FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

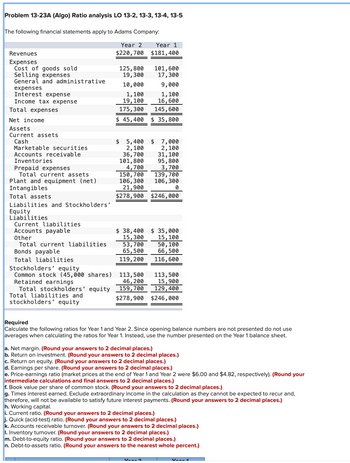

Transcribed Image Text:Problem 13-23A (Algo) Ratio analysis LO 13-2, 13-3, 13-4, 13-5

The following financial statements apply to Adams Company:

Year 2

$220,700

Revenues

Expenses

Cost of goods sold

Selling expenses

General and administrative

expenses

Interest expense

Income tax expense

Total expenses

Net income

Assets

Current assets

Cash

Marketable securities

Accounts receivable

Inventories

Prepaid expenses

Total current assets

Plant and equipment (net)

Intangibles

Total assets

Liabilities and Stockholders'

Equity

Liabilities

Current liabilities

Accounts payable

Other

Total current liabilities

Bonds payable

Total liabilities

Stockholders' equity

Common stock (45,000 shares)

Retained earnings

Total stockholders' equity

Total liabilities and

stockholders' equity

125,800

19,300

10,000

$

1,100

19, 100

175,300

$ 45,400 $ 35,800

36,700

101,800

4,700

5,400 $

2,100

Year 1

$181,400

$ 38,400

15,300

101, 600

17,300

9,000

1,100

16, 600

145, 600

53,700

65,500

119, 200

150,700

139,700

106,300 106,300

21,900

0

$278,900 $246,000

113,500

46, 200

159, 700

$278,900

7,000

2,100

31,100

95,800

3,700

$ 35,000

15, 100

50, 100

66,500

116, 600

113,500

15,900

129,400

$246,000

Required

Calculate the following ratios for Year 1 and Year 2. Since opening balance numbers are not presented do not use

averages when calculating the ratios for Year 1. Instead, use the number presented on the Year 1 balance sheet.

a. Net margin. (Round your answers to 2 decimal places.)

b. Return on investment. (Round your answers to 2 decimal places.)

c. Return on equity. (Round your answers to 2 decimal places.)

d. Earnings per share. (Round your answers to 2 decimal places.)

e. Price-earnings ratio (market prices at the end of Year 1 and Year 2 were $6.00 and $4.82, respectively). (Round your

intermediate calculations and final answers to 2 decimal places.)

f. Book value per share of common stock. (Round your answers to 2 decimal places.)

g. Times interest earned. Exclude extraordinary income in the calculation as they cannot be expected to recur and,

therefore, will not be available to satisfy future interest payments. (Round your answers to 2 decimal places.)

h. Working capital.

i. Current ratio. (Round your answers to 2 decimal places.)

j. Quick (acid-test) ratio. (Round your answers to 2 decimal places.)

k. Accounts receivable turnover. (Round your answers to 2 decimal places.)

I. Inventory turnover. (Round your answers to 2 decimal places.)

m. Debt-to-equity ratio. (Round your answers to 2 decimal places.)

n. Debt-to-assets ratio. (Round your answers to the nearest whole percent.)

Vaard

Transcribed Image Text:TRUTBOLUN LL

Accounts receivable

Inventories

داد البال

Prepaid expenses

Total current assets

Plant and equipment (net)

Intangibles

Total assets

Liabilities and Stockholders'

Equity

Liabilities

Current liabilities

Accounts payable

Other

Total current liabilities

Bonds payable

Total liabilities

Stockholders' equity

Common stock (45,000 shares)

Retained earnings

Total stockholders' equity

Total liabilities and

stockholders' equity

36,700

101,800

4,700

150,700

139,700

106,300 106,300

21,900

0

$278,900

$246,000

$ 38,400

15,300

a. Net margin

b. Return on investment

53,700

65,500

119, 200

Required

Calculate the following ratios for Year 1 and Year 2. Since opening balance numbers are not presented do not use

averages when calculating the ratios for Year 1. Instead, use the number presented on the Year 1 balance sheet.

C. Return on equity

d. Earnings per share

e. Price-earnings ratio

f.

113,500

46,200

159,700

$278,900

a. Net margin. (Round your answers to 2 decimal places.)

b. Return on investment. (Round your answers to 2 decimal places.)

