FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Calculate the following from the information given Fego Ltd:

1. Payback Period (expressed in years, months and days).

2. Accounting

3.

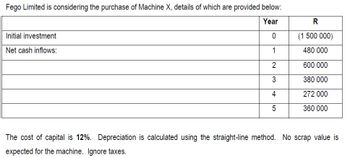

Transcribed Image Text:Fego Limited is considering the purchase of Machine X, details of which are provided below:

Year

R

Initial investment

Net cash inflows:

0

(1 500 000)

1

480 000

2

600 000

3

380 000

4

272 000

5

360 000

The cost of capital is 12%. Depreciation is calculated using the straight-line method. No scrap value is

expected for the machine. Ignore taxes.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 1 steps

Knowledge Booster

Similar questions

- An arithmetic cash flow gradient series equals $600 in year 1, $800 in year 2, and amounts increasing by $200 per year through year 5. At i = 6% per year, determine the factor from the compound interest factor table that is used to calculate the equivalent annual worth of the revenue through year 5. Multiple choice question. A. 4.212 B. 5.637 C. 1.884 D. 7.934arrow_forwardFind the net present value (NPV) for the following series of future cash flows, assuming the company’s cost of capital is 10.19 percent. The initial outlay is $471,448. Year 1: 191,637 Year 2: 128,236 Year 3: 161,255 Year 4: 138,369 Year 5: 190,517 Round the answer to two decimal places in percentage form.arrow_forwardBaghibenarrow_forward

- What is the paypack period if initial investemnet is - $3700.00 Cash Flow for seven years as follow: year Year 1 -$612.50 year 2 $-105.00 year 3 $105.00 year 4 $612.50 year 5 $1225.00 year 6 $2100.00 year 7 $3937.50 What is the Net Present Value with a dicount rate of 10.0?arrow_forwardFor the cash flow revenues shown below, find the value of G that makes the equivalent annual worth in years 1 through 7 equal to $500. The interest rate is 6.00% per year. (Round the final answer to three decimal places.) Cash flow, $ Year 0 1 2 3 The value of G is $ 225.0 225.0+ G 225.0+2G Year 4 5 16 Cash flow, $ 225.0+36 225.0+4G 225.0+5G 225.0+66arrow_forwardWhat is the internal rate of return (IRR) of the following set of cash flows? (Enter your answer as a percentage rounding to 2 decimals, e.g., 12.34% as 12.34) Year O cash flow = -146,000 Year 1 cash flow = -32,000 Year 2 cash flow= 60,000 Year 3 cash flow = 70,000 Year 4 cash flow = 53,000 Year 5 cash flow = 65,000arrow_forward

- The following investment requires a table factor for a period beyond the table. Calculate the new table factor and the present value (principal). Use Table 11-2. Round your new table factor to five decimal places and your present value to the nearest cent. Compound Amount New Table Factor Term of Nominal Interest Present Investment (years) Rate (%) Compounded Value $36,000 36 7 annually $ Need Help? Read Itarrow_forwardThe following investment requires table factors for periods beyond the table. Using Table 11-1, create the new table factor, rounded to five places, and calculate the compound amount (in $, rounded to the nearest cent.) Time Nominal Interest New Table Compound Principal Period (years) Rate (%) Compounded Factor Amount $17,000 29 annually $ Need Help? Read Itarrow_forwardCalculate the APR of the following investment, entered as a percentage (Example: if your answer is 14.5%, enter 14.5 and not 0.145) Year Number Cashflow 0 -11000 1 3000 2 3500 3 2900 4 2800arrow_forward

- Value of a mixed stream For the mixed stream of cash flows shown in the following table, . determine the future value at the end of the final year if deposits are made into an account paying annual interest of 11%, assuming that no withdrawals are made during the period and that the deposits are made: a. At the end of each year. b. At the beginning of each year. a. The future value at the end of the final year if deposits are made at the end of each year is $. (Round to the nearest dollar)arrow_forwardFor each of the following annuities, calculate the annual cash flow. (Enter rounded anware adirected, but do not use rounded numbers in intermediate calculations. 2 nswers to 2 decimal places (e.g., 32.16).): Years Cash Flow Present Value Interest Rate $ 36,800 27,500 145,000 215,000 11% 6 8 8 15 6 20arrow_forwardAssume that you are looking at 3 perpetuities. P1 has annual cash flows of $850 in Yeata 1 through infinity (1-infinity) and present value at Year 0 of $10,119.047619. P2 has annual cash flows of $620 in Yeara 11 through infinity (11-infinity) and same effective rate as P1. P3 has annual cash flows of $480 in Years 25 through infinity (25-infinity) and same effective rate as P1 and P2. Determine the value of all three perpetuities when evaluated at Year 35.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education