FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

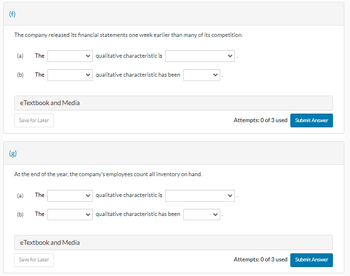

Transcribed Image Text:(f)

The company released its financial statements one week earlier than many of its competition.

(a)

(b)

The

The

eTextbook and Media

Save for Later

(b)

At the end of the year, the company's employees count all inventory on hand.

(a) The

The

eTextbook and Media

qualitative characteristic is

qualitative characteristic has been

Save for Later

qualitative characteristic is

qualitative characteristic has been

Attempts: 0 of 3 used Submit Answer

Attempts: 0 of 3 used Submit Answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Prepare the journal entry to record the LIFO adjustment. See the information below: The balances in Inventory – Finished Goods for the first and second year that WTG was in business were $275,000 and $350,000, respectively. The relevant indices for the 4 years are as follows: Year 1: 100 Year 2: 101 Year 3: 102 Year 4 (Current Year): 103 The computation of LIFO is included in the “Inventory” spreadsheet attached.arrow_forwardintermediate accounting please show work and explain, thank you.arrow_forwardP3-4. Alex Company.runs. a computer supplies icompany During the first:few. months of the .. year, the accounting records shovs.the following tranšactions: January. Februäry March April-. „May. "Total'operafingexpenses during'the period amounted lo P5,000. Required: "a Calculate the ending inventory, using FIFO; LIFO'and average method b. Determinė ihe net.income undet each;method. Öpening'stock of 400 units at a costiof.P30:00 each- Bought 200 units.:al a.cost of P35.00 each Sold 350 units for P50,00.each" Bought 120 units.at a cost of P38.00 eäch Şold 280 units for P50:00 each CS Scanned with CamScannerarrow_forward

- I need help with this accounting questionarrow_forward1. 2. 3. E7-8 Analyzing and Interpreting the Financial Statement Effects of Periodic FIFO, LIFO, and Weighted Average Cost Orion Iron Corp. tracks the number of units purchased and sold throughout each year but applies its inventory costing method at the end of the year, as if it uses a periodic inventory system. Assume its accounting records provided the following information at the end of the annual accounting di abru banon period, December 31. motor borliom goitebo voloval doidW CHAPTER 7 Inventory and Cost of Goods Sold LO 7-3 Transactions a. Inventory, Beginning Bib qulwollel silT mstave osm sibonaq 300 For the year:ensaxe b. Purchase, April 11 c. Purchase, June 1 (bibal Units moon! Jest Unit Cost $12 sqo :862 18 21iau 000,00 (2E2 sa alinu 0001 nomovar gai Edmosse uus lasieyda rag-tolovni gnib 900 02,102 x 100 POE in amoani 800 vs bnser2 13 15 300 600 d. Sale, May 1 (sold for $40 per unit) e. Sale, July 3 (sold for $40 per unit) f. Operating expenses (excluding income tax…arrow_forwardI need help.arrow_forward

- i need the answer quicklyarrow_forwardJournalize the following transactions that occurred in March for Downton Company. Assume Downton uses the periodic inventory system. No explanations are needed. Identify each accounts payable and accounts receivable with the vendor or customer name. Downton estimates sales returns at the end of each month. (Record debits first, then credits. Exclude explanations from journal entries. Assume the company records sales at the net amount. Round all amounts to the nearest whole dollar.) More info Mar. 3 Mar. 4 Mar. 4 Mar. 6 Mar. 8 Mar. 9 Mar. 10 Mar. 12 Mar. 13 Mar. 15 Mar. 22 Mar. 23 Mar. 25 Mar. 29 Mar. 30 Purchased merchandise inventory on account from Sherry Wholesalers, $4,000. Terms 1/15, n/EOM, FOB shipping point. Paid freight bill of $90 on March 3 purchase. Purchase merchandise inventory for cash of $1,900. Returned $1,100 of inventory from March 3 purchase. Sold merchandise inventory to Hillis Company, $2,500, on account. Terms 1/15, n/35. Purchased merchandise inventory on…arrow_forwardOn August 31, 2010, Harvey Co. decided to change from the FIFO periodic inventory system to the weightedaverage periodic inventory system. Harvey is on a calendar year basis. The cumulative effect of the change is determineda. As of January 1, 2010.b. As of August 31, 2010. c. During the eight months ending August 31, 2010, by a weighted-average of the purchases.d. During 2010 by a weighted-average of the purchases.arrow_forward

- Sanchez Company was formed on January 1 of the current year and is preparing the annual financial statements dated December 31, current year. Ending inventory information about the four major items stocked for regular sale follows: Item ABUD A ENDING INVENTORY, CURRENT YEAR Quantity Unit Cost When on Hand Acquired (FIF0) Required: 1. Compute the valuation that should be used for the current year ending inventory using lower of cost or net realizable value applied on an item-by-item basis. 2. What will be the effect of the write-down of inventory to lower of cost or net realizable value on cost of goods sold for the year ended December 31, current year? Complete this question by entering your answers in the tabs below. Total Net tem Quantity Total Cost Realizable Value D Required 1 Required 2 Compute the valuation that should be used for the current year ending inventory using lower of cost or net realizable value applied on an item-by-item basis. C D 31 31 66 46 21 $16 45 56 33 66 DE $…arrow_forwardplease answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education