Book value per share of common

stock

c. Return on equity. (Round your answers to 2 decimal places.)

d. Earnings per share. (Round your answers to 2 decimal places.)

g. Times interest earned

h. Working capital

i. Current ratio

e. Price-earnings ratio (market prices at the end of Year 1 and Year 2 were $6.00 and $4.82, respectively). (Round your

intermediate calculations and final answers to 2 decimal places.)

li. Quick (acid-test) ratio

k. Accounts receivable turnover

I. Inventory turnover

m. Debt-to-equity ratio

n. Debt-to-assets ratio

f. Book value per share of common stock. (Round your answers to 2 decimal places.)

g. Times interest earned. Exclude extraordinary income in the calculation as they cannot be expected to recur and,

therefore, will not be available to satisfy future interest payments. (Round your answers to 2 decimal places.)

h. Working capital.

i. Current ratio. (Round your answers to 2 decimal places.)

j. Quick (acid-test) ratio. (Round your answers to 2 decimal places.)

k. Accounts receivable turnover. (Round your answers to 2 decimal places.)

I. Inventory turnover. (Round your answers to 2 decimal places.)

$ 35,000

15, 100

50, 100

66,500

116, 600

m. Debt-to-equity ratio. (Round your answers to 2 decimal places.)

n. Debt-to-assets ratio. (Round your answers to the nearest whole percent.)

31, 100

95,800

3,700

113,500

15,900

129,400

$246,000

Year 2

%

%

%

times

times

%

times

times

Year 1

%

%

%

times

times

times

times

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Finish the question

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Finish the question

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Sales. Costs and expenses Cost of goods sold. Operating expenses. Interest expense... Income before income taxes. Income tax expense.. Net income.. Statement of Income For the Year Ended December 31, 2020 $1,140,000 $1,700,000 364,800 37,800 1,542,600 157,400 55,090 $ 102,310 GEORGE INDUSTRIES Statement of Financial Position December 31, 2020 Total assets. Total liabilities.. Total shareholders' equity... 2020 2019 $842,110 $717,800 329,600 279,600 512,510 438,200 Calculate the Net profit margin ratio (use up to 2 decimal places and do not use a % sign)arrow_forwardASSETS Cash Accounts Receivable Inventory Plant and equipment Accumulated Depreciation TOTAL ASSETS LIABILITIES Accounts Payable Accrued Expenses Long Term Notes Payable TOTAL LIABILITIES EQUITIES Common Stock, No Par Retained Earnings TOTAL EQUITIES TOTAL LIABILITIES & EQUITIES COMPUTE THE 1. Current Ratio for 2020 & 2021 2. Quick Ratio for 2020 & 2021 2021 45,000.00 212,500.00 155,000.00 1,885,000.00 (480,000.00) 1,817,500.00 55,000.00 112,500.00 250,000.00 417,500.00 1,000,000.00 400,000.00 1,400,000.00 1,817,500.00 2020 50,000.00 207,500.00 140,000.00 1,662,500.00 (375,000.00) 1,685,000.00 47,500.00 110,000.00 237,500.00 395,000.00 1,000,000.00 290,000.00 1,290,000.00 1,685,000.00arrow_forwardNikularrow_forward

- Calculate the following ratios all are required 1-Receivables Turnover 2-Inventory Turnover 3-Payables Turnover 4-Debt-Equity Ratio 5-Debt Ratio Balance sheet Group Parent Company 31 December 2018 31 March 2018 31 December 2018 31 March 2018 Notes RO RO RO RO ASSETS Non-current Property, plant and equipment 5 6,406,433 7,113,759 3,683,610 4,182,275 Investment in subsidiaries - - 515,750 515,750 Fixed deposit 9.1 1,048,399 - 1,048,399 - Deferred tax assets 27 675,393 537,722 727,632 602,078 Non-current assets 8,130,225 7,651,481 5,975,391 5,300,103 Current Inventories 6 4,481,209 3,832,010 4,450,529 3,651,720 Trade and other receivables 7 3,771,104 3,502,574 3,244,883 2,758,158 Due from related parties 18 - - 351,897 2,439,914 Financial assets at…arrow_forwardSales Cost of goods sold Gross profit Selling expenses Administrative expenses Total expenses Income before taxes. Income tax expense Net income Assets Current assets Long-term investments Plant assets, net Total assets Sin Comparative Income Statements For Years Ended December 31 2021 $ 420,027 252,856 167,171 59,644 37,802 97,446 69,725 12,969 $ 56,756 Liabilities and Equity Current liabilities Common stock Other paid-in capital Retained earnings Total liabilities and equity Assets Current assets Long-term investments Plant assets, net. Total assets Liabilities and Equity Current liabaties Common stock Other paid-in capital Retained earnings Total liabilities and equity 2020 $ 321,775 202,718 KORBIN COMPANY Comparative Balance Sheets December 31 2021 119,057 44,405 28,316 72,721 46,336 9,499 $ 36,837 $ 55,286 0 102,674 $ 157,960 2020 3. Complete the below table to calculate the balance sheet data in trend percents with 2019 as answers to 2 decimal places.) 111.77 % 0.00 $ 37,003 700…arrow_forwardQuestion Content Area Use the information provided for Harding Company to answer the question that follow. Harding Company Accounts payable $33,234 Accounts receivable 67,995 Accrued liabilities 6,510 Cash 22,738 Intangible assets 35,347 Inventory 83,390 Long-term investments 101,069 Long-term liabilities 79,156 Notes payable (short-term) 27,161 Property, plant, and equipment 689,074 Prepaid expenses 2,037 Temporary investments 30,842 Based on the data for Harding Company, what is the quick ratio (rounded to one decimal place)? a.3.1 b.0.8 c.1.8 d.15.4arrow_forward

