ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

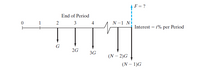

Refer to the accompanying cash-flow diagram (see Figure), and solve for the unknown quantity in If F = $10,000, G = $600, and N = 6, then i = ? that makes the equivalent value of

Transcribed Image Text:F = ?

End of Period

1

2

3

4

N -1 Nị

Interest = i% per Period

G

2G

3G

(N – 2)G

(N – 1)G

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Suppose that a father, on the day his son is born, wishes to determine what lump amount would have to be paid into an account bearing interest of 17% per year to provide withdrawals of $4,000 on each of the son's 9th, 10th, 11th, and 12th birthdays. How much money does the father have to deposit on the day his son is born ? Please, represent the cash-flow diagram.arrow_forwardJoel borrows $60,000 at 7% interest per year for a 10-year period. He can make payments of $450 at the beginning of each month until the loan is closed. He plans on making a balloon payment at the end of the period. What is the expected size of the balloon payment?arrow_forwardHow long will it take money to double if it is invested at (A) 11% compounded continuously? (B) 13% compounded continuously? (A) At 11% compounded continuously, the investment doubles in years. (Round to one decimal place as needed.) (B) At 13% compounded continuously, the investment doubles in years. (Round to one decimal place as needed.)arrow_forward

- 3B. The following equation describes the conversion of a cash flow into an equivalent equal payment series with N=10: A= [800+20(A/G,6%,7)] * (P/A, 6%, 7) (A/P,6%,7) + [300(F/A, 6%, 3)-500] * (A/F, 6%, 10) Reconstruct the original cash flow diagram.arrow_forwarddon't provide handwritten solutionarrow_forwardSuppose you start saving for retirement when you are 45 years old. You invest $5,200 the first year and increase this amount by 2% each year to match inflation for a total of 15 years. The interest rate is 7% per year. How much money will you have saved when you are 60 years old? Click the icon to view the interest and annuity table for discrete compounding when i = 2% per year. Click the icon to view the interest and annuity table for discrete compounding when i = 7% per year. When you are 60 years old, you will have saved $. (Round to the nearest dollar.)arrow_forward

- Provide Cash Flow Diagram, solution and discussion. Subject : ME Economics 3.How much money should be deposited each year for 12 years if you wish to withdraw $309 each year for five years, beginning at the end of the 14th year? Let i= 8% per year.arrow_forward*Any help with this question would be appreciated, thanks!*arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education