FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

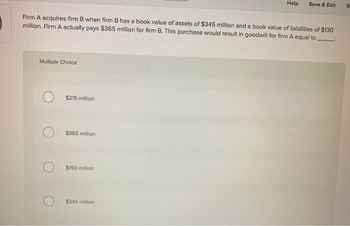

Transcribed Image Text:Firm A acquires firm B when firm B has a book value of assets of $345 million and a book value of liabilities of $130

million. Firm A actually pays $365 million for firm B. This purchase would result in goodwill for firm A equal to.

Multiple Choice

$215 million

$365 million

$150 million

Help Save & Exit

$345 million

S

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Case B. Kapono Farms exchanged 100 acres of farmland for similar land. The farmland given had a book value of $520,000 and a fair value of $740,000. Kapono paid $54,000 cash to complete the exchange. The exchange has commercial substance. Required: What is the amount of gain or loss that Kapono would recognize on the exchange? What is the initial value of the new land? Assume the fair value of the farmland given is $416,000 instead of $740,000. What is the amount of gain or loss that Kapono would recognize on the exchange? What is the initial value of the new land? Assume the same facts as Requirement 1 and that the exchange lacked commercial substance. What is the amount of gain or loss that Kapono would recognize on the exchange? What is the initial value of the new land? Assume the same facts as Requirement 2 and that the exchange lacked commercial substance. Assume the fair value of the farmland given is $416,000 instead of $740,000. What is the amount of gain or loss that…arrow_forwardTesla acquired Amazon, for $33,520,000. The fair value of all Amazon's identifiable tangible and intangible assets was $30,000,000. Short will amortize any goodwill over the maximum number of years allowed. What is the annual amortization of goodwill for this acquisition? Multiple Choice O O $880,000 $1,760,000 $O $3,520,000 < Prev 6 of 25 Save & Ex Nextarrow_forwardIn a like - kind exchange, Greyland exchanged investment - use real property (FMV $210,000, adjusted basis $190,000) for a smaller piece of investment - use property (FMV $200,000) plus $10,000. They will report a $10,000 gain on the exchange. What is their basis in the replacement property? $170,000 $180,000 $190,000 $200,000arrow_forward

- Hoolia Corporation acquires equipment and patents from another company for $50 million and records the acquisition as an asset acquisition. The equipment has a fair value of $19.20 million and the patents have a fair value of $28.80 million. Neither asset is nonqualifying. At what value does Hoolia record the equipment? Select one: a. $25.0 million b. $20.0 million c. $21.2 million d. $19.2 millionarrow_forwardSuppose that an acquirer decides to pay a 25% premium to buy Uber. The book value of Uber’s net assets is $6.7 million. The fair value of Uber’s net assets is estimated at $7 million. What amount of goodwill will be recorded in this acquisition? Question 14Answer a. $75,000 b. $8,750,000 c. $1,675,000 d. $1,750,000arrow_forwardMalik Edson has the following assets: • Land with ACB of $60,000 Building with a cost of $105,000, and UCC of $79,000. Malik sells both of land and building in a single transaction for $219,000. The estimated FMV of each was: • Land: $146,000 • Building: $73,000 How much capital gain and terminal loss will Malik realize on this transaction? Choose the correct answer. A. capital gain of $73,000, terminal loss of $32,000 B. capital gain of $73,000, terminal loss of $6,000 C. capital gain of $54,000, terminal loss of $0 D. capital gain of $80,000, terminal loss of $0arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education