- B Net sales Cost of goods sold Selling and administrative expenses Interest expense Other income (expense) Income tax expense Net income Current assets. Noncurrent assets Total assets Current liabilities Long-term debt Total stockholders' equity Total liabilities and stockholders' equity Total assets Total stockholders' equity Current liabilities Total liabilities Average net accounts receivable Average inventory Net cash provided by operating activities Capital expenditures Cash dividends paid 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. Ratio Current ratio Accounts receivable turnover Average collection period Inventory turnover Days in inventory Profit margin Asset turnover Return on assets Debt to assets ratio Walmart Inc. Income Statement Data for Year Times interest earned Target Corporation Return on common stockholders' equity Free cash flow $66,900 44,000 14,400 750 (95) 1,500 $6,155 $17,000 26,800 $43,800 Balance Sheet Data (End of Year) $10,000 17,300 16,500 $43,800 13,400 10,000…arrow_forwardAssets Current assets Cash and cash equivalents Accounts receivable, net Supplies Other current assets Total current assets Property and equipment Accumulated depreciation Net property and equipment Goodwill Deferred charges Other Total assets Liabilities and equity Current liabilities Accounts payable Accrued liabilities Current maturities of long-term debt Total current liabilities Operating lease liabilities non-current Long-term debt Other non-current liabilities Total liabilities Total liabilities Common stock Cummulative dividends Retained earnings Other Total equity Total liabilities and equities Revenue, net Operating charges Salaries, wages, and benefits Other operating expenses Supplies expense Depreciation and amortization Lease and rental expense Total operating charges Income from operations Interest expense, net Other (income) expense, net Income before income taxes Provision for income taxes Net income $61,268 1,560,847 Cost of debt (%) Cost of equity (%) Weighted…arrow_forwardD. Return on Common Shareholders' Equity Net Income-preferred Dividends / Average Common Shareholders' Equity E. Accounts Receivables Turnover Net Credit Sales/Average Accounts Receivable F. Merchandise Inventory Turnover Cost of Goods Sold/ Average Inventory d. Return on Common Stockholders’ Equitye. Accounts Receivables Turnoverf. Merchandise Inventory Turnoverarrow_forward

- Illies Corporation's comparative balance sheet appears below: Beginning Balance Assets: Current assets Cash and cash equivalents. Accounts receivable. Inventory. Total current assets Property, plant, and equipment. Less accumulated depreciation. Net property, plant, and equipment. Total assets. Liabilities and Stockholders' Equity Current liabilities: Accounts payable. Accrued wages and salaries payable.. Accrued income taxes payable. Notes payable. Total current liabilities. Long-term debt. Deferred income taxes. Total liabilities Stockholders' equity: Common stock. Retained earnings. Ending Balance Select one: $ 40,000 19,000 O a. $7,000 O b. $40,000 O c. $29,000 O d. $33,000 67,000 126,000 123,000 358,000 339,000 156,000 132,000 202.000 $328,000 $ 33,000 21,000 69,000 $ 18,000 35,000 23,000 207.000 $330,000 23,000 103,000 22,000 102,000 Total stockholders' equity 126,000 124.000 Total liabilities and stockholders' equity.... $328,000 $330.000 $ 19,000 37,000 19,000 19,000 22,000…arrow_forwardComparative financial statements for Weaver Company follow: Weaver Company Comparative Balance Sheet at December 31 Assets Cash and cash equivalents Accounts receivable Inventory Prepaid expenses Total current assets Property, plant, and equipment Less accumulated depreciation Net property, plant, and equipment Long-term investments Total assets Liabilities and Stockholders' Equity Accounts payable Accrued liabilities Income taxes payable Total current liabilities Bonds payable Total liabilities Common stock Retained earnings Total stockholders' equity Total liabilities and stockholders' equity Weaver Company Income Statement For This Year Ended December 31 Sales Cost of goods sold Gross margin Selling and administrative expenses Net operating income Nonoperating items: Gain on sale of investments Loss on sale of equipment Income before taxes Income taxes Net income Weaver Company Statement of Cash Flows-Indirect Method (partial) Net income Adjustments to convert net income to a cash…arrow_forwardOperating profit 43-7 Sales revenue 910-4 Share capital and reserves 182-3 Long-term borrowing 77-9 Inventory 46-2 Receivables 97-8 Payables 51:3 Calculate the following: GReturn on Cepitatemployest (i Assetturnover (ii) Current ratio (iv) Acid test (quick) ratioarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education