FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

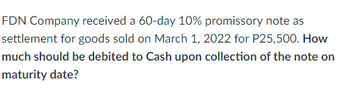

Transcribed Image Text:FDN Company received a 60-day 10% promissory note as

settlement for goods sold on March 1, 2022 for P25,500. How

much should be debited to Cash upon collection of the note on

maturity date?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On June 30, 2020, GHI Company discounted at the bank a customer P6,000,000, 6-month, 10% note receivable dated April 30,2020. The bank discounted the note at 12%. What amount should be reported as net proceeds from the discounted note receivable?arrow_forwardOn January 1, 2018, The Barrett Company purchased merchandise from a supplier. Payment was a noninterestbearing note requiring five annual payments of $20,000 on each December 31 beginning on December 31, 2018,and a lump-sum payment of $100,000 on December 31, 2022. A 10% interest rate properly reflects the timevalue of money in this situation.Required:Calculate the amount at which Barrett should record the note payable and corresponding merchandise purchasedon January 1, 2018.arrow_forwardSeifert Supply Company sold merchandise to a customer on December 1, 2020 for $100,000. The transaction resulted in recording a note receivable with a term of 6 months and an annual interest rate of 9%. The company's accounting period ends on December 31, 2020. What amount should Seifert Supply Company recognize as interest revenue on the note receivable on December 31, 2020? A. $1,500 B. $9,000 C. $750 D. $0arrow_forward

- Sh5arrow_forwardWindsor, Inc. lends Flint industries $43200 on August 1, 2022, accepting a 9-month, 6% interest note. If Windsor, Inc. accrued interest at its December 31, 2022 year-end, what entry must it make to record the collection of the note and interest at its maturity date?arrow_forwardDomesticarrow_forward

- A 180-day promissory note was issued by FDNACCT Co. on November 1, 2021 in exchange of goods bought from ACCT Company in the amount of P600,000. The note has an interest rate of 8%. How much Interest Income should be recorded for this particular note in the books of ACCT Company for the year ended December 31, 2021?arrow_forwardWaterway Company has the following two notes receivable at May 31, 2024, its fiscal year end: 1. 2. $32,400 six-month, 6% note issued January 1, 2024. $12,000 three-month, 4% note issued April 30, 2024. Interest is payable at maturity for both notes. (a) Calculate the accrued interest on both notes at May 31, 2024. (Round answers to the nearest whole dollar, e.g. 5,275.) Note 1: Note 2: Total accrued interest $arrow_forwardOn September 1,2020, Sunland Company issued a note payable to Fidelity Bank in the amount of $2691000, bearing interest at 9%, and payable in three equal annual principal payments of $897000. On this date, the bank's prime rate was 10%. The first payment for interest and principal was made on September 1, 2021. At December 31, 2021, Sunland should record accrued interest payable of O $89700. O $80730. O $179400, O $53820.arrow_forward

- On August 1, 2021, Avonette, Inc., sold equipment and accepted a six-month, 9%, $50,000 note receivable. Avonette's year-end is December 31. Which of the following accounts will Avonette credit in the journal entry at maturity on February 1, 2022, assuming collection in full? O A. Interest Receivable B. Cash OC. Interest Payable O D. Note Payablearrow_forwardPhilip Company has a P200,000, 9%, 120-day note receivable outstanding on December 31. The note is dated November 1, 2021. What is the adjusting entry on December 31, 2021?arrow_forwardVaughn Manufacturing lends Pina Colada industries $51600 on August 1, 2022, accepting a 9-month, 12% interest note. If Vaughn Manufacturing accrued interest at its December 31, 2022 year-end, what entry must it make to record the collection of the note and interest at its maturity date? Cash 56244 Notes Receivable 51600 Interest Revenue 4644 Cash 56244 Notes Receivable 51600 Interest Receivable 2580 Interest Revenue 2064 Cash 56244 Notes Receivable 56244 Notes Receivable 51600 Interest Receivable 2580 Interest Revenue 2064 Cash 56244arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education