EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

General accounting

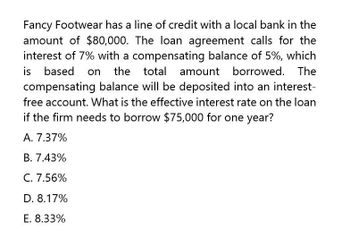

Transcribed Image Text:Fancy Footwear has a line of credit with a local bank in the

amount of $80,000. The loan agreement calls for the

interest of 7% with a compensating balance of 5%, which

is based on the total amount borrowed. The

compensating balance will be deposited into an interest-

free account. What is the effective interest rate on the loan

if the firm needs to borrow $75,000 for one year?

A. 7.37%

B. 7.43%

C. 7.56%

D. 8.17%

E. 8.33%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Need helparrow_forwardEzze Mattress needs to raise $200,000 for 6 months. The bank quotes a discount interest rate of 7.5% but does not require compensating balances. What is the effective annual interest rate on this loan? Multiple choice question. 7.50% 8.11% 7.84% 7.81%arrow_forwardEverett's Electronics is receiving a senior bank loan with the following terms: $6MM principal, 5.6% interest rate, 7 year loan term, 0.75% commitment fee, and a 1% closing fee. What is the expected annual return to the lender? A. 5.85% B. 6.85% C. 5.91% D. 6.2%arrow_forward

- Cloud Venture has a line of credit with a local bank of $75,000. The loan agreement calls for interest of 6 percent with a compensating balance requirement of 3 percent that is based on the total amount borrowed. What is the effective interest rate if the firm needs $58,000 for one year to finance a fixed asset purchase?arrow_forwardYoo, Incorporated, has arranged a line of credit that allows it to borrow up to $42 million at any time. The interest rate is 618 percent per month. Additionally, the company must deposit 4 percent of the amount borrowed in a noninterest bearing account. The bank uses compound interest on its line-of-credit loans. If the company needs $18 million for 7 months, how much will it pay in interest? Multiple Choice $925.47741 $793.266.35 $918,132.35 $826,319.11 $1,057,688.46arrow_forwardA bank offers your firm a revolving credit arrangement for up to $68 million at an interest rate of 1.70% per quarter. The bank also requires you to maintain a compensating balance of 4% against the unused portion of the credit line, to be deposited in a non interest- bearing account. Assume you have a short-term investment account at the bank that pays 1.05% per quarter, and assume that the bank uses compound interest on its trevolving credit loans. (Do not round intermediate calculetions. Round the final answers to 2 decimal places.) a. What is your effective annual interest rate (an opportunity cost) on the revolving credit arrangement if your firm does not use It during the year? Effective annual Interest rate b. What is your effective annual interest rate on the lending arrangement if you borrow $35 million immediately and repay it in one year? Effective annual interest rate 1% c. What is your effective annual interest rate if you borrow $68 milion Immediately and repoy it in one…arrow_forward

- The York Company has arranged a line of credit that allows it to borrow up to $45 milion at any time. The interest rate is .621 percent per month. Additionally, the company must deposit 3 percent of the amount borrowed in a non-interest bearing account. The bank uses compound interest on its line-of-credit loans. What is the effective annual rate on this line of credit? Multiple Choices 6.40% 7.71% 7.95% 7.06% 8.83%arrow_forwardA bank offers your firm a revolving credit arrangement for up to $86 million at an interest rate of 2.15 percent per quarter. The bank also requires you to maintain a compensating balance of 2 percent against the unused portion of the credit line, to be deposited in a non-interest-bearing account. Assume you have a short-term investment account at the bank that pays 1.50 percent per quarter, and assume that the bank uses compound interest on its revolving credit loans. a. What is your effective annual interest rate (an opportunity cost) on the revolving credit arrangement if your firm does not use it during the year? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Effective annual interest rate % b. What is your effective annual interest rate on the lending arrangement if you borrow $50 million immediately and repay it in one year? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2…arrow_forwardHagar Company's bank requires a compensating balance of 10% on a $100,000 loan. If the stated interest on the loan is 7%, what is the effective cost of the loan?arrow_forward

- The First Common Bank has advertised one of its loan offerings asfollows: “We will lend you $125,000 for up to 3 years at an APR of 7.5% (interestcompounded monthly).” If you borrow $125,000 for one year, how much interestwill you have paid and what is the banks APY?arrow_forwardYoo, Incorporated, has arranged a line of credit that allows it to borrow up to $51 million at any time. The interest rate is 627 percent per month. Additionally, the company must deposit 5 percent of the amount borrowed in a noninterest-bearing account. The bank uses compound interest on its line-of-credit loans. If the company needs $27 million for 8 months, how much will it pay in interest? Multiple Choice $1.307,50417 $1,457,29019 $1619,200.22 $1.230.592.16) $1,384,41618arrow_forwardMasukharrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT