FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

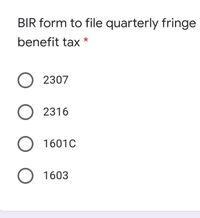

Transcribed Image Text:BIR form to file quarterly fringe

benefit tax *

O 2307

O 2316

O 1601C

1603

Transcribed Image Text:Mandaue reimbursed the following expense liquidation of its managerial employee:

20,000.00

Purchase of office supplies

Personal meals and groceries

15,000.00

Gasoline for transportation (1/2 for business)

8,000.00

Office electricity, water, and telephone bills

12,000.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Received RM900,000 in advance for journal subsriptions to be Delivered in December and January.Prepare journal entry?arrow_forwardPrepare all relevant journal entries for a $40,000 four year 5% interest note issued on January 1arrow_forwardMar 15) issued check No. 417, payable to payroll, in payment of sales salaries expense for the first half of the month, $20,100. Cashed the check and paid the employeesarrow_forward

- Annual interest of 3.5 percent paid if balance exceeds $800, $6 monthly fee if account falls below minimum balance, average monthly balance $880, account falls below $800 during 6 months. Round the answer to the nearest cent.arrow_forwardAdjusting entry: On 1 December 2019, Count-On-Us Pty Ltd invested $50,000 in a term deposit at Commonwealth Bank. Interest is received after one year and the interest rate is 6% p.a. Instructions: Record the adjusting entry for the year ending 30 June 2020 by selecting the correct accounts and amounts that are debited and credited.arrow_forwardTO: Bill Bugnay MEMORNDUM FROM: M. Lasker Please make the GST Remittances (nomally monthly) to the Receiver General for November (#2147) now as we will be closed until January 5.20XX + 1. For Computer Software Applications: November Detail Sales for GST purposes Purchases for ITC purposes Owing (December 1 Balance carried Forward) GST $1,000,000 $50.000 $759,000 $37.950 $12.050 (#2147) Thanks Arif Record the transaction in the general journal.arrow_forward

- sarrow_forwardComplete the following table: Spot One-month Three-month 1.9072-1.9077 Forward Quotations 32 - 30 57 - 54 v) Is there a discount or a premium? ? ?arrow_forwardExercise 10-5A (Algo) Calculations for a line of credit LO 10-2 Colson Company has a line of credit with Federal Bank. Colson can borrow up to $373,000 at any time over the course of the Year 1 calendar year. The following table shows the prime rate expressed as an annual percentage, along with the amounts borrowed and repaid during the first four months of Year 1. Colson agreed to pay interest at an annual rate equal to 2.00 percent above the bank's prime rate. Funds are borrowed or repaid on the first day of each month. Interest is payable in cash on the last day of the month. The interest rate is applied to the outstanding monthly balance. For example, Colson pays 5.25 percent (3.25 percent + 2.00 percent) annual interest on $84,800 for the month of January. Month January February Month Amount Borrowed or (Repaid) January February March April $ 84,800 124,000 (15,200) 26,400 Prime Rate for the March April Required: a. Compute the amount of interest that Colson will pay on the line…arrow_forward

- create a journal entry for Jul 01 Purchased equipment, paying $6,060 cash and signing a 2-year note payable for $19,240. The equipment has a 8-year useful life. The note has a 9% interest rate, with interest payable on the first day of each following month.arrow_forwardYear-end adjusting journal entries Prepare budgetary and proprietary journal entries to record the following year-end adjustments: Note: If a journal entry is not required, select No entry as your answers and leave the Debit and Credit answers blank (zero). 1. An accrual of $60,000 was made for salaries earned the last week of September, to be paid in October. Budgetary funds were available for this purpose.arrow_forwardForm 941 is filed: A. annually B. Quarterly C. Weekly D. monthlyarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education