Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

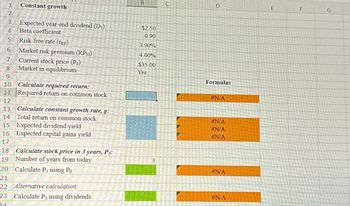

Transcribed Image Text:1

2

3

4

5 Risk-free rate (TRF)

6 Market risk premium (RPM)

7 Current stock price (Po)

Market in equilibrium

8

9

10

11

12

Constant growth

18

19

20

Expected year-end dividend (D₁)

Beta coefficient

Calculate required return:

Required return on common stock

13

14

Calculate constant growth rate, g:

Total return on common stock

15 Expected dividend yield

16 Expected capital gains yield

17

Calculate stock price in 3 years, P3:

Number of years from today

Calculate P3 using Po

21

22 Alternative calculation:

23 Calculate P3 using dividends

24

B

$2.50

0.90

3.90%

4.00%

$35.00

Yes

3

C

D

Formulas

#N/A

#N/A

#N/A

#N/A

#N/A

#N/A

E

F

G

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Historical Realized Rates of Return You are considering an investment in either individual stocks or a portfolio of stocks. The two stocks you are researching, Stock A and Stock B, have the following historical returns: ΤΑ -17.00% 37.00 28.00 ЇВ -6.00% 16.00 -12.00 -5.00 47.00 23.00 21.00 a. Calculate the average rate of return for each stock during the 5-year period. Do not round intermediate calculations. Round your answers to two decimal places. Stock A: Stock B: % % Std. Dev. b. Suppose you had held a portfolio consisting of 50% of Stock A and 50% of Stock B. What would have been the realized rate of return on the portfolio in each year? What would have been the average return on the portfolio during this period? Do not round intermediate calculations. Round your answers to two decimal places. Negative values, if any, should be indicated by a minus sign. Year 2017 2018 2019 2020 2021 Average return c. Calculate the standard deviation of returns for each stock and for the portfolio.…arrow_forwardnaranarrow_forwardA B с E F Investment Opportunity set for stocks and bonds with varios correlation coeffients SD s SDB 19 8 E(rs) 10 Weight in stocks WS -0.1 0.0 0.1 0.2 0.3 0.4 0.6 0.8 1.0 1.1 D E(TB) 5 Portfolio expected return ws(min) = (GB^2 - OBOSP) / (Os^2 + B^2 - 2*0BÚSP) E(rp) = ws(min) *E(rs)+(1-wg(min))*E(rb) = SDp = G -1 Portfolio Standard Deviation for Given Correlation 0 0.2 0.5 H Minimum Variance Portfolio 1arrow_forward

- Given the following information for the stock of Foster Company, calculate the risk premium on its common stock. Current price per share of common stock $47.02 Expected dividend per share next year $2.46 Constant annual dividend growth rate 5.9% Risk-free rate of return 3.9% The risk premium on Foster stock is ___%arrow_forwardReview the following market information: Current Stock Market Return 11.25% Current T-Bill Price $979.43 Historic T-Bill Average Return 2.80% Historic Stock Market Average Return 8.10% Stock Beta 1.23 What is the required return (rounded to two places)?arrow_forwardWhat is the most you should be willing to pay for the stock in the table? Expected Expected Price in 1Dividend in 1 year Required Current Return Price Year $376.29 $3.91 5.80% $89.00arrow_forward

- What is the expected return of a portfolio consisting of $6,000 stocks G and $4,000 stock H ? State of Probability of Returns if State Occurs Economy State of Economy Stock G (" Stock H ")/(11%) Boom 22% 14% 1% Normal 78% 7% 9% a. 7.2% b. 7.6% c. $7.9% d. 8.3% e. $8.9% 33. Joel Foster is the portfolio manager of the SF Fund, a $1 million hedge fund that contains the following stocks. The required rate of return on the market is 10% and the risk-free rate is 4%. What rate of return should investors expect (and require) on this fund? Stoo Amount bar(A) 270,000 B 330,000 1.4 bar(C) 400,000 0.7 $1,000,000 a. 8.756% b. 9.382% c. 9.921%arrow_forwardMarket Equilibrium and Common Stock Growth The required return on the market is 11.5% and the risk free rate is 5.5% APPR Inc. has a beta of 9 and is expected to pay a dividend of $3.00 per share at the end of the current year. Its current stock price is $50 per share. Assume the market is in equilibrium so the required rate of return equals the expected rate of return. Calculate the following Required rate of return of APPR Inc. stock Expected growth rate Dividend yield and capital gain yield b. Farrow_forwardConsider the rate of return of stocks ABC and XYZ. Year rABC rXYZ 1 22 % 34 % 2 12 12 3 14 18 4 7 0 5 1 −8 1. If you were equally likely to earn a return of 22%, 12%, 14%, 7%, or 1%, in each year (these are the five annual returns for stock ABC), what would be your expected rate of return? (Do not round intermediate calculations.) 2. What if the five possible outcomes were those of stock XYZ? 3. Given your answers to (d) and (e), which measure of average return, arithmetic or geometric, appears more useful for predicting future performance? A. Arithmetic B. Geometricarrow_forward

- Bhupatbhaiarrow_forwardYou are considering purchasing a share of preferred stock with the following characteristics: par value = $100 dividend rate = 12% per year payment schedule = quarterly maturity date = required rate of return = 6% per year current market price = $135 per share Based on this information, answer the following: A. What is the dollar amount of the quarterly dividend on this stock? B. Using the Discounted Cash Flow Method, what is the dollar value of this stock? C. Using the Discounted Cash Flow Method, what is the annual expected return for this stock? D. Based on your answer to part B, should you invest in the stock? Why or why not? E.…arrow_forwardRequired: Using Table 5.3 as your guide, what is your estimate of the expected annual HPR on the market index stock portfolio if the current risk- free interest rate is 4.3% ? (Round your answer to 2 decimal places.) Answer is complete but not entirely correct. 0.120 Expected annual HPR TABLE 5.3 Risk and return of investments in major asset classes, 1927-2018 Average Risk premium Standard deviation max min T-bills 3.38 na 3.12 14.71 -0.02 T-bonds 5.83 2.45 11.59 41.68 -25.96 Stocks 11.72 8.34 20.05 57.35 -44.04arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education