FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

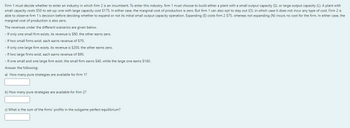

Transcribed Image Text:Firm 1 must decide whether to enter an industry in which firm 2 is an incumbent. To enter this industry, firm 1 must choose to build either a plant with a small output capacity (S), or large output capacity (L). A plant with

small capacity costs $50 to set up; one with large capacity cost $175. In either case, the marginal cost of production is zero. But firm 1 can also opt to stay out (O), in which case it does not incur any type of cost. Firm 2 is

able to observe firm 1's decision before deciding whether to expand or not its initial small output capacity operation. Expanding (E) costs firm 2 $75, whereas not expanding (N) incurs no cost for the firm. In either case, the

marginal cost of production is also zero.

The revenues under the different scenarios are given below.

- If only one small firm exists, its revenue is $80, the other earns zero.

- If two small firms exist, each earns revenue of $70.

- If only one large firm exists, its revenue is $200, the other earns zero.

- If two large firms exist, each earns revenue of $90.

- If one small and one large firm exist, the small firm earns $40, while the large one earns $160.

Answer the following:

a) How many pure strategies are available for firm 1?

b) How many pure strategies are available for firm 2?

c) What is the sum of the firms' profits in the subgame perfect equilibrium?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Which of the following factors are considered when analyzing an indistry? I-the nature and conditions of governmental regulations II-the number, size and power of suppliers to the industry III- the development of new technologies relevant to the industry IV- the extent of competition within the industry A- I, II,III AND IV B-I, II AND III C-II, III, AND IV ONLY D-I, II, AND IV ONLYarrow_forwardWhat are the steps that would be needed for a company to transition from GAAP to IFRS?arrow_forwardWhat is the objective of the firm? Why? (Explain)arrow_forward

- eek 2a) What is a social contract and how does it relate to organisational legitimacy? b) Explain two ways organisations can use corporate disclosure policy to maintain or regainorganisational legitimacy?arrow_forwardShould a company allow the owners to use the resources as they see fit?arrow_forwardWhich business vehicle(Company or partnership) you will adopt if you are to set up a business and give reasons to support your choice.arrow_forward

- Briefly discuss how differentiated products in a monopolistic competitive framework can arise.arrow_forwardQuestion 2 Which of these is not one of the key concepts to consider when evaluating potential new clients and re-evaluating existing clients? Ethics and integrity. Company logo. Business activities. People involved.arrow_forwardexplain in detail, what is a firm, why firms exist and what are Coasian transaction c osts?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education