ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Transcribed Image Text:please solve with formulas like (F/P, 5% , n)

not with the excell.

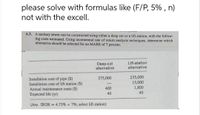

A.3. A sanitary sewer can be constructed using either a deep cut or a lift station, with the follow-

ing costs estimnated. Using incremental rate of return analysis techniques, determine which

alternative should be selected for an MARR of 7 percent.

Deep-cut

alternative

Lift-station

alternative

235,000

15,000

1,800

275,000

Installation cost of pipe ($)

Installation cost of lift station ($)

Annual maintenance costs ($)

Expected life (yr)

400

40

40

(Ans. IROR = 4.73% < 7%; select lift station)

Expert Solution

arrow_forward

Step 1

Introduction:

The minimum acceptable rate of return, also known as the hurdle rate, is the lowest rate of return that the project must achieve in order to cover the costs of the investment. Projects are also evaluated by discounting future cash flows to the present by the hurdle rate in order to obtain the net present value (NPV), which measures the difference between the PV (present value) of cash inflows and the PV (present value) of cash outflows.

In general, the hurdle rate is equal to the company's costs of capital, which are a mix of the cost of stock and the cost of debt. Managers generally raise the hurdle rate for riskier projects or when the organisation is assessing various investment alternatives.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 3arrow_forwardMargaret has a project with a $28 000 first cost that returns $5000 per year over its 10-year life. It has a salvage value of $3000 at the end of 10 years. If the MARR is 5 percent, what is the payback period of this project? Ctrl) -arrow_forwardplease dont provide solution in an image format thank youarrow_forward

- Give proper answer without photo answer and take a likearrow_forwardLittrell's Nursery needs a new irrigation system. System one will cost $145,000, have annual maintenance costs of $10,000, and need an overhaul at the end of year six costing $30,000. System two will have first year maintenance costs of $5,000 with increases of $500 each year thereafter. System two would not require an overhaul. Both systems will have no salvage value after 12 years. If Littrell's cost of capital is 4%, using annual worth analysis determine the maximum Littrell's should be willing to pay for system two.arrow_forwardthe rate of return n (year) 0 1 2 For the investment project with cash flow transaction given in the Table, compute i= Table Project(S) -4,000 2,500 1,000 4000 ܘܘܪܙܐ 11,000 2arrow_forward

- Which increment should be examined first in incremental rate of return analysis, if MARR = 10.0%? Do-nothing A B C D First cost 0 $8,000 $4,500 $8,500 $6,000 Annual 0 1,387 914 1,661 935 benefit Life 10 yrs ROR 11.5% 15.5% 14.5% 9.0% A-B OB-A OA-C OB-Carrow_forwardA sportswear factory has two alternative machines for producing jerseys. Costs are shown below. Minimum acceptable rate of return is 8%.What is the annual cost for machine Y?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education