ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

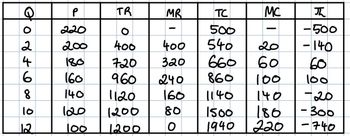

If there are two firms Atlas and Bowden in this market with the total cost function TC = 500 + 10Q^2 and they engage in Cournot competition, what is each firm's

Transcribed Image Text:© or + ७००

10

12

P

२२०

200

180

160

140

120

100

TR

०

400

MR

।

400

३२०

720

960 240

1120

1200

1200

TC

500

540

660

860 100

MC

160 1140

80

O

२०

60

140

1500

180

1940 | 220

गू

-500

- 140

60

loo

-२०

- 300

-740

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

-

Is this a long run equilibrium? Why or why not?

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

-

Is this a long run equilibrium? Why or why not?

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Please no written by hand solutionarrow_forward3arrow_forwardSuppose the iceberg lettuce industry is a Cournot duopoly with two firms: Xtra Leafy (a) and Yummy Farms (y). Xtra Leafy produces q units of output and Yummy Farms produces qy units of output. Aggregate market output is Q = x + y. The (inverse) market demand schedule is: p = 176 - 2Q Both firms have identical cost structures: MC = MC₁ = ATC₂ = ATC₁ = $12 Find Xtra Leafy's Cournot reaction function of the form: 9x = a + bay Where "a" is the reaction function's intercept and "b" is its slope. Note: Please review the formatting instructions above. If any value is negative, be sure to include its negative sign. a. a= b. b = Hint: One of your answers will be negative. Think about why.arrow_forward

- Q1: Firms A and B are two firms supplying products in two separate differentiated goods markets. Equations (1) and (2) give the total cost functions of the two firms: - Firm A: TC = 2Q -----------------------------(1) - Firm B TC = 10 + 2Q -------------------------(2) Each firm has the ability to produce a maximum quantity of 80,000 units in ten batches of 8,000. Question: Explain and draw the relationship between the zero-profit curve and the marginal cost curve for the two firms using the quantity schedule of the two firms and the relevant plots of equations (1) and (2) ? *Please draw diagram and answer asap*arrow_forwardCould you answer the red highlighted part pleasearrow_forwardQ1: Firms A and B are two firms supplying products in two separate differentiated goods markets. Equations (1) and (2) give the total cost functions of the two firms: - Firm A: TC = 2Q -----------------------------(1) - Firm B TC = 10 + 2Q -------------------------(2) Each firm has the ability to produce a maximum quantity of 80,000 units in ten batches of 8,000. Question : Use the information given about firm A above and use appropriate diagrams/figures to explain how the equilibrium will change if it’s cost of production rises to $5?arrow_forward

- 1 Cournot Suppose that the inverse market demand function is given by P 100 - Q. where Q is the total output. There are two firms in the industry. Each firm has a total cost function given by C; = 10g,, where i = 1,2. They are competing in quantities. Calculate the profit maximizing price and quantity for both firms.arrow_forwardOnly typed answerarrow_forward2.- Each of two firms, firms 1 and 2, has a cost function C(q) = 1 2 q; the demand function for the firms' output is Q = 1.5-p, where Q is the total output. Firms compete in prices. That is, firms choose simultaneously what price they charge. Consumers will buy from the firm offering the lowest price. In case of tying, firms split equally the demand at the (common) price. The firm that charges the higher price sells nothing. (Bertrand model.) (a) Formally argue that there could be no equilibrium in prices other than p1 = p2 = 1 2. (b) Solve the same problem, but this time assuming that firms compete in quantities.Now, suppose that firm 1 has a capacity constraint of 1/3. That is, no matter what demand it gets, it can serve at most 1/3 units. Suppose that these units are served to the consumers who are willing to pay the most. Thus, even if it sets a price above that of firm 1, firm 2 may be able to sell some output. (c) Obtain the (residual) demand of firm 2 (as a function of its own…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education