Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

I only need help with the first picture which is summary of the finances which is on the second picture. The second picture is already taken care of but I am struggling with the first picture which is the summary.

Transcribed Image Text:C

c

11

Financial Performance Summary: Provide a brief

summary of your financial analysis from the

Financial Calculations.

Insert your summary.

Transcribed Image Text:Index

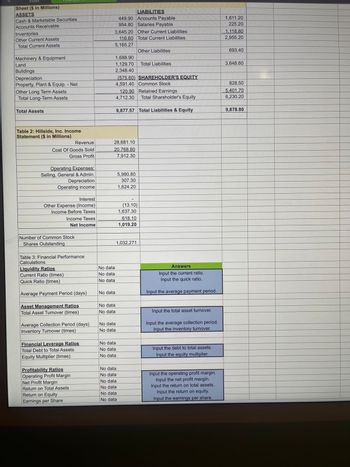

Sheet ($ in Millions)

ASSETS

Cash & Marketable Securities

Accounts Receivable

Inventories

Other Current Assets

Total Current Assets

Machinery & Equipment

Land

Buildings

Depreciation

Property, Plant & Equip. - Net

Other Long Term Assets

Total Long-Term Assets

Total Assets

Table 2: Hillside, Inc. Income

Statement ($ in Millions)

Revenue

Cost Of Goods Sold

Gross Profit

Operating Expenses:

Selling, General & Admin.

Depreciation

Operating income

Interest

Other Expense (Income)

Income Before Taxes

Income Taxes

Net Income

Number of Common Stock

Shares Outstanding

Table 3: Financial Performance

Calculations

Liquidity Ratios

Current Ratio (times)

Quick Ratio (times)

Average Payment Period (days)

Asset Management Ratios

Total Asset Turnover (times)

Average Collection Period (days)

Inventory Turnover (times)

Financial Leverage Ratios

Total Debt to Total Assets

Equity Multiplier (times)

Profitability Ratios

Operating Profit Margin

Net Profit Margin

Return on Total Assets

Return on Equity

Earnings per Share

3,645.20 Other Current Liabilities

116.60 Total Current Liabilities

5,165.27

No data

No data

No data

No data

No data

No data

1,688.90

1,129.70

2,348.40

LIABILITIES

449.90 Accounts Payable

954.80 Salaries Payable

28,681.10

20.768.80

7,912.30

(575.60) SHAREHOLDER'S EQUITY

4,591.40 Common Stock

No data

No data

120.90 Retained Earnings

4,712.30

No data

No data

No data

No data

No data

No data

No data

No data

No data

9,877.57 Total Liabilities & Equity

5,980.80

307.30

1,624.20

(13.10)

Other Liabilities

1,637.30

Total Liabilities

618.10

1,019.20

1,032,271

Total Shareholder's Equity

Answers

Input the current ratio.

Input the quick ratio.

Input the average payment period.

Input the total asset turnover.

Input the average collection period.

Input the inventory turnover.

Input the debt to total assets.

Input the equity multiplier.

Input the operating profit margin.

Input the net profit margin.

Input the return on total assets.

Input the return on equity.

Input the earnings per share.

1,611.20

225.20

1,118.80

2,955.20

693.40

3,648.60

828.50

5.401.70

6,230.20

9,878.80

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- I asked this question just earlier and received an inadequate answer that was not thorough or complete. I need to know the exact order of Assets and how they are recorded. Example I know Current Assets are listed first in order of Liquidity. I though Long Term Assets were next. So now I am confused. I am pasting the answer the prior individual gave me. Please make any corrections and be as clear as possible with terminology and provide examples. So I need a complete list of how Assets are recorded what they are called and examples of each type of Asset."Yes, There is a proper order of listing assets, current assets comes first in the order of liquidity and the comes the long term investment, fixed assets, intangibles.Tangibles and intangles assets are covered under Long term assets."arrow_forwardI can't read the bottom part " expenses on what ? The hand writing is bad please helparrow_forwardI am completing an income statement. I am not understanding what the whole thing means. Please helparrow_forward

- Robin states that 'voluntary disclosure of information in financial reports can help resolve the lemons problem'. Do you agree? Why and why not?arrow_forwardIf a cash payments journal is supposed to save time spent writing, why are there so many entries in the Other Accounts Debit column?arrow_forwardWhich of the following is true of EFT? It is easy to document purchase and sale transactions. It means Effective Funds Transfer. It cost more than receiving cash payments through the mail. It can process certain cash transactions at less cost than by using the mail.arrow_forward

- Describe who Elliott Ness was and how his team was able to capture evidence that led to the successful of Al "Scarface" Capone. Provide two websites that demonstrate forensic accounting in practice.arrow_forward7. The following are included in the current file, except: * A. Management representation letter B. Bank reconciliation C. Chart of accounts D. Draft of financial statements E. None of themarrow_forwardPlease help ASAP. Clearly define the answers for the following questions. (use at least 10 sentences for each , thanks) Question 1: Explain and give examples of the use of a fraud theory. Question 2: Outline the Fraud Triangle and give two examples of each elementarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education