Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

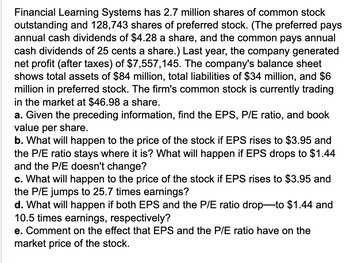

Transcribed Image Text:Financial Learning Systems has 2.7 million shares of common stock

outstanding and 128,743 shares of preferred stock. (The preferred pays

annual cash dividends of $4.28 a share, and the common pays annual

cash dividends of 25 cents a share.) Last year, the company generated

net profit (after taxes) of $7,557,145. The company's balance sheet

shows total assets of $84 million, total liabilities of $34 million, and $6

million in preferred stock. The firm's common stock is currently trading

in the market at $46.98 a share.

a. Given the preceding information, find the EPS, P/E ratio, and book

value per share.

b. What will happen to the price of the stock if EPS rises to $3.95 and

the P/E ratio stays where it is? What will happen if EPS drops to $1.44

and the P/E doesn't change?

c. What will happen to the price of the stock if EPS rises to $3.95 and

the P/E jumps to 25.7 times earnings?

d. What will happen if both EPS and the P/E ratio drop-to $1.44 and

10.5 times earnings, respectively?

e. Comment on the effect that EPS and the P/E ratio have on the

market price of the stock.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 1 images

Knowledge Booster

Similar questions

- Financial Leaming Systems has 3.1 million shares of common stock outstanding and 117,066 shares of preferred stock. (The preferred pays annual cash dividends of $4.65 a share, and the common pays annual cash dividends of 26 cents a share) Last year, the company generated net profit (after taxes) of $7.627.939. The company's balance sheet shows total assets of $80 million, total liabilitios of $30 million, and $5 million in preferred stock. The firm's common stock is currently trading in the market at $46.72 a share. a. Given the preceding information, find the EPS, P/E ratio, and book value per share b. What will happen to the price of the stock if EPS rises to $3.38 and the P/E ratio stays where it is? What will happen if EPS drops to $1.39 and the P/E doesn't change? c. What will happen to the price of the stock if EPS rises to $3.38 and the P/E jumps to 28.8 times eamings? d. What will happen if both EPS and the P/E ratio drop-to $1.39 and 12.1 times earnings, respectively? e.…arrow_forwardJames Corporation earned net income of $90,000 this year. The company began the year with 600 shares of common stock and issued 500 more on April 1. They issued $5,000 in preferred dividends for the year. What is the EPS for the year for James (rounded to the nearest dollar)?arrow_forwardThe Paulson Company's year-end balance sheet is shown below. Its cost of common equity is 15%, its before-tax cost of debt is 8%, and its marginal tax rate is 25%. Assume that the firm's long-term debt sells at par value. The firm's total debt, which is the sum of the company's short-term debt and long-term debt, equals $1,201. The firm has 576 shares of common stock outstanding that sell for $4.00 per share. Assets Liabilities And Equity Cash $ 120 Accounts payable and accruals $ 10 Accounts receivable 240 Short-term debt 51 Inventories 360 Long-term debt 1,150 Plant and equipment, net 2,160 Common equity 1,669 Total assets $2,880 Total liabilities and equity $2,880 Calculate Paulson's WACC using market-value weights. Do not round intermediate calculations. Round your answer to two decimal places. %arrow_forward

- A firm had the following financials last year: Sales Revenue = $3,060Accounts receivable = $500Interest expense = $126Total operating expenses = $600Accounts payable = $240Cost of goods sold = $1,800Dividend on preferred stock = $18Tax rate = 40% Number of outstanding number of common shares = 1,000 The E.P.S of the firm, rounded to four decimal places isarrow_forwardFuturistic Development (FD) generated $2 million in sales last year with assets equal to $5 million. The firm operated at full capacity last year. According to FD's balance sheet, the only current liabilities are accounts payable, which equals $460,000. The only other liability is long-term debt, which equals $730,000. The common equity section is comprised of 500,000 shares of common stock with a book value equal to $3 million and $810,000 of retained earnings. Next year, FD expects its sales will increase by 22 percent. The company's net profit margin is expected to remain at its current level, which is 16 percent of sales. FD plans to pay dividends equal to $0.60 per share. It also plans to issue 70,000 shares of new common stock, which will raise $460,000. Estimate the additional funds needed (AFN) to achieve the forecasted sales next year. Round your answer to the nearest dollar.arrow_forwardyellow Fire had Net Income for the year just ended of $1,850, and the firm paid out $500 in cash dividends. The company currently has 10,000 shares of common stock outstanding, and the stock currently sells for $240 per share. �What is the PE ratio?arrow_forward

- The Paulson Company's year-end balance sheet is shown below. Its cost of common equity is 14%, its before-tax cost of debt is 10%, and its marginal tax rate is 25%. Assume that the firm's long-term debt sells at par value. The firm's total debt, which is the sum of the company's short-term debt and long-term debt, equals $1,183. The firm has 576 shares of common stock outstanding that sell for $4.00 per share. Cash Assets Accounts receivable Inventories Liabilities And Equity $ 120 Accounts payable and accruals $ 10 53 240 360 Short-term debt Long-term debt 1,130 30 Plant and equipment, net Total assets 2,160 $2,880 Common equity Total liabilities and equity 1,687 $2,880 Calculate Paulson's WACC using market-value weights. Do not round intermediate calculations. Round your answer to two decimal places. %arrow_forwardDuring Year 3, Solomon Corporation reported after-tax net income of $3,635,000. During the year, the number of shares of stock outstanding remained constant at 9,540 of $100 par, 10 percent preferred stock and 397,000 shares of common stock. The company's total stockholders' equity is $19,500,000 at December 31, Year 3. Solomon Corporation's common stock was selling at $53 per share at the end of its fiscal year. All dividends for the year have been paid, including $4.80 per share to common stockholders. Required a. Compute the earnings per share. (Round your answer to 2 decimal places.) b. Compute the book value per share of common stock. (Round your answer to 2 decimal places.) e. Compute the price-earnings ratio. (Round intermediate calculations and final answer to 2 decimal places.) d. Compute the dividend yield. (Round your percentage answer to 2 decimal places (i.e., 0.2345 should be entered as 23.45)) a Eamings per share b. Book value per share e. Price eamings ratio a. Dividend…arrow_forwardIn its most recent financial statements, Nessler Inc. reported $55 million of net income and $880 million of retained earnings. The previous retained earnings were $854 million. How much in dividends were paid to shareholders during the year? Assume that all dividends declared were actually paid. Write out your answer completely. For example, 25 million should be entered as 25,000,000. Round your answer to the nearest dollar.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education