Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

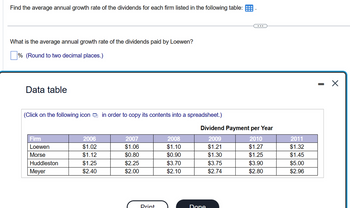

Transcribed Image Text:Find the average annual growth rate of the dividends for each firm listed in the following table:

What is the average annual growth rate of the dividends paid by Loewen?

% (Round to two decimal places.)

Data table

...

(Click on the following icon in order to copy its contents into a spreadsheet.)

Dividend Payment per Year

Firm

2006

2007

2008

2009

2010

2011

Loewen

$1.02

$1.06

$1.10

$1.21

$1.27

$1.32

Morse

$1.12

$0.80

$0.90

$1.30

$1.25

$1.45

Huddleston

$1.25

$2.25

$3.70

$3.75

$3.90

$5.00

Meyer

$2.40

$2.00

$2.10

$2.74

$2.80

$2.96

Print

Done

- ☑

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Firm A’s stock’s dividend’s growth rate = 2.75% annually. Do= $1.67. The dividend 6 years from now =? A) $1.88 B) $1.92 C) $1.97 D) $2.02 E) $2.05arrow_forwardPROVIDE Answer with calculationarrow_forwardRetained earnings versus new common stock Using the data for a firm shown in the following table, calculate the cost of retained earnings and the cost of new common stock using the constant-growth valuation model. (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Current market price per share $36.00 a. The cost of retained earnings is %. (Round to two decimal places.) Dividend growth rate 9% Projected dividend per share next year $1.08 (…) Underpricing Flotation cost per share per share $2.50 $2.00arrow_forward

- A company has an ROE of 12% and payouts 41% of its earnings as dividends. It is planning to pay a $3.02 dividend next year with a current stock price of $40. What is the company's dividend growth rate? Express your answer as a percentage and round to two decimals.arrow_forwardPlc plc has paid the following dividends over the past seven years: Year Dividend per share 2020 £2.30 2019 £2.22 2018 £2.05 2017 £1.95 2016 £1.86 2015 £1.79 2014 2013 £1.74 £1.65 i) Based on the information provided above, apply Gordon’s growth model to compute the dividend growth rate.arrow_forwardklp.2arrow_forward

- Please see attached. Find both the arithmetic growth rate and the geometric growth rate of the dividendsarrow_forwardAnnual dividends of Generic Electrical grew from $0.68 in 2012 to $1.05 in 2017. What was the annual growth rate? (Round your answer to 2 decimal places.)arrow_forwardABC plc has paid the following dividends over the past seven years: Year Dividend per share 2014 £2.35 2013 £2.28 2012 £2.10 2011 £1.95 2010 £1.82 2009 £1.80 2008 2007 £1.73 £1.61 i) Based on the information provided above, apply Gordon’s growth model to compute the dividend growth rate. explain how to find growth rate by showing formula which will used. ii) If you can earn 13% percent on similar-risk investments, what is the most you would be willing to pay per share?arrow_forward

- See Table 2.5 LOADING... showing financial statement data and stock price data for Mydeco Corp. Suppose Mydeco's costs and expenses had been the same fraction of revenues in 2016-2019 as they were in 2015. What would Mydeco's EPS have been each year in this case? Calculate the new EPS for 2016-2019 below: (Round dollar amounts and number of shares to one decimal place. Round percentage amount and the EPS to two decimal places.)arrow_forwardSubject: accounting Estimating the Market’s Expected Growth Rate in Dividends Mattel, Inc. was trading at a price of $31.24 per common share at December 31, 2015. Using the Gordon growth model, estimate the market’s expected growth in dividends that is required to yield the $31.24 price per common share. Assume that the current dividend per share is $1.52 and is expected to grow thereafter, and that the cost of equity capital is 8.0%. (Hint: Use the equation for the dividend discount model with increasing perpetuity, at the top of page 12-20.) Round answer to one decimal place (ex: 0.0235 = 2.4%). Note: Assume current dividend per share is the dividend amount when the constant growth period begins. Answer%arrow_forwardSuppose Potter Ltd. just issued a dividend of $2.52 per share on its common stock. The company paid dividends of $2.02, $2.09, $2.26, and $2.36 per share in the last four years. If the stock currently sells for $71, what is your best estimate of the company’s cost of equity capital using arithmetic and geometric growth rates?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education