FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

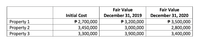

Each property had an estimated useful life of 50 years. The accounting policy is to use the fair value model for investment properties. What is the carrying value of the investment properties that should be presented in the 2020 statement of financial position?

Transcribed Image Text:Fair Value

Fair Value

Initial Cost

December 31, 2019

December 31, 2020

P 2,700,000

P 3,200,000

Property 1

Property 2

Property 3

P 3,500,000

2,800,000

3,400,000

3,450,000

3,000,000

3,300,000

3,900,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Marigold Company uses IFRS and owns property, plant and equipment with a historical cost of 5170000 euros. At December 31, 2019, the company reported a valuation reserve of 8640000 euros. At December 31, 2020, the property, plant and equipment was appraised at 5520000 euros.The property, plant and equipment will be reported on the December 31, 2020 statement of financial position at 5520000 euros. 8990000 euros. 5170000 euros. 8640000 euros.arrow_forwardBased upon the provided information, how would I be able to calculate the Amortization of prior service costs and expected return on the plan assets? Additionally, would you be able to please help me understand what formula to use in these two calculations and why you use those. Thank you!arrow_forwardA Property is expected to have 5 Year NOI flow of $10,000, $12,000, $15,000, $18,000, and $10,000 and a final (year 5) sale price of $90,000. Using capitalization rate of 12% what is the estimated market value of the property? 97,354 104,664 87,641 100,919 90,724arrow_forward

- How do you prepare the depreciation for the year 2026?arrow_forwardUse the following information to answer the next two questions. Franco Company uses IFRS and owns property, plant and equipment with a historical cost of 5,000,000 euros. At December 31, 2019, the company reported a valuation reserve of 8,565,000 euros. At December 31, 2020, the property, plant and equipment was appraised at 5,525,000 euros. 18) The property, plant and equipment will be reported on the December 31, 2020 statement of financial position at a) 5,000,000 euros. b) 5,525,000 euros. c) 8,565,000 euros. d) 9,090,000 euros 19) The valuation reserve at December 31, 2020 will be reported at a) 8,040,000 euros on the Statement of Stockholders' Equity. b) 8,565,000 euros in the Assets section of the Statement of Financial Position c) 9,090,000 euros in the equity section of the Statement of Financial Position. d) 525,000 euros on the Income Statement.arrow_forwardThe acquisition price of a property is $380,000. The loan amount is $285,000. If the property’s NOI is expected to be $22,560, operating expenses $12,250, and the annual debt service $19,987, the debt coverage ratio (DCR) is approximately equal toarrow_forward

- Assume that you purchase a property for $200,000 and it generates annual cash flows of $30,000 in years 1-3; and $45,000 in years 4&5. You are able to sell it at the end of year 5 for $400,000. Calculate the IRR for this investment property.arrow_forwardIf using the 15th edition of the text (or an earlier edition), refer to the Web Tax Appendix to correctly answer this question. Cornett Inc. is considering a new investment whose data are shown below. The required equipment will be used for 3 years during the project's life. The equipment qualifies for bonus depreciation, so it will be fully depreciated at the time of purchase. It will have a positive salvage value at the end of Year 3, when the project would be terminated. Also, some new net operating working capital would be required, but it would be recovered at the end of the project's life. Revenues and operating costs are expected to be constant over the project's 3-year life. What is the project's NPV? WACC 10% Purchase price of equipment $250,000 Required new NOWC $25,000 Sales revenues $310,000 Operating costs $186,000 Before-tax salvage value $45,000 Tax rate 25% a. $10,324.94 b. $27,229.53 c. $44,134.11 d. $53,525.55 e. $62,916.98arrow_forwardAn asset was acquired on January 1, 2020 for P800,000 and is expected to have a 5-year useful life. The straight-line method was used. On January 1, 2022, the asset was deemed to have a sound value of P720,000. How much is the revaluation surplus for the period ended December 31, 2022?arrow_forward

- In 2020, which of the following types of business or investment property is eligible for like-kind exchange? Group of answer choices 1.Machinery & Equipment 2.Inventory held for sale 3.Rental real estate 4. Securitiesarrow_forwardIn some commercial property operating agreements, investors are scheduled to receive their “pro rata” share of all cash flow distributions. Based on your understanding of what is meant by a “pro rata” distribution, an investor that contributed 1/10 of the required equity investment would be entitled to receive what proportion of all future cash flows?arrow_forwardharrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education