ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

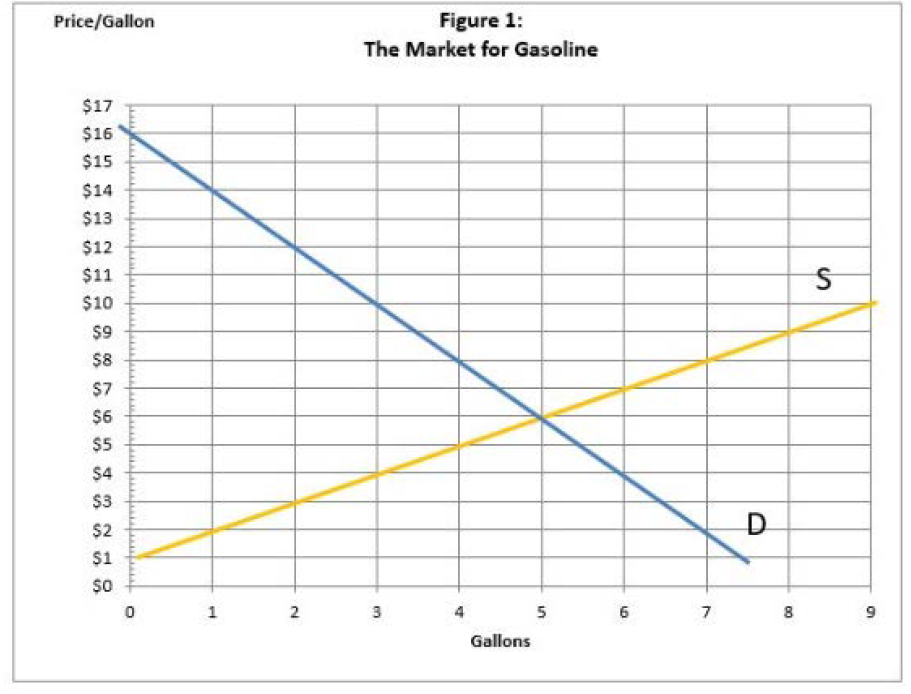

In Figure 1, suppose the marginal value for gasoline falls by $6 for every quantity demanded for all gas stations in the market. Next, assume that the government enacts a

A) $6

B) $2

C) $12

D) There is no consumer welfare loss because prices are lower.

E) There is not enough information to calculate.

Transcribed Image Text:Figure 1:

Price/Gallon

The Market for Gasoline

$17

$16

$15

$14

$13

$12

$11

$10

$9

$8

$7

$6

$5

$4

$3

$2

$1

0

1

5

6

7

8

Gallons

en

O

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- A cup of Starbucks Macchiato will cost you almost $6, and a similar cup at McDonald will cost about $3. The exotic Indonesian Civet Coffee will cost at least $25 per cup. What is the most that you are willing to pay for a cup? Is it worth to pay more? Do you have any consumer surplus on this consumption?arrow_forwardPlease written by computer source Suppose that the demand curve for a product is given by Q = 100 −10p and the supply curve is Q = 10p. Assume that income effects (elasticities) are small so consumer surplus is a good measure of consumer welfare. (a) What is the equilibrium price and quantity with no distortions? (b) The government imposes a tax of $2.00 per unit sold. What is the new equilibrium quantity? Sketch the market equilibrium in a graph. (c) Given the tax what is the change in consumer surplus? What is the change in producer surplus? What is the change in government revenue? What is the net Dead Weight Loss from the tax? (d) Say the government proposes to use the revenue from the tax to pay for snacks in our last ECON 312A lecture. The total social benefits from the snacks would be $82.00. Will the tax increase overall welfare if the revenue is used to buy the snacks? What is the dollar value of the net gain or loss to society?arrow_forward. Suppose that the demand curve is P = f(Q) = 30−0.2Q and the supply curve is P = g(Q) =0.1Q + 15. Find the equilibrium price and compute the consumer and producer surplus.arrow_forward

- Lesson 6- Individual and Market Demand Question 2arrow_forwardSuppose that a $4 subsidy is given to consumers in this market, what is the new consumer surplus?arrow_forwardIf Samantha's income is reduced to zero after she loses her job, her consumption will be ________ and her saving will be ________. Group of answer choices greater than zero; less than zero less than zero; less than zero greater than zero; greater than zero less than zero; greater than zeroarrow_forward

- Refer to the graph shown. With an effective price ceiling at $3, total surplus is reduced by: Please see attached image.arrow_forwardWhich of the following would lead to the creation of some consumer surplus? Sam refuses to pay $10 for a haircut because it is only worth $8 to him. Fred buys a car for $4000, the maximum amount that he is willing to pay. Danette pays $30 a month for phone service, but it is worth $70 a month to her. When Florence purchases a candy bar for 50 cents, she uses a $20 bill to pay for it.arrow_forwardConsider the data in the table below when you answer this question. (As the table suggests, the demand curve for this continuous good is a straight line and so is the supply curve. Use that information and the geometric method for calculating surplus.) P $12 12 $10 4 10 $8 8 8 $6 12 6 $4 16 4 $2 20 2 Suppose the price is $8 but that only 4 pizzas are bought and sold due to regulations imposed by the government. The most social surplus that can be generated isarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education