest due on the April 15 note payable. Jul. 13 Purchased $15,000 of merchandise from Sharp Company; signed a 90-day note with ten percent interest. Jul. 21 Paid the May 22 note due Sinclair Bank. Oct. 2 Borrowed $38,000 from Sinclair Bank, signing a 120-day note at 12 percent. Oct. 11 Defaulted on the note payable to Sharp Company. Requireda. Record these transactions in general journal form.b. Record any adjusting entries for interest in general journal form. Simon Company has a December 31 year-end. Round answers to nearest dollar. Use 360 days for interest calculations.a. General Journal Date Description Debit Credit Apr.15…arrow_forward

- Matsumoto construction has a 100,000 line of credit at Bank of America. The annual percentage rate is the current prime rate plus 3%. The balance on October 1 was 22,500.00 On October 10, Matsumoto borrowed 15,000 to pay for a shipment of plants & on October 20 be borrowed another 32,500 for equipment repairs. On October 25 Matsumoto made a 25,000 payment on the account. The billing cycle for October has 31 days. The current prime rate is 6%. Use the average daily method to determine the finance charge? What is Matsumotos new balance?arrow_forwardHall Company sells merchandise with a one-year warranty. In the current year, sales consisted of 2,987 units. It is estimated that warranty repairs will average $17 per unit sold, and 30% of the repairs will be made in the current year and 70% in the next year. In the current year's income statement, Hall should show warranty expense of a.$35,545 b.$0 c.$50,779 d.$15,234arrow_forwardOn October 29, Lobo Company began operations by purchasing razors for resale. The razors have a 90-day warranty. When a razor is returned, the company discards it and mails a new one from Merchandise Inventory to the customer. The company's cost per new razor is $15 and its retail selling price is $80. The company expects warranty costs to equal 7% of dollar sales. The following transactions occurred. November 11 Sold 70 razors for $5,600 cash. November 30 Recognized warranty expense related to November sales with an adjusting entry. December 9 Replaced 14 razors that were returned under the warranty. December 16 Sold 210 razors for $16,800 cash. December 29 Replaced 28 razors that were returned under the warranty. December 31 Recognized warranty expense related to December sales with an adjusting entry. January 5 Sold 140 razors for $11,200 cash. January 17 Replaced 33 razors that were returned under the warranty. January 31 Recognized warranty expense related to…arrow_forward

- Accounts receivable in the amount of $658,000 were assigned to the Fast Finance Company by Sunland, Inc., as security for a loan of $564,000. The finance company assessed a 4% finance charge on the face amount of the loan, and the note bears interest at 8% per year.During the first month, Sunland collected $366,600 on assigned accounts. This amount was remitted to the finance company along with one month's interest on the note.Make all the entries for Sunland Inc. associated with the transfer of the accounts receivable, the loan, and the remittance to the finance company. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Round answers to 0 decimal places, e.g. 5,275.) Account Titles and Explanation Debit Credit (To record the transfer of the accounts receivable.) (To record the loan amount…arrow_forwardBack in Time Inc. warrants its products for one year. The estimated product warranty is 7% of sales. Assume that sales were $929,500 for March. In April, a customer received warranty repairs requiring $61,812 of parts. a. Determine the warranty liability at March 31, the end of the first month of the current fiscal year. Round your answer to the nearest dollar.$fill in the blank 1arrow_forwardThe official terms of purchases of National Co. are 2/10, net 30 but generally the company does not pay until 40 days after the invoice date. Its purchases total P3,600,000 per year. Assuming 360 days a year, the approximate cost of the “non-free trade credit amounts to Answer format: 11.1%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education