Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

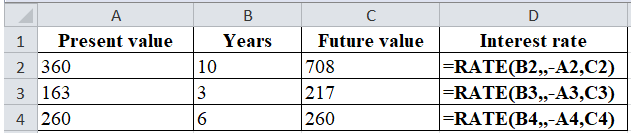

Find the interest rate implied by the following combinations of present and future values: (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places. Leave no cells blank - be certain to enter "0" wherever required.)

|

Expert Solution

arrow_forward

Step 1

Calculation of interest rates:

Excel workings:

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Solve for the unknown interest rate in each of the following: (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) Present Value S 775 965 21,000 76,300 Years 6 7 18 21 Interest Rate % Future Value $ 1,501 1,838 147,832 324,815arrow_forwardWhat is the present value of $876.89 if we discount it by 0.09 for one year (remember the equation c/(1+r)^n ) NOTE interest rate is in decimal already, no need to convertarrow_forwardpm.3arrow_forward

- For each of the following, compute the present value: (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Present Value Years Interest Rate Future Value 12 6% $ 14,451 3 12 % 41,557 28 13 % 876,073 30 10 % 540,164arrow_forwardFor each of the following annuities, calculate the annuity payment. Note: Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16. Annuity Payment $ $ $ Future Value 24,150 960,000 772,000 131,000 Years 8 36 22 13 Interest Rate 5% 7 8 4arrow_forwardInterest rates or discount rates. Fill in the interest rates for the following table using one of the three methods below: a. Use the interest rate formula, r=FVPV1n−1. b. Use the TVM keys from a calculator. c. Use the TVM function in a spreadsheet. Present Value Future Value Number of Periods Interest Rate $ 493.61 $ 1,902.61 20 ? $17,077.77 $228,416.84 32 ? $34,251.51 $ 63,755.61 24 ? $26,813.61 $212,279.67 10 ? Present Value Future Value Number of Periods Interest Rate $ 493.61 $ 1,902.61 20 nothing% (Round to two decimal places.) $17,077.77 $228,416.84 32 nothing% (Round to two decimal places.) $34,251.51 $ 63,755.61 24 nothing% (Round to two decimal places.) $26,813.61 $212,279.67 10 nothing% (Round to two decimal places.)arrow_forward

- Solve for the unknown number of years in each of the following: Note: Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16. $ Present Value Years Interest Rate Future Value 950 8% $ 1,805 2,641 6% 4,400 34,205 11 % 394,120 33,900 18 % 219,380arrow_forwardВ I U A 川。= Calibri 12 3 Question 2 Solve for the unknown interest rate in each of the following (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, eg.. 32.16) Present Value Years Interest Rate Future Value 181 317 335 17 1.080 48 000 13 185 382 40,353 30 531618 !!! 日arrow_forwardFor each of the following, compute the future value: Note: Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16. Present Value Years Interest Rate Future Value $ 2,400 6 17 % 9,953 19 9% 104,305 13 10 % 242,382 29 5%arrow_forward

- Interest rates or discount rates. Fill in the interest rates for the following table, , using one of the three methods below: FV a. Use the interest rate formula, r= PV - 1. b. Use the TVM keys from a calculator. c. Use the TVM function in a spreadsheet. Present Value Future Value Number of Periods Interest Rate 529.63 5 1,884.87 20 6.55 % (Round to two decimal places.) $17 207.92 $223,893.69 40 % (Round to two decimal places.)arrow_forwardFor each of the following, compute the present value: (Do not round inte calculations and round your answers to 2 decimal places, e.g., 32.16.) Present Value Years 12 4 16 21 Interest Rate 4 % 9 12 11 Future Value $ 18,528 42,717 802,382 659,816arrow_forwardFor each of the following, compute the present value: Note: Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16. Present Value Years 11 3 15 20 Interest Rate 5% 10 % 13 % 12 % Future Value $ 18,628 42,817 803,382 660,816arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education