Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

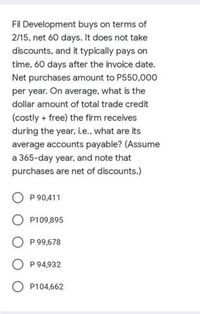

Transcribed Image Text:Fil Development buys on terms of

2/15, net 60 days. It does not take

discounts, and it typically pays on

time, 60 days after the invoice date.

Net purchases amount to P550,000

per year. On average, what is the

dollar amount of total trade credit

(costly + free) the firm receives

during the year, i.e., what are its

average accounts payable? (Assume

a 365-day year, and note that

purchases are net of discounts.)

P 90,411

O P109,895

P 99,678

O P 94,932

P104,662

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- ABCD Corporation has credit sales of $12,690,000 and receivables of $1,970,000. Assume there are 365 days in a year. What is the receivables turnover? Round your answer to two decimal places. What is the average collection period (days sales outstanding)? Round your answer to the nearest whole number. days If the company offers credit terms of 50 days, are its receivables past due? Round your answer to the nearest whole number. Enter zero if the receivables are not past due. -Select-YesNoItem 3 , it is days overdue.arrow_forwardAxis Wells and Excavation (AWE) currently generates $110,000 in annual credit sales. AWE sells on terms of net 50, and its accounts receivable balance averages $11,000. AWE is considering a new credit policy with terms of net 25. Under the new policy, sales will decrease to $104,000, and accounts receivable will average $13,000. Compute the days sales outstanding (DSO) under the existing policy and the proposed policy. Assume there are 360 days in a year. Round your answers to the nearest whole number. DSO Existing: days DSO New: daysarrow_forwardSnider Industries sells on terms of 2/10, net 35. Total sales for the year are $600,000. Thirty percent of customers pay on the 10th day and take discounts; the other 70% pay, on average, 40 days after their purchases. Assume a 365-day year. What is the days sales outstanding? Do not round intermediate calculations. Round your answer to the nearest whole number. days What is the average amount of receivables? Do not round intermediate calculations. Round your answer to the nearest dollar. $ What would happen to average receivables if Snider toughened its collection policy with the result that all nondiscount customers paid on the 35th day? Do not round intermediate calculations. Round your answer to the nearest dollar. $arrow_forward

- Black Panther Inc. buys on terms of 2/15, net 60 days. It does not take discounts, and it typically pays on time, 60 days after the invoice date. Net purchases amount to P450,000 per year. On average, how much “free” trade credit does the firm receive during the year? (Assume a 365-day year, and note that purchases are net of discounts.)arrow_forwardAssume that a firm issues $500,000,000 of U.S. commercial papers (and therefore uses a 360-day year for CP calculations) with a 30-day maturity at a discount of 0.5%. The annualized dealer fee is 0.175% and the cost of a backup line of credit is 0.25%. a. What is the amount of usable funds? b. What is the amount of dealer fee? c. What is the amount of backup line of credit? d. What is the annualized cost of the paper?arrow_forwardDome Metals has credit sales of $450,000 yeariy with credit terms of net 45 days, which is also the average collection perlod. a. Assume the fnrm offers a 2 percent discount for payment in 18 days and every customer takes advantage of the discount. Also assume the firm uses the cash generated from its reduced receivables to reduce its bank loans which cost 12 percent. What will the net gain or loss be to the firm if this discount is offered? (Use a 360-day year.)arrow_forward

- Aggarwal Inc. buys on terms of 1/10, net 20, and it always pays on the 20th day. The CFO calculates that the average amount of costly trade credit carried is $750,000. What is the firm's average accounts payable balance? Assume a 365-day year. a. $1,000,000 b. $1,492,500 c. $1,500,000 d. $1,125,000 e. $1,113,750arrow_forwardBumpas Enterprises purchases $4,562,500 in goods per year from its sole supplier on terms of 4/10, net 65. If the firm chooses to pay on time but does not take the discount, what is the effective annual percentage cost of its non-free trade credit? (Assume a 365-day year.) a. 21.98% b. 27.65% c. 29.49% d. 31.12% e. 28.46%arrow_forwardABC Corp. has net credit sales of P1,440,000 yearly with credit terms of n/30, which is also the average collection period. BECK does not offer discounts for early payment; thus, customers take the full 30 days to pay. (Use 360 days/year) 1.What is the average receivable balance? 2.What is the accounts receivable turnover?arrow_forward

- TBTF Bank makes a 3 year interest only loan to AFC Inc of $2,350,000.00. The interest rate on the loan is ¡ (52) = 12.500%, and the payments will be made quarterly. TBTF reinvests the payments at an interest rate of ¡(26) = 14.250%. At maturity, what is TBTF Bank's annual ROI over the lifetime of the loan? (AFC does not default.) a. 11.289% b. 12.241% C. 13.601% d. 14.009% e. 12.377%arrow_forwardIf a firm has sales of $21,764,000 a year, and the average collection period for the industry is 55 days, what should this firm’s accounts receivable be if the firm is comparable to the industry? Assume there are 365 days in a year. Do not round intermediate calculations. Round your answer to the nearest dollar.arrow_forwardngram Office Supplies, Inc., buys on terms of 2/15, net 50 days. It does not take discounts, and it typically pays on time, 50 days after the invoice date. Net purchases amount to $675,000 per year. On average, what is the dollar amount of costly trade credit (total credit – free credit) the firm receives during the year? (Assume a 365-day year, and note that purchases are net of discounts.) Do not round intermediate calculations. $56,959 $64,726 $78,318 $59,548 $53,723arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education