FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Financial Analysis Activity

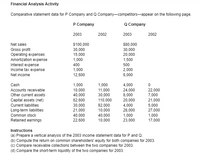

Comparative statement data for P Company and Q Company-competitors-appear on the following page.

P Company

Q Company

2003

2002

2003

2002

Net sales

$100,000

30,000

15,000

1,000

S80,000

Gross profit

Operating expenses

Amortization expense

Interest expense

Income tax expense

30,000

20,000

1,500

400

1,000

500

2,000

6,000

Net income

12,600

Cash

1,000

1,000

10,000

40,000

62,600

30,000

21,000

40,000

22,600

4,000

Accounts receivable

11,000

24,000

22,000

7,000

30,000

110,000

Other current assets

8,000

21,000

5,000

27,000

1,000

17,000

Capital assets (net)

20,000

Current liabilities

92,000

10,000

4,000

28,000

Long-term liabilities

40,000

10,000

1,000

23,000

Common stock

Retained earnings

Instructions

(a) Prepare a vertical analysis of the 2003 income statement data for P and Q.

(b) Compute the return on common shareholders' equity for both companies for 2003.

(c) Compare receivable collections between the two companies for 2003.

(d) Compare the short-term liquidity of the two companies for 2003.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- ancial Statements Nataro, Incorporated, has sales of $676,000, costs of $338,000, depreciation expense of $82,000, interest expense of $51,000, and a tax rate of 24 percent. What is the net income for this firm? (Do not round intermediate calculations.) Net incomearrow_forwardVertical analysis The following income statement data for AT&T Inc. and Verizon Communications Inc. were taken from their recent annual reports (in millions): AT&T Verizon Revenues $132,447 $127,079 Cost of services (expense) 60,611 49,931 Selling and marketing expense 39,697 41,016 Depreciation and other expenses 20,393 16,533 Operating income $ 11,746 $ 19,599 Required: a. Prepare a vertical analysis of the income statement for AT&T. Round to one decimal place. AT&T Income Statement Amount Percent Revenues Cost of services (expense) Selling and marketing expense Depreciation and other expenses Operating income b. Prepare a vertical analysis of the income statement for Verizon. Round to one decimal place. Verizon Income Statement Amount Percent Revenues Cost of services (expense) Selling and marketing expense Depreciation and other expenses Operating…arrow_forwardTrend Analysis Critelli Company has provided the following comparative information: Year 5 Year 4 Year 3 Year 2 Year 1 Net income $940,300 $810,600 $681,200 $582,200 $493,400 Interest expense 319,700 291,800 252,000 192,100 153,000 Income tax expense 300,896 226,968 190,736 151,372 118,416 Average total assets 5,779,817 5,103,704 4,360,748 3,704,785 3,153,171 Average stockholders' equity 1,975,420 1,769,869 1,548,182 1,373,113 1,203,415 You have been asked to evaluate the historical performance of the company over the last five years. Selected industry ratios have remained relatively steady at the following levels for the last five years: Industry Ratios Return on total assets 21.5 % Return on stockholders’ equity 44.4 % Times interest earned 4.6 Instructions: Calculate three ratios for Year 1 through Year 5. Round to one decimal place. a. Return on total assets: Year 5…arrow_forward

- Caesar Limited The Statement of Comprehensive Income of Caesar Limited for the year to 31st December 2021 is shown below. The company's statement of financial position as of that date (with comparative figures for 2020) is also shown. Caesar LimitedStatement of Comprehensive Income for the year to 31st December 2021 2021 £'000 Sales 4,450 Cost of sales (2,738) Gross profit 1,712 Administration and distribution expenses (980) Interest payable (740) Dividend received 649 Profit before tax 641 Taxation (200) Profit after tax 441 Caesar Limited Statements of Financial Position as at 31 December 2021 and 2020 2021 2020 £'000 £'000 ASSETS: Non-current assets Property, plants and equipment 3,450 3,340 Investments 840 840 4,290 4,180 Current assets Inventories 790 588 Trade receivables 423 541 Cash at bank 621 1,834 --- 1,129 6,124…arrow_forwardIncome statement net sales $51,407.00 cost of products sold $25,076.00 gross profit $26,331.00 marketing, research, administrative exp $15,746.00 Depreciation $758.00 operating income(loss) $9,827.00 Interest expense $477.00 Earnings (loss)before income taxes $9,350.00 Income taxes $2,869.00 Net earnings(loss) $6,481.00 Balance Sheet Assets: Liablilites and Equity: cash and marketable securities $5,469.00 accounts payable $3,617.00 investment securities $423.00 accrued and other liablilties $7,689.00 accounts receivable $4,062.00 taxes payable $2,554.00 inventory $4,400.00 debt due within one year $8,287.00 deffered income taxes $958.00 total current liabilite $22,147.00 prepaid expense and other receivables $1,803.00 long term debt $12,554.00 total current assets $17,115.00 deferrred income taxes…arrow_forwardCalculate the profit margin (net income / sales) for the firm below. Sales 1700 COGS $1,200 Depreciation $800 Interest $500 Net Income 900 Total Assets $5,000arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education