FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

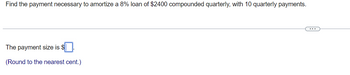

Transcribed Image Text:Find the payment necessary to amortize a 8% loan of $2400 compounded quarterly, with 10 quarterly payments.

The payment size is $.

(Round to the nearest cent.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Find the payment R needed to amortize a loan of $22,000 at 3.5%/year compounded monthly with 36 monthly installments over a period of 3 yearsarrow_forwardConsider a loan of 1,000,000 which is to be amortized by 60 monthly payments. The interest rate is 10% converted monthly. Construct the first 5 rows (t=0 to t=4) of the amortization schedulearrow_forwardThe payment necessary to amortize a 5.5% loan of $82,000 compounded annually, with 8 annual payments is $12,944.85. The total of the payments is $103,558.80 with a total interest payment of $21,558.80. The borrower ma larger payments of $13,000.00. Calculate (a) the time needed to pay off the loan, (b) the total amount of the paymen and (c) the amount of interest saved.arrow_forward

- Using the Add-On Method, calculate the monthly payment for a $ 8,500 loan that is borrowed for 3 years at an interest rate of 4%arrow_forwardThe following loan is a simple interest amortized loan with monthly payments. (Round your answers to the nearest cent.) $4000, 9 1/2%, 4 years (a) Find the monthly payment.(b) Find the total interest.arrow_forwardFind the payment necessary to amortize a 12% loan of $2300 compounded quarterly, with 12 quarterly payments. The payment size is $ (Round to the nearest cent.)arrow_forward

- Find the monthly payment needed to amortize a typical $90,000 mortgage loan amortized over 30 years at an annual interest rate of 3.3% compounded monthly. (Round your answers to the nearest cent.)$ Find the total interest paid on the loan.$arrow_forwardFind the monthly payment needed to amortize a typical $245,000 mortgage loan amortized over 30 years at an annual interest rate of 3.5% compounded monthly. (Round your answers to the nearest cent.)$ Find the total interest paid on the loan.$arrow_forwardA $35,000 loan at 4% compounded quarterly is to be repaid with six equal quarterly payments. The first payment is one year after the loan. Calculate the amount of each payment. For full marks your answer(s) should be rounded to the nearest cent. Payment $ 0.00arrow_forward

- Find the amortization table for a $8,000 loan amortized in five annual payments if the interest rate is 4.3% per year compounded annually. (Round your answers to the nearest cent.) End ofPeriod RepaymentMade InterestCharged PaymentTowardPrincipal Outstanding principle 0 8,000 1 2 3 4 5arrow_forwardFind the payment necessary to amoritize a 4% loan of $1600 compounded quarterly, with 9 quarterly payments The payment size is % (Round to the nearest cent.)arrow_forwardFind the monthly payment and estimate the remaining balance. Assume interest is on the unpaid balance. 4-year computer loan for $3106 at 5.7%; remaining balance after 2 years. The monthly payment is $. (Round to the nearest cent as needed.) The remaining balance is $. (Round to the nearest dollar as needed.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education