FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Assume all assets were purchased at cost at the beginning of the accounting period Required

Determine the Chargeable Income of Father Bernard for 2022 year of Assessment

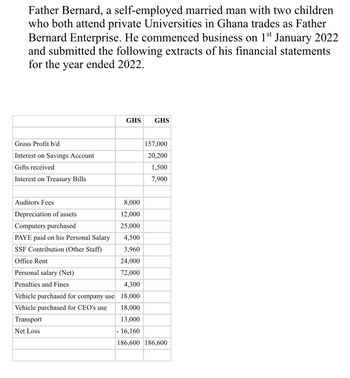

Transcribed Image Text:Father Bernard, a self-employed married man with two children

who both attend private Universities in Ghana trades as Father

Bernard Enterprise. He commenced business on 1st January 2022

and submitted the following extracts of his financial statements

for the year ended 2022.

Gross Profit b/d

Interest on Savings Account

Gifts received

Interest on Treasury Bills

Auditors Fees

Depreciation of assets

Computers purchased

PAYE paid on his Personal Salary

SSF Contribution (Other Staff)

Office Rent

Personal salary (Net)

Penalties and Fines

Vehicle purchased for company use

Vehicle purchased for CEO's use

Transport

Net Loss

GHS GHS

157,000

20,200

1,500

7,900

8,000

12,000

25,000

4,500

3,960

24,000

72,000

4,300

18,000

18,000

13,000

- 16,160

186,600 186,600

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Support your computations with relevant explanations.

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Support your computations with relevant explanations.

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What is the journal entry Declan's Designs recorded to recognize 2022 deprecation expense? Question 5 options: Dr. Accumulated Depreciation $3,000 Cr. Depreciation Expense $3,000 Dr. Depreciation Expense $2,000 Cr. Accumulated Depreciation $2,000 Dr. Depreciation Expense $3,000 Cr. Accumulated Depreciation $3,000 Dr. Depreciation Expense $1,000 Cr. Accumulated Depreciation $1,000arrow_forwardjsyarrow_forwardAccrued Expenses: Entity D acquired a piece of land on April 1, 20x1. The purchase price was reduced by a credit for the real property taxes accrued during the year. Entity D records real property taxes at each month-end by adjusting the prepaid tax or tax payable account as appropriate On May 1, 20x1 Entity D paid the first of two equal installments of P72,000 for real property taxes. Requirement: What is the entry to record the payment on May 1?arrow_forward

- Haresh jaanarrow_forwardFor federal tax purposes, how long should a sole proprietor keep records on a machine used for 100%? Until three years after the due date of the return: 1) in which the machine is disposed of in a taxable disposition 2) when the machine is purchased. 3) after the machine is disposed of in a taxable disposition. 4) when the machine is placed in service.arrow_forwardN1.arrow_forward

- Current Attempt in Progress Carla Vista Co., organized in 2024, has set up a single account for all intangible assets. The following summary discloses the debit entries that have been recorded during 2025 and 2026. 7/1/25 10/1/25 12/31/25 1/2/26 3/1/26 4/1/26 6/1/26 9/1/26 Intangible Assets 8-year franchise; expiration date 6/30/33 Advance payment on laboratory space (2-year lease) Net loss for 2025 including state incorporation fee, $3,000, and related legal fees of organizing, $7,000 (all fees incurred in 2025) Patent purchased (10-year life) Cost of developing a secret formula (indefinite life) Goodwill purchased (indefinite life) Legal fee for successful defense of patent purchased above Research and development costs $48,000 25,800 17,800 80,600 82,000 279,600 12,765 165,000 Prepare the necessary entries to clear the Intangible Assets account and to set up separate accounts for distinct types of intangibles. Make the entries as of December 31, 2026, recording any necessary…arrow_forwardAndy purchased a new desk for $750 on May 1, 2021. He immediately placed it into service for his accounting business. He will depreciate it using the 200% declining balance method and the half-year convention. How much is his 2021 depreciation deduction? A.$75 B.$107 C.$150 D.$750arrow_forwardPrepare the complete Depreciation and Amortisation Form 4562.arrow_forward

- Hypothetical Corporation incurred the following expenses: 2019 2020Research and Development 619,000 703,000 The new product will be available for sale July 1, 2021. Calculate the deduction for R&D expenses for 2019, 2020, and 2021 under the following independent assumptions:a. Armando Corporation elects to expense the R&D expenses. b. Armando Corporation elects to amortize the R&D expenses over 60 months.arrow_forwardIncreases in the effect of asset ceiling are recognized in full during the year in other comprehensive income recognized in full in the following year in other comprehensive income amortized over the remaining average service lives of the plan participants partly recognized in profit or loss and other comprehensive incomearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education