Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

infoPractice Pack

Question

infoPractice Pack

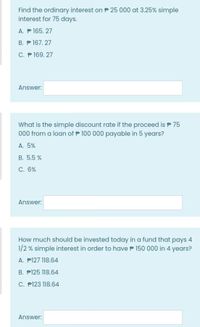

Transcribed Image Text:Find the ordinary interest on P 25 000 at 3.25% simple

interest for 75 days.

A. P 165. 27

B. P 167. 27

C. P 169. 27

Answer:

What is the simple discount rate if the proceed is P 75

000 from a loan of P 100 000 payable in 5 years?

A. 5%

B. 5.5 %

С. 6%

Answer:

How much should be invested today in a fund that pays 4

1/2 % simple interest in order to have P 150 000 in 4 years?

A. P127 118.64

B. P125 118.64

C. P123 118.64

Answer:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Includes step-by-step video

Trending nowThis is a popular solution!

Learn your wayIncludes step-by-step video

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Convert 6.66% compounded monthly to an equivalent interest rate compounded quarterly. Round EFF to four decimal places, round NOM (2) to two decimal places. C/Y (1) 12 NOM (1) 6.66 NOM (2) % % EFF % Enter an integer or decimal number [more..] (4 decimal places) C/Y (2)arrow_forwardA B E 2 Determine the maturity date and compute interest for each note. 3 Days to be used per year 360 days 4 Note Contract Date Principal Interest Rate Period of Note (Term) 6. 1 1-Mar $10,000 6% 60 days 7 2 15-May 15,000 8% 90 days 8 3 20-Oct 8,000 4% 45 days 9. 10 Required: 11 12 (Use cells A5 to F8 from the given information to complete this question.) 13 14 Note Contract Date Maturity Date Interest Expense 15 16 17 3 18arrow_forward14. What is the present value of $250,000 received in 250 days at 12% p.a. simple interest? Select one: a. $250,000.00 b. $231,012.66 c. $201,905.00 d. $213,012.66arrow_forward

- Present value of an Annuity of $1 in Arrears Periods 4% 6% 8% 10% 12% 14% 1 0.962 0.943 0.926 0.909 0.893 0.877 2 1.886 1.833 1.783 1.736 1.690 1.647 3 2.775 2.673 2.577 2.487 2.402 2.322 4 3.630 3.465 3.312 3.170 3.037 2.914 5 4.452 4.212 3.993 3.791 3.605 3.433 6 5.242 4.917 4.623 4.355 4.111 3.889 7 6.002 5.582 5.206 4.868 4.564 4.288 8 6.733 6.210 5.747 5.335 4.968 4.639 9 7.435 6.802 6.247 5.759 5.328 4.946 10 8.111 7.360 6.710 6.145 5.650 5.216 Lucas Company is considering a project with an initial investment of $530,250 in new equipment that will yield annual net cash flows of $95,000, and will be depreciated at $75,750 per year over its seven year life. What is the internal rate of return? a.6% b.14% c.10% d.12% e.8%arrow_forward4arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education