Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

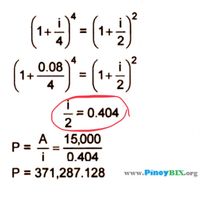

How can you get the value of 0.404 from the solution below? Step by step.

Transcribed Image Text:+1

0.08

1+

4

1+

= 0.404

2

A 15,000

P =

i

0.404

P = 371,287.128

www.PinoyBIX.org

Transcribed Image Text:Find the present value in pesos, of a perpetuity of P15,000 payable semi-annually if

the money is worth 8% compounded quarterly.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- hi im looking at the solution above and have a quuestion-im a littlepuzzled on exactly how i should be plugging in the numbersfor example, the chart liists Time (ln2/(ln(1+r)) but how exactly should i type this in my calculatorto get =l3/J3? maybe im overthinking itarrow_forwardPlease answer ASAP if you can please. Thank you! Please Please write expression or formula used Set up expression initially with functional notation (e.g.,(P/F,I,n))arrow_forwardMake sure to calculate the NPV correctly! The previous answer was wrong!arrow_forward

- Can you please show the mathematical breakdown of computing the IRR? I am unable to get the same result.arrow_forwardfor question 3b under step 3: There are two things to the power of n but then you plugged in two different n values. why is that? why is one of them to the power of 9?arrow_forwardExpected return is best described as ________________________________ and is based on the single word ___?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education

Expert Answers to Latest Homework Questions

Q: Hello.tutor please provide correct answer general Accounting

Q: Calculate the amount of equity at the end of the year on these accounting

Q: General accounting

Q: ??

Q: (Subject: Financial accounting 5 marks) please answer

Q: Kindly help me with accounting questions

Q: A company has a net income of $790,000 and 55,300 outstanding shares. What is the earnings per…

Q: Not use ai solution this question answers general Accounting question

Q: A company has a net income of $790,000 and 55,300 outstanding shares. What is the earnings per…

Q: The firm's turnover and average total assets?

Q: What is the earnings per share?

Q: Financial Accounting Question please solve

Q: Please provide answer this accounting problem with correct calculation

Q: If a business has a net income of $44,700 and total equity of $111,750, what is the ROE? a.10% b.…

Q: If a business has a net income of $44,700 and total equity of $111,750, what is the ROE? a.10% b.…

Q: Can help with this accounting questions

Q: If a business has a net income of $44,700 and total equity of $111,750, what is the ROE? a.10% b.…

Q: Kindly help me with general accounting question

Q: Abc corporation has total shareholders

Q: Financial accountant

Q: Need answer