Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

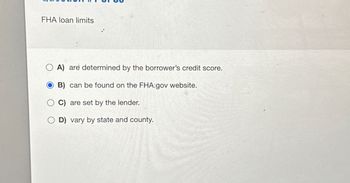

Transcribed Image Text:FHA loan limits

OA) are determined by the borrower's credit score.

B) can be found on the FHA:gov website.

C) are set by the lender.

D) vary by state and county.

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Which of the following is considered to be a good debt? Select one or more: a. credit card debt b. student loan debt c. store credit card debt d. payday loanarrow_forwardStudent loans are an example of Non-FICO debt Unsecured debt FICO debt Secured debtarrow_forwardWhich are the fundamental relationships to know in any loan refinancing decision include at least three ingredients?arrow_forward

- Which of the following correctly describes the exchange between lender and borrower in a typical lending transaction? O The borrower signs the Note in return to receive Mortgage from the lender O The borrower signs the Mortgage in return to receive Deed of Trust from the lender O The borrower signs both Mortgage and Deed of Trust to receive money from the lender The borrower signs both Note and Mortgage to receive money from the lenderarrow_forwardExplain the treatment of The City’s loan relationships, including the non-trade loanrelationship credits brought forward.arrow_forwardis a type of debt that is a term loan mostly used for a specific investment, to start a business, or to make a substantial purchase. A O SBA 7(A) loan CDC-504 loan Leases Business loanarrow_forward

- State the kinds of note disclosures that need to be made to help users understand the nature of “Transfers in” to the General Fund.arrow_forwardWhat federal law protects cosigners on a loan agreement? What is the bank required to do? What other protections are included in this law?arrow_forwardMulitple choice question When are liabilities recognized for the federal Social Security program? Select one: a. When benefits are paid to the recipients b. When benefits are earned by the recipients c. When benefits are due and payable at the end of a reporting period d. When the social security trust fund receives cash from employees and employersarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education