Structural Analysis

6th Edition

ISBN: 9781337630931

Author: KASSIMALI, Aslam.

Publisher: Cengage,

expand_more

expand_more

format_list_bulleted

Question

Do the task according to the given instructions. Show solutions.

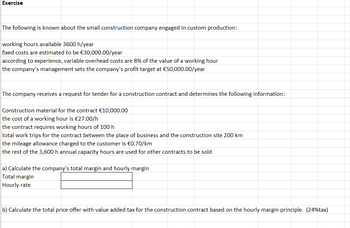

Transcribed Image Text:Exercise

The following is known about the small construction company engaged in custom production:

working hours available 3600 h/year

fixed costs are estimated to be €30,000.00/year

according to experience, variable overhead costs are 8% of the value of a working hour

the company's management sets the company's profit target at €50,000.00/year

The company receives a request for tender for a construction contract and determines the following information:

Construction material for the contract €10,000.00

the cost of a working hour is €27.00/h

the contract requires working hours of 100 h

total work trips for the contract between the place of business and the construction site 200 km

the mileage allowance charged to the customer is €0.70/km

the rest of the 3,600 h annual capacity hours are used for other contracts to be sold

a) Calculate the company's total margin and hourly margin

Total margin

Hourly rate

b) Calculate the total price offer with value added tax for the construction contract based on the hourly margin principle. (24% tax)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 1 steps

Knowledge Booster

Similar questions

Recommended textbooks for you

Structural Analysis (10th Edition)Civil EngineeringISBN:9780134610672Author:Russell C. HibbelerPublisher:PEARSON

Structural Analysis (10th Edition)Civil EngineeringISBN:9780134610672Author:Russell C. HibbelerPublisher:PEARSON Principles of Foundation Engineering (MindTap Cou...Civil EngineeringISBN:9781337705028Author:Braja M. Das, Nagaratnam SivakuganPublisher:Cengage Learning

Principles of Foundation Engineering (MindTap Cou...Civil EngineeringISBN:9781337705028Author:Braja M. Das, Nagaratnam SivakuganPublisher:Cengage Learning Fundamentals of Structural AnalysisCivil EngineeringISBN:9780073398006Author:Kenneth M. Leet Emeritus, Chia-Ming Uang, Joel LanningPublisher:McGraw-Hill Education

Fundamentals of Structural AnalysisCivil EngineeringISBN:9780073398006Author:Kenneth M. Leet Emeritus, Chia-Ming Uang, Joel LanningPublisher:McGraw-Hill Education

Traffic and Highway EngineeringCivil EngineeringISBN:9781305156241Author:Garber, Nicholas J.Publisher:Cengage Learning

Traffic and Highway EngineeringCivil EngineeringISBN:9781305156241Author:Garber, Nicholas J.Publisher:Cengage Learning

Structural Analysis (10th Edition)

Civil Engineering

ISBN:9780134610672

Author:Russell C. Hibbeler

Publisher:PEARSON

Principles of Foundation Engineering (MindTap Cou...

Civil Engineering

ISBN:9781337705028

Author:Braja M. Das, Nagaratnam Sivakugan

Publisher:Cengage Learning

Fundamentals of Structural Analysis

Civil Engineering

ISBN:9780073398006

Author:Kenneth M. Leet Emeritus, Chia-Ming Uang, Joel Lanning

Publisher:McGraw-Hill Education

Traffic and Highway Engineering

Civil Engineering

ISBN:9781305156241

Author:Garber, Nicholas J.

Publisher:Cengage Learning