Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

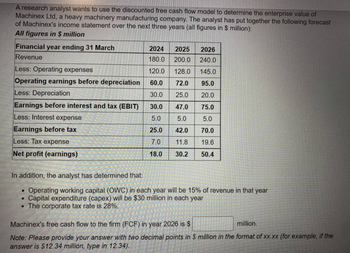

Transcribed Image Text:A research analyst wants to use the discounted free cash flow model to determine the enterprise value of

Machinex Ltd, a heavy machinery manufacturing company. The analyst has put together the following forecast

of Machinex's income statement over the next three years (all figures in $ million):

All figures in $ million

Financial year ending 31 March

2024 2025

Revenue

180.0

Less: Operating expenses

120.0

Operating earnings before depreciation

60.0

Less: Depreciation

30.0

Earnings before interest and tax (EBIT) 30.0

5.0

25.0

7.0

18.0

Less: Interest expense

Earnings before tax

Less: Tax expense

Net profit (earnings)

2026

200.0 240.0

128.0

145.0

72.0

95.0

25.0

20.0

47.0

75.0

5.0

5.0

42.0

70.0

11.8

19.6

30.2

50.4

In addition, the analyst has determined that:

Operating working capital (OWC) in each year will be 15% of revenue in that year

Capital expenditure (capex) will be $30 million in each year

The corporate tax rate is 28%.

.

Machinex's free cash flow to the firm (FCF) in year 2026 is $

million.

Note: Please provide your answer with two decimal points in $ million in the format of xx.xx (for example, if the

answer is $12.34 million, type in 12.34).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The table below gives the expected cash inflows of a firm for a period of 9 years. Time 3 6 9 Cash inflow (£) 45000 90000 120000 Assume the present value of the cash outflows is £87000, and the applicable cost of capital is 13%. Calculate the (a) Future value of the cash inflows (b) Modified internal rate of return (MIRR)arrow_forwardAs a financial analyst, you have been tasked with evaluating Randy Watson Music's free cash flow. Based on the 2022 income statement, BIT was $41 million, the tax rate was 21 percent, and its depreciation expense was $6 million. NOPAT gross fixed assets increased by $28 million from 2021 and 2022. The company's current assets increased by $18 million and current liabilities increased by $14 million. Calculate the Investment in operating capital (IOC) for 2022.arrow_forwardElmdale Enterprises is deciding whether to expand its production facilities. Although long-term cash flows are difficult to estimate, management has projected the following cash flows for the first two years (in millions of dollars): a. What are the incremental earnings for this project for years 1 and 2? (Note: Assume any incremental cost of goods sold is included as part of operating expenses.) b. What are the free cash flows for this project for years 1 and 2? a. What are the incremental earnings for this project for years 1 and 2? (Note: Assume any incremental cost of goods sold is included as part of operating expenses.) Calculate the incremental earnings of this project below: (Round to one decimal place.) Incremental Earnings Forecast (millions) Sales Operating Expenses Depreciation EBIT Income tax at 21% Unlevered Net Income Year 1 Year 2 $ $ SA $ 69 $ GA 67 69 $ $ $ 6969 $ $ SAarrow_forward

- You are considering an investment in Fields and Struthers, Inc., and want to evaluate the firm's free cash flow. From the income statement, you see that Fields and Struthers earned an EBIT of $64 million, had a tax rate of 21 percent, and its depreciation expense was $5 million. Fields and Struthers's NOPAT gross fixed assets increased by $30 million from 2020 and 2021. The firm's current assets increased by $26 million and spontaneous current liabilities increased by $15 million. Calculate Fields and Struthers's NOPAT operating cash flow for 2021. (Enter your answer in millions of dollars rounded to 2 decimal places.) Operating cash flow Calculate Fields and Struthers's NOPAT investment in operating capital for 2021. (Enter your answer in millions of dollars.) Investment in operating capital million Free cash flow Check my work million million Calculate Fields and Struthers's NOPAT free cash flow for 2021. (Enter your answer in millions of dollars rounded to 2 decimal places.)arrow_forwardConsider the following data (be careful there might be some "unnecessary" information). EBIT = 176 Interest expense = 10 Tax rate = 30% Depreciation = 38 Net working capital = 30 Increase in net working capital = 10 Beginning of period Net PP&E = 50 Capex = 16 What is the free cash flow of the firm that year?arrow_forwardFind the present value of the following stream of a firm's cash flows, assuming that the firm's opportunity cost is 8%. End of year Cash flow 1 2 3 $5,000 $25,000 $14,000arrow_forward

- As a financial analyst, you have been tasked with evaluating Randy Watson Music's free cash flow. Based on the 2022 income statement, EBIT was $41 million, the tax rate was 21 percent, and its depreciation expense was $6 million. NOPAT gross fixed assets increased by $28 million from 2021 and 2022. The company's current assets increased by $18 million and current liabilities increased by $14 million. Calculate the operating cash flow (OCF) for 2022. (Enter your answer in millions of dollars.)arrow_forwardA company is considering a $166,000 investment in machinery with the following net cash flows. The company requires a 10% return on its investments. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.) Year 1 Year 2 Year 3 Year 4 Year 5 Net Cash Flow $10,000 $28,000 $55,000 $42,000 $111,000 (a) Compute the net present value of this investment.(b) Should the machinery be purchased?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education