Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

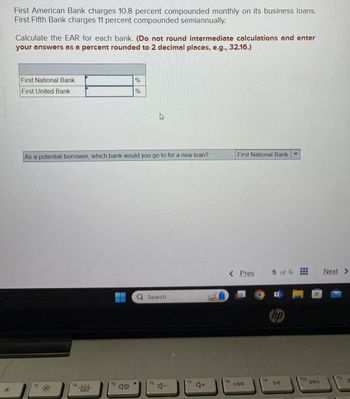

Transcribed Image Text:First American Bank charges 10.8 percent compounded monthly on its business loans.

First Fifth Bank charges 11 percent compounded semiannually.

Calculate the EAR for each bank. (Do not round intermediate calculations and enter

your answers as a percent rounded to 2 decimal places, e.g., 32.16.)

f3

First National Bank

First United Bank

%

%

As a potential borrower, which bank would you go to for a new loan?

**

f4

f5

f6

Search

ムー

17

4+

First National Bank

< Prev

5 of 6

www

www

Next >

hp

f8

fg

f10

144

DII

DDI

f11

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- SOLVE STEP BY STEP IN DIGITAL FORMAT ▸ A bank gives Mr. Aldama the amount $1,255,000.00 for a loan for one year, three months and fifteen days, with a rate of 27%. What is the initial capital of the loan? Formulas Simple interest |= Cxrxt Amount M = C (1+rxt)arrow_forwardMf4. You've worked out a line of credit arrangement that allows you to borrow up to $80million at any time. The interest rate is0.61 percent per month. In addition, 4 percent of the amount that you borrow must be deposited in a non-interest-bearing account. Assume that your bank uses compound interest on its line of credit loans. Required: (a)What is the effective annual interest rate on this lending arrangement? (Do not round your intermediate calculations.) (b)Suppose you need $16 million today and you repay it in 6 months. How much interest will you pay? (Do not round your intermediate calculations.)arrow_forwardPlease use the formula given , and solve with steps thank youarrow_forward

- Dave borrowed $550 on January 1, 2022, and paid it all back at once on December 31, 2022. The bank charged him a $3.50 service charge, and interest was $40.70. What was the APR? Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. Annual percentage rate %arrow_forwardI need answer typingarrow_forwardC3.7arrow_forward

- 4. Interest Rate Oliver has the following outstanding balances: Balance ($) Form of Credit Bank Loan Credit Card A Credit Card B a. 6686.98 765.39 1028.14 7.2% compounded monthly 20.99% compounded daily 17.5% compounded daily Monthly Payment $300 Minimum payment of $50 Minimum payment of $30 Length to Pay off Use the last column to determine how long it will take for Oliver to pay of each balance if he pays the (minimum) monthly payment. Show relevant calculations below. b. Suppose Oliver consolidates his loan and credit card balance by using a line of credit to pay off each debt. The line of credit has an interest rate of 7.5%, compounded monthly. If Oliver makes payments of $380, how long will it take to be debt free? c. How much interest would he save by consolidating his debt?arrow_forwardI need help with finance homework questions asap. (rounded to 2 decimal places) 7 If a bank charges an interest rate of 0.18% per week on loans, what rate must the bank quote?arrow_forwardplease provide excel formulasarrow_forward

- Can you solve thisarrow_forward[item-5] PLEASE PROVIDE THE CORRECT AND SOLUTION. (kindly provide complete and full solution. i won't like your solution if it is incomplete or not clear enough to read.)arrow_forward2 Quantitative Problem: Bank 1 lends finds at a nominal rate of 6% with payments to be made semiannually. Bank 2 requires payments to be made quarterly. If Bank would like to change the same effective amual rate as Bank 1, what nominal interest rate will they charge their customers? Do not round intermediate calculations. Rand your answers to three decimal WL places. wer maiteme SA A ngu? A 2118 tax f 40 THE # AALIY S * مجلسی Warrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education