FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

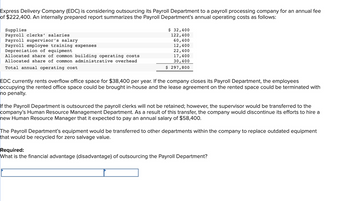

Transcribed Image Text:Express Delivery Company (EDC) is considering outsourcing its Payroll Department to a payroll processing company for an annual fee

of $222,400. An internally prepared report summarizes the Payroll Department's annual operating costs as follows:

Supplies

Payroll clerks' salaries

Payroll supervisor's salary

Payroll employee training expenses

Depreciation of equipment

Allocated share of common building operating costs

Allocated share of common administrative overhead

Total annual operating cost

$ 32,400

122,400

60,400

12,400

22,400

17,400

30,400

$ 297,800

EDC currently rents overflow office space for $38,400 per year. If the company closes its Payroll Department, the employees

occupying the rented office space could be brought in-house and the lease agreement on the rented space could be terminated with

no penalty.

If the Payroll Department is outsourced the payroll clerks will not be retained; however, the supervisor would be transferred to the

company's Human Resource Management Department. As a result of this transfer, the company would discontinue its efforts to hire a

new Human Resource Manager that it expected to pay an annual salary of $58,400.

The Payroll Department's equipment would be transferred to other departments within the company to replace outdated equipment

that would be recycled for zero salvage value.

Required:

What is the financial advantage (disadvantage) of outsourcing the Payroll Department?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- ABC, Inc. has the following information available regarding costs at various levels of monthly production: Production volume 8,000 12,000 Direct materials $75,000 $70,000 Direct labor 56,000 80,000 Packaging materials 22,000 30,000 Supervisors' salaries 14,000 14,000 Depreciation on plant and equipment 11,000 11,000 Maintenance 31,000 45,000 Utilities 15,000 21,000 Insurance on plant and equipment 2,600 2,600 Property taxes on plant and equipment…arrow_forward1. FAN Company has the following data for the year 2021 (in thousand) January 1, 2021 December 31, 2021 Raw Materials Inventory $16,300 $15,000 Work-in-process Inventory $40,000 $40,110 Finished Goods Inventory $49,600 $44,256 During 2021 the amount of raw material purchased was $21,700 and direct labor costs incurred were $10,100. The finance department also provides the following additional data : Factory Machinery Rent $ 1,840 Indirect Materials $ 3,400 Delivery Expense $ 760 Factory Utilities $ 1,200 Depreciation on Factory Building $ 3,500 Sales Commissions $ 340 Administrative Expense 1,620 Factory Insurance $ 1,266 Sales Revenue $ 98,600 Factory Manager's Salary $ 2,240 Indirect Labor $ 5,670 Instructions: b. Prepare an Income Statement for the year ended 2021! %24arrow_forwardNonearrow_forward

- 1. FAN Company has the following data for the year 2021 (in thousand) January 1, 2021 December 31, 2021 Raw Materials Inventory $16,300 $15,000 Work-in-process Inventory $40,000 $40,110 Finished Goods Inventory $49,600 $44,256 During 2021 the amount of raw material purchased was $21,700 and direct labor costs incurred were $10,100. The finance department also provides the following additional data : Factory Machinery Rent $ 1,840 Indirect Materials $ 3,400 Delivery Expense $ 760 Factory Utilities $4 1,200 Depreciation on Factory Building $ 3,500 Sales Commissions $ 340 Administrative Expense $ 1,620 Factory Insurance $ 1,266 Sales Revenue $ 98,600 Factory Manager's Salary $ 2,240 Indirect Labor $ 5,670 Instructions: c. Assume that FAN Company's accounting records show the balance of the following current asset accounts on December 31, 2021 (in thousand): Cash $110,250 Accounts Receivable $ 12,440 Prepaid Expenses $9,250 Supplies $ 500 Short-Term Investment $ 550 Prepare the current…arrow_forwardSterling Archer Spy Agency provides independent intelligence gathering services. The agency has the following data concerning its overhead costs and its activity-based costing system: Overhead costs: Wages and salaries $400,000 Administrative expenses 150,000 Total $550,000 Distribution of resource consumption: Activity Cost Pools Intelligence Report procurement Writeups Other Total Wages and salaries 70% 25% 5% 100% Administrative expenses…arrow_forwardBob Randall, cost accounting manager for Hemple Products, was asked to determine the costs of the activities performed within the company’s Manufacturing Engineering Department. The department has the following activities: creating bills of materials (BOMs), studying manufacturing capabilities, improving manufacturing process, training, employees, and designing tools. The general ledger accounts reveal the following expenditures for Manufacturing Engineering: Salaries $ 500,000 Equipment 100,000 Supplies 30,000 Total $630,000 The equipment is used for two activities: improving process and designing tools. The equipment’s time is divided by two activities: 40 percent for improving process and 60 percent for designing tools. The salaries are for nine…arrow_forward

- Webster Company provides the following ABC costing information: Activities Total Costs Activity-cost drivers Account inquiry hours $250,000 10,000 hours Account billing lines $125,000 5,000,000 lines Account verification accounts $50,000 50,000 accounts Correspondence letters $ 25,000 5,000 letters Total costs $450,000 The above activities are used by Departments A and B as follows: Department A Department B Account inquiry hours 1,000 hours 3,000 hours Account billing lines 200,000 lines 300,000 lines Account verification accounts 10,000 accounts 8,000 accounts Correspondence letters 1,000 letters 1,500 letters How much of the account inquiry cost will be assigned to Department A? Group of answer choices $5,000 $250,000 $75,000 $25,000arrow_forwardPlease help mearrow_forwardTasman Products has a Maintenance Department that services equipment in the company's Forming Department and Assembly Department. The cost of this servicing is charged to the operating departments based on machine-hours. Data for the Maintenance Department follow: Variable costs for lubricants Fixed costs for salaries and other Budget $ 261,000* Actual $ 215,000 $ 333,300 $ 231,500 *Budgeted at $18 per machine-hour. Data for the Forming and Assembly Departments follow: Percentage of Peak- Forming Department Assembly Department Total Machine-Hours Period Capacity Required Budget Actual 74% 9,700 11,700 26% 100% 4,800 3,800 14,500 15,500 The amount of fixed costs in the Maintenance Department is determined by peak-period requirements. Required: 1. How much Maintenance Department cost should be charged to the Forming Department and to the Assembly Department? 2. How much, if any, of the Maintenance Department's actual costs should be treated as a spending variance and not charged to the…arrow_forward

- Baldwin Enterprises has two service departments, Personnel and Legal, and two operating divisions, Eastern and Western. Personnel costs are allocated on the basis of employees and Legal costs are allocated on the basis of hours. A summary of Baldwin operations follows: Employees Hours Department direct costs Costs Personnel Legal Complete this question by entering your answers in the tabs below. Total Personnel $ Personnel $ 10,800 $ 320,000 Required: a. Allocate the cost of the service departments to the operating divisions using the direct method. b. Allocate the cost of the service departments to the operating divisions using the step method. Start with Legal. c. Allocate the cost of the service departments to the operating divisions using the reciprocal method. 320,000 $ 320,000 $ Required A Required B Required C Allocate the cost of the service departments to the operating divisions using the reciprocal method. Note: Do not round intermediate calculations. Round your final answers…arrow_forwardWithin the costing system of Asempa manufacturing company the following types of expense are incurred. GHȼCost of oils used to lubricate production machinery 20,000Motor vehicle licences for lorries 50,000Depreciation of factory plant and equipment 40,000Cost of chemicals used in the laboratory 10,000Commission paid to sales representatives 25,000Salary of the secretary to the finance director 22,000Trade discount given to customers 12,000Holiday pay of machine operatives 32,000Salary of security guard in raw material warehouse 15,000Fees to advertising agency 8,000Rent of finished goods…arrow_forwardLily Accounting performs two types of services, Audit and Tax. Lily's estimated overhead costs consist of computer support, $312000; and legal support, $153000. Information on the two services and their estimated use of cost drivers is as follows: Direct labor cost CPU minutes Legal hours used Audit Tax $50000 $100000 O $3744 O $5097 O $5544 O $3897 40000 200 10000 800 Lily Accounting performs tax services for Cathy Lane. Direct labor cost is $1200, 600 CPU minutes were used; and 1 legal hour was used. What is the total cost of the Lane job using ABC?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education