Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

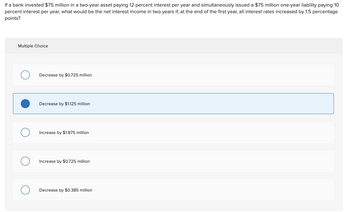

Transcribed Image Text:If a bank invested $75 million in a two-year asset paying 12 percent interest per year and simultaneously issued a $75 million one-year liability paying 10

percent interest per year, what would be the net interest income in two years if, at the end of the first year, all interest rates increased by 1.5 percentage

points?

Multiple Choice

Decrease by $0.725 million

Decrease by $1.125 million

Increase by $1.875 million

Increase by $0.725 million

Decrease by $0.385 million

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Canary Company invested this year's profits of $73,800.00 in a fund that matured to $167,895.17 in 9 years. What nominal interest rate compounded quarterly is this investment earning? % Round to two decimal placesarrow_forwardAn investment of $3435.82 earns interest at 2.8% per annum compounded semi-annually for 3 years. At that time the interest rate is changed to 7.1% compounded quarterly. How much will the accumulated value be 4.5 years after the change? The accumulated value is $ (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.)arrow_forwardAn initial amount of $10,000 is deposited into a high-yield savings account with an 8.6% APR. Complete the table below, assuming that no additional deposits will be made. Round each answer to 2 decimal places. accumulated amount after 8 years effective rate years required for balance to be $100,000 interest compounded semiannually 1 $ 3 % per year 5 years interest compounded continuously 2 $ 4 % per year 6 yearsarrow_forward

- A principal of $12, 000 is 3/5th itself invested at \times % interest rate for 5 years. If the same principal was invested for 2 years at an annual compound interest rate of (x+4) %. The interest return amount in dollars equalsO a. $ 4, 147.20 b. $4, 292.30 c. $4,219.80 d. $4,890.4arrow_forwardFind the future value of a five-year $106,000 investment that pays 9.25 percent and that has the following compounding periods: (Do not round intermediate calculations, round final answers to 2 decimal places, e.g. 15.25.) Value of investment after 5 years a. Quarterly $ b. Monthly $ c. Daily $ d. Continuous $arrow_forwardAssume an investment of $100,000 is made today and is expected to earn a quoted interest rate of 9.20%. Compute the future value of the initial investment after 5 years (Column B), 25 years (Column C), and 45 years (Column D) at each compounding frequency in Column A (annual, semiannual, monthly, daily, and continuous). (A) (B) (C) (D) Frequency (m) FV (5 Years) FV (25 Years) FV (45 Years) 1 2 12 365 ∞arrow_forward

- Let us assume that an investor can obtain an 80% LTV loan for a property valued at 500,000 at a 10% interest rate to be amortized over 25 years with monthly payments. If the property generates $70,000 net operating income per year, answer the following. What is the equity dividend rate? 26.38% 15.48% 25.93% 28.56%arrow_forwardSOLVE STEP BY STEP IN DIGITAL FORMAT 1. What is the amount of an investment for $155,000 at a compound interest rate of 21% per year in 7 years? Formulas Compound interest Annual compounding M=C(1 + i)" 1 = Cni M = C(1 + i) Fractional capitalization M-C{1+4)*arrow_forwardA company has a savings account with a 10% annually compounded return for five years. The value of the account at the end of five years will be $75,000. The implied annual interest is $75,000 x 0.10 = $7,500, and the present value of the savings account is $75,000 x 0.6209 = $46,567. What is the discounted value of the account at the beginning of Year 1? $67,500 $37,500 $75,000 $46,567arrow_forward

- s. How much must be deposited at 6% each yearbeginning on January 1, year 1, in order toaccumulate 500,000.00 after 6 deposits were made?Interest is (a) 10% compounded semi-annually include a non-excel cash flowarrow_forwardIf $10,000 is invested in a certain business at the start of the year, the investor will receive $3,000 at the end of each of the next four years. What is the present value of this business opportunity if the interest rate is 4% per year? A. $1,068 B. $890 C. $445 D. $1424arrow_forwardWhich investment will earn more money, a $1,000.00 investment for 6 years at 8% compounded continuously or a $1,000.00 investment for 6 years at 9% compounded quarterlya) 8% compounded continuously would be worth $. (Round to 2 decimal places.)b) 9% compounded quarterly would be worth $. (Round to 2 decimal places.)c) 8% compounded continuously would be worth more 9% compounded quarterly would be worth more The would be worth the same.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education