Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:10:20

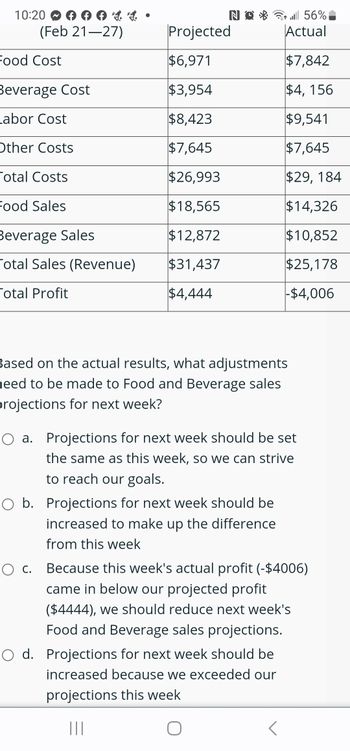

(Feb 21-27)

Food Cost

044

Beverage Cost

Labor Cost

Other Costs

Total Costs

Food Sales

Beverage Sales

Total Sales (Revenue)

Total Profit

•

N

Projected

$6,971

$3,954

$8,423

$7,645

$26,993

$18,565

$12,872

$31,437

$4,444

56% السم

Based on the actual results, what adjustments

need to be made to Food and Beverage sales

projections for next week?

O b. Projections for next week should be

increased to make up the difference

from this week

Actual

$7,842

$4, 156

$9,541

$7,645

$29, 184

$14,326

$10,852

$25,178

-$4,006

O a. Projections for next week should be set

the same as this week, so we can strive

to reach our goals.

O d. Projections for next week should be

increased because we exceeded our

projections this week

|||

O

O c. Because this week's actual profit (-$4006)

came in below our projected profit

($4444), we should reduce next week's

Food and Beverage sales projections.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Express the gross profit (GP) in money and as a percentage in the table below. (15 points) Selling Price Food Cost Gross Profit GP as % $10.00 $2.75 $12.50 $4.30 $7.95 $3.10 14.90 $4.65 $31.65 $7.90arrow_forwardcontent/qualsims/accounting/cost_volume_profit/v2/player/#/891e73d6eefafa67438268e177eaa497_qualsimsaccountingcost_volume_profitmiller_nobles_mattis 75 Tumblers Sora per month Sales Revenue Less: Variable Expenses Contribution Margin Less: Fixed Expenses Operating Income Total Per Unit $ 2,250 $ 30 1,350 18 $ 900 $ 12 250 $ 650 In order to determine how much contribution margin is earned for each $1 of sales, what is the contribution margin ratio on your tumbler sales? Round to the nearest whole number. Select an option from the choices below and click Submit. ○ 29% ○ 40% ○ 250% Submitarrow_forwardFind expressions for the Revenue, Cost, and Profit from selling x thousand items. 2) Item Price Fixed Cost Variable Cost $3.00 $31,471 3775xarrow_forward

- chapter 3 3. Given the information below, what is the profit dollars? Round your answer to the dollar and add a dollar sign and comma separator (i.e. $15,467) Gross Sales $341,420 Customer Returns 29,870 Cost of Goods Sold 161,570 Expenses 138,140arrow_forwardWhat is the gross profit margin percentage?arrow_forwardSolve this question financial accountingarrow_forward

- 2022 Food Sales Beverage Sales Total Sales Food Cost Beverage Cost Total Cost of Sales Gross Profit Operating Expenses Salaries Wages Employee Benefits Overhead Costs Total Operating Expenses Income Before Taxes $ O a. $223,397 O b. $203,385 O c. $296,192 O d. $210,752 780,000 644,000 1,424,000 100.0 249,600 148,120 397,720 1,026,280 % 185,700 210,752 110,800 426,000 933,252 93,028 The above pro forma projected income statement was partially completed for a restaurant that should open in 2023. Management would like to see what profitability would be if they could predict a 6.0% increase in total sales. Assume Wages will be treated as a variable cost. What will be the total amount (dollars) of Wages on the new income statement with the 6.0% increase in Total Sales?arrow_forwardchapter 3 4. Given the information below, what is the profit percent? Round your answer to two decimal places and add a percent sign (i.e. 15.37%) Gross Sales $341,420 Customer Returns 29,870 Cost of Goods Sold 161,570 Expenses 138,140arrow_forwardsolve this problemsarrow_forward

- The following information is available for Concord Company: Sales Total fixed expenses Cost of goods sold Total variable expenses $301000 $51600 103200 86000 What amount would you find on Concord's CVP income statement? General 41:18 O gross profit of $197800 • contribution margin of $163400 O contribution margin of $215000 O gross profit of $163400arrow_forwardContribution Margin, Break-Even Sales, Cost-Volume-Profit Chart, Margin of Safety, and Operating Leverage Belmain Co. expects to maintain the same inventories at the end of 20Y7 as at the beginning of the year. The total of all production costs for the year is therefore assumed to be equal to the cost of goods sold. With this in mind, the various department heads were asked to submit estimates of the costs for their departments during the year. A summary report of these estimates is as follows: Estimated Estimated Variable Cost Fixed Cost (per unit sold) Production costs: Direct materials $50.00 Direct labor 30.00 Factory overhead $350,000 6.00 Selling expenses: Sales salaries and commissions 340,000 4.00 Advertising 116,000 Travel 4,000 Miscellaneous selling expense 2,300 1.00 Administrative expenses: Office and officers' salaries 325,000 Supplies 6,000 4.00 Miscellaneous administrative expense 8,700 1.00 Total $1,152,000 $96.00 It is expected that 12,000 units will be sold at a price…arrow_forwardUse the following to answer questions 30 – 35 Find the missing amounts: Case 1 Case 2 Case 3 Net Sales S687,000 $922,500 COGS ? 478,500 654,000 Gross profit 324.100 456.000| Operating expense 299,500 354,200 Operating income ? ? 94.500 30. $ sold For case 1, determine cost of goods 31. $ For case 1, determine operating income (include “-“ if needed) 32. $ For case 2, determine gross profit 33. $ (include For case 2, determine operating income “_“ if needed) 34. $ For case 3, determine net sales 35. $ For case 3, determine operating expensearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education