Financial Management: Theory & Practice

16th Edition

ISBN: 9781337909730

Author: Brigham

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Financial Accounting

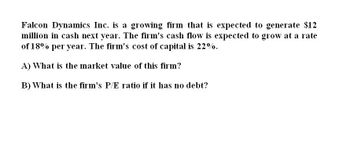

Transcribed Image Text:Falcon Dynamics Inc. is a growing firm that is expected to generate $12

million in cash next year. The firm's cash flow is expected to grow at a rate

of 18% per year. The firm's cost of capital is 22%.

A) What is the market value of this firm?

B) What is the firm's P/E ratio if it has no debt?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Happy Time Inc. is expected to generate the following cash flows for the next year, as shown in the table below. Happy Time now only has one outstanding debt with a face value of $110 million to be repaid in the next year. The current market value for the debt is $67 million. The tax rate is zero. If the firm is financed by common equity and debt, what is the expected value of common equity next year? Cash flow in the next year Probability Amount Economy Boom 0.3 $110 million Normal 0.4 $101 million Recession 0.3 $61 million $26.8 million $24.7 million $0 -$18.3 millionarrow_forwardHappy Time Inc. is expected to generate the following cash flows for the next year, as shown in the table below. Happy Time now only has one outstanding debt with a face value of $110 million to be repaid in the next year. The current market value for the debt is $67 million. The tax rate is zero. If you invest in the corporate debt of Happy Time Inc. today, what is your expected percentage return on this investment? Cash flow in the next year Economy Probability Amount Boom 0.3 Normal 0.4 Recession 0.3 O 36.87% O -26.37% 64.8% O-16.63% $110 million $101 million $61 millionarrow_forwardYour company doesn't face any taxes and has $768 million in assets, currently financed entirely with equity. Equity is worth $51.80 per share, and book value of equity is equal to market value of equity. Also, let's assume that the firm's expected values for EBIT depend upon which state of the economy occurs this year, with the possible values of EBIT and their associated probabilities as shown below: State Probability of state Expected EBIT in state Recession 0.10 $118 million Average Boom 0.75 0.15 $193 million $253 million The firm is considering switching to a 15 percent debt capital structure, and has determined that they would have to pay a 11 percent yield on perpetual debt in either event. What will be the standard deviation in EPS if they switch to the proposed capital structurearrow_forward

- Plank’s Plants had net income of $3,000 on sales of $40,000 last year. The firm paid a dividend of $1,500. Total assets were $200,000, of which $140,000 was financed by debt. What is the firm’s sustainable growth rate? If the firm grows at its sustainable growth rate, how much debt will be issued next year? What would be the maximum possible growth rate if the firm did not issue any debt next year?arrow_forwardFinCorp’s free cash flow to the firm is expected to be $50 million. The firm’s interest expense is $12 million. Assume the tax rate is 35% and the net debt of the firm remains the same. What is the market value of equity if the FCFE is projected to grow at 2% indefinitely and the cost of equity is 12.5%? Enter your answer in millions, rounded to one decimal place (e.g., 2.1 for $2.1 million).arrow_forwardMilton Industries expects free cash flow of $12 million each year. The corporate tax rate is 22 %, and its unlevered cost of equity is 12%. The firm also has outstanding debt of $40 million and it expects to maintain this amount permanently. What is the value of Milton Industries with leverage? a) 85, 973,333 b) 88, 573, 333 c) 89,646, 444 d) 90, 125, 564 What is the value of equity of Milton Industries with leverage? a) 76, 573, 333 b) 73,973,333 c) 77,646,444 d) 78, 125, 564arrow_forward

- The value of a firm is estimated to be $10 million. Next year’s cash flow is expected to be $1 million and the long-term growth is expected to be 3%. What is the cost of capital for this firm?arrow_forwardStart-Up Industries is a new firm that has raised $360 million by selling shares of stock.Management plans to earn a 20% rate of return on equity, which is more than the 15% rate of return available on comparable-risk investments. Half of all earnings will be reinvested in the firm. What will be Start-Up’s ratio of market value to book value? What will be Start-Up’s ratio of market value to book value if the firm can earn only a rate of return of 5% on its investments?arrow_forwardSuppose the growth rate of a firm's profits is 5%, the interest rate is 6%, and the current profits of the firm are $100 million dollars. What is the value of the firm?arrow_forward

- Suppose Goodyear Tire and Rubber Company is considering divesting one of its manufacturing plants. The plant is expected to generate free cash flows of 51.54 million per year, growing at a rate of 2.4% per year. Goodyear has an equity cost of capital of 8,7%, a debt cost of capital of 6.7%, a marginal corporate tax rate of 38%, and a debt- equity ratio of 2.6. If the plant has average risk and Goodyear plans to maintain a constant debt equity ratio, what after tax amount must it receive for the plant for the divestiture to be profitable?arrow_forwardA company is projected to have a free cash flow of $357 million next year, growing at a 4.4% rate until the end of year 3. After that, cash flows are expected to grow at a stable rate of 2.4%. The company's cost of capital is 9.3%. The company owes $129 million to lenders and has $8 million in cash. If it has 279 million shares outstanding, what is your estimate for its stock price? Round to one decimal place.arrow_forwardSefton Villa will be worth either €60 million, €80 million or €100 million in one year with equal probabilities. The firm has bonds outstanding with a promised payment of €75 million in one year at an expected rate of 6% and the required rate of return on the assets is 12%. What is the company's equity cost of capital? What is the expected payoff of the debt? What is the debt’s promised rate of return?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT