FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

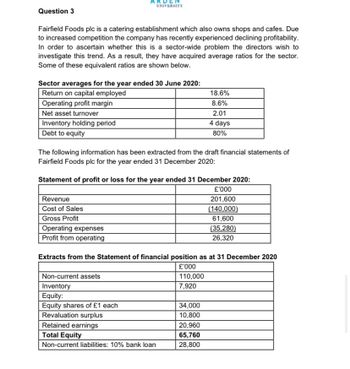

Transcribed Image Text:Question 3

Fairfield Foods plc is a catering establishment which also owns shops and cafes. Due

to increased competition the company has recently experienced declining profitability.

In order to ascertain whether this is a sector-wide problem the directors wish to

investigate this trend. As a result, they have acquired average ratios for the sector.

Some of these equivalent ratios are shown below.

ARDE

UNIVERSITY

Sector averages for the year ended 30 June 2020:

Return on capital employed

Operating profit margin

Net asset turnover

Inventory holding period

Debt to equity

The following information has been extracted from the draft financial statements of

Fairfield Foods plc for the year ended 31 December 2020:

Revenue

Cost of Sales

Gross Profit

Statement of profit or loss for the year ended 31 December 2020:

£'000

201,600

(140,000)

61,600

(35,280)

26,320

Operating expenses

Profit from operating

18.6%

8.6%

2.01

4 days

80%

Extracts from the Statement of financial position as at 31 December 2020

£'000

110,000

7,920

Non-current assets

Inventory

Equity:

Equity shares of £1 each

Revaluation surplus

Retained earnings

Total Equity

Non-current liabilities: 10% bank loan

34,000

10,800

20,960

65,760

28,800

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Grant Communications is forecasting its financial statements for the upcoming year. Highlights include: Current assets of $6 million Current ratio of 2.0 Sales of $20 million Inventory turnover ratio (Sales/Inventory) of 6 The company's CFO is concerned about the forecasted inventory turnover ratio. Her goal is cut inventory enough to obtain an inventory turnover ratio of X, which is the industry average, while still maintaining sales at $20 million. If the company can accomplish this goal, the cash generated from the cut in inventories will be used to cut accounts payable. This will give the firm a Quick Ratio [(Current Assets - Inventory) / Current Liabilities] of 1.50. What is X, the desired inventory turnover ratio? Enter your answer, truncated to 2 decimal places. For example, enter 7.777 as 7.77.arrow_forwardSuppose you are conducting an analysis of the financial performance of Cold Goose Metal Works Inc. over the past three years. The company did not issue new shares during these three years and has faced some operational difficulties. The company has thus pilot tested some new forecasting strategies for better operations management. You have collected the company's relevant financial data, made reasonable assumptions based on the information available, and calculated the following ratios. Price-to-cash-flow Inventory turnover Debt-to-equity Ratios Calculated Year 1 Year 2 1.40 0.98 2.80 2.24 0.40 0.32 Year 3 0.78 1.79 0.26 Based on the preceding information, your calculations, and your assumptions, which of the following statements can be included in your analysis report? Check all that apply. A decline in the inventory turnover ratio could likely be explained by operational difficulties that the company faced, which led to duplicate orders placed to vendors. A decline in the inventory…arrow_forwardCalculate the Rate of Return on Assets (ROA) for 2011. Disaggregate ROA into the profit margin for ROA and total assets turnover components. Calculate the Rate of Return on Common Stockholders’ Equity (ROCE) for 2011. Disaggregate ROCE into the profit margin for ROCE, total assets turnover and capital structure leverage components.arrow_forward

- Which of the following statements is TRUE? When EBIT and total assets both increase by 25%, the basic earnings power will also increase O a. An increase in the quick ratio over time means that the company's liquidity position is improving. O b. approximately by 25%. A lower than the industry's average inventory turnover ratio means that the company turns over or sells O C. and replaces its inventory more times per year. A higher than industry average P/E ratio indicates the company's stock must be overvalued. d.arrow_forwardCompare the performance of Fly X to the Industry. For each ratio, comment on whether Fly X is positive or negative relative to the Industry. Median Industry Fly X Ratios Current Ratio 1.43X 1.45 Quick Ratio 0.84X 0.88 Total Asset Turnover Ratio 0.85 1.30 Inventory Turnover Ratio 6.15 12.10 Average Inventory Ratio 59.35 30.17 Receivables Turnover 9.82 13.08 Average Collection Period 37.17 27.90 Debt Ratio 0.52 0.39arrow_forwardPROBLEM 11-17 Return on Investment (ROI) and Residual Income LO11-1, LO11-2 Financial data for Joel de Paris, Inc., for last year follow: Joel de Paris, Inc. Balance Sheet Beginning Ending Balance Balance Assets Cash $ 140,000 $ 120,000 Accounts receivable 450,000 530,000 Inventory 320,000 380,000 Plant and equipment, net 680,000 620,000 Investment in Buisson, S.A. 280,000 170,000 250,000 Land (undeveloped) 180,000 Total assets $2,020,000 $2,100,000 Liabilities and Stockholders' Equity Accounts payable. $ 360,000 $ 310,000 Long-term debt Stockholders' equity 1,500,000 1,500,000 160,000 290,000 Total liabilities and stockholders' equity $2,020,000 $2,100,000 Joel de Paris, Inc. Income Statement Sales $4,050,000 Operating expenses Net operating income 3,645,000 405,000 Interest and taxes: Interest expense $150,000 Таx expense 110,000 260,000 Net income $ 145,000 The company paid dividends of $15,000 last year. The "Investment in Buisson, S.A.," on the balance sheet represents an…arrow_forward

- Compare the performance of Fly X to the Industry. For each ratio, comment on whether Fly X is positive or negative relative to the Industry. Median Industry Fly X Ratios Current Ratio 1.43X 1.45 Quick Ratio 0.84X 0.88 Total Asset Turnover Ratio 0.85 1.30 Inventory Turnover Ratio 6.15 12.10 Average Inventory Ratio 59.35 30.17 Receivables Turnover 9.82 13.08 Average Collection Period 37.17 27.90 Debt Ratio 0.52 0.39arrow_forwardA firm's current ratio is above the previous year; however, the firm's quick ratio is below the previous year. What do these ratios suggest about the firm? Has relatively more total current assets and even more inventory than the previous year Is very efficient at managing inventories in the current year Has liquidity that is superior to the average firm in the industry None of these is correctarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education