Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Assume all bonds have a face value or par value of 1,000

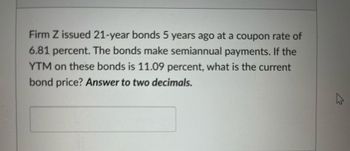

Transcribed Image Text:Firm Z issued 21-year bonds 5 years ago at a coupon rate of

6.81 percent. The bonds make semiannual payments. If the

YTM on these bonds is 11.09 percent, what is the current

bond price? Answer to two decimals.

4

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- From page 9-3 of the VLN, when determining the issue price of a bond, which interest rate would you use? Group of answer choices A. Stated rate B. Market rate C. Nominal rate D. Compound ratearrow_forwardBonds with a face value of $336000 and a quoted price of 98.5 have a selling price of $329297. $329448. $330960. $330120.arrow_forwardComplete the table Find the market pricearrow_forward

- The following information about bonds A, B, C, and D are given. Assume that bond prices admit noarbitrage opportunities. What is the convexity of Bond D?Cash Flow at the end ofBond Price Year 1 Year 2 Year 3A 91 100 0 0B 86 0 100 0C 78 0 0 100D ? 5 5 105arrow_forwardWhat is assumed the be the face value aka par value aka principal aka loan amount of a bond? It's also assumed to be a bond's FV. 10% $0 $100 $1,000arrow_forwardYou can use Excel functions to find the answers for the following question (round off the values to 4 decimal places): Supplier on-time delivery performance is critical to enabling the buyer’s organization to meet its customer service commitments. Therefore, monitoring supplier delivery times is critical. Based on a great deal of historical data, a manufacturer of personal computers finds for one of its just-in-time suppliers that the delivery times are random and well approximated by the Normal distribution with mean 51.7 minutes and standard deviation 9.5 minutes. (15p) a. What is the probability that a particular delivery will exceed one hour? b. What is the probability that a particular delivery arrives in less than one hour? c. What is the probability that the mean time of 5 deliveries will exceed one hour?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education