FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

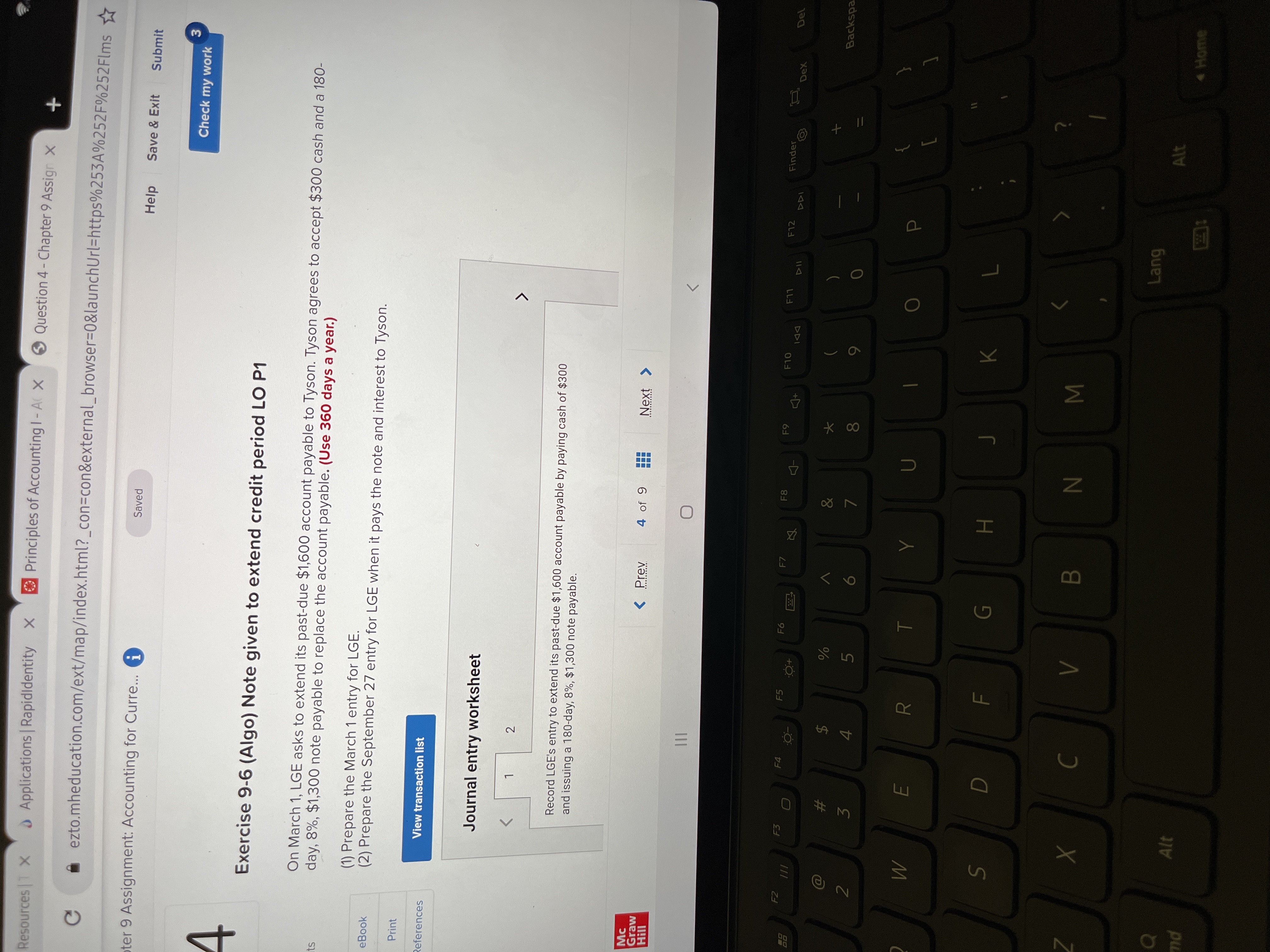

Transcribed Image Text:**Exercise 9-6 (Algo) Note Given to Extend Credit Period LO P1**

On March 1, LGE asks to extend its past-due $1,600 account payable to Tyson. Tyson agrees to accept $300 cash and a 180-day, 8%, $1,300 note payable to replace the account payable. (*Use 360 days a year.*)

Tasks:

1. Prepare the March 1 entry for LGE.

2. Prepare the September 27 entry for LGE when it pays the note and interest to Tyson.

There is an option to view the transaction list.

**Journal Entry Worksheet**

1 of 2:

- Record LGE’s entry to extend its past-due $1,600 account payable by paying cash of $300 and issuing a 180-day, 8%, $1,300 note payable.

No diagrams or graphs are present in the image.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- nik.6 November 1 Accepted a $17,000, 180-day, 8% note from Kelly White in granting a time extension on her past-due account receivable. December 31 Adjusted the year-end accounts for the accrued interest earned on the White note. April 30 White honored her note when presented for payment. Complete the table to calculate the interest amounts at December 31st and April 30th and use those calculated values to prepare your journal entries. Note: Do not round intermediate calculations. Use 360 days a year.arrow_forwardExercise 8-6A Record a line of credit (LO8-2) The following selected transactions relate to liabilities of Rocky Mountain Adventures. Rocky Mountain's fiscal year ends on December 31. January 13 Negotiate a revolving credit agreement with First Bank that can be renewed annually upon bank approval. The amount available under the line of credit is $10 million at the banks prime rate. Arrange a three-month bank loan of $5 million with Pirst Bank under the line of credit agreement. Interest at the prime rate of 78 is payable at maturity. 1 Pay the 71 note at maturity. February May Required: Record the appropriate entries, if any, on January 13, February 1, and May 1. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field. Enter your answers in dollars, not In millions (I.e. 5 should be entered as 5,000,000).) Answer Is complete but not entirely correct. General Journal Debit Credit No Date January 13 No Journal Entry…arrow_forwardSylvestor Systems borrows $186,000 cash on May 15 by signing a 180- day, 6%$, 186,000 note .arrow_forward

- 2arrow_forwardQuestion 13 On November 1, Fastly Co. sold goods and accepted a note of $72,000, six-month, with annual interest rate of 10% (real from the customer. The December 31 adjusting entry should be: Debit Interest Receivable 3,600; Credit Interest Revenue 3,600 Debit Interest Receivable 1,200; Credit Interest Revenue 1,200 O Debit Discount on Notes Receivable 1,200; Credit Interest Revenue 1,200 Debit Interest Revenue 3,600; Credit Interest Receivable 3,600arrow_forwardA B E 2 Determine the maturity date and compute interest for each note. 3 Days to be used per year 360 days 4 Note Contract Date Principal Interest Rate Period of Note (Term) 6. 1 1-Mar $10,000 6% 60 days 7 2 15-May 15,000 8% 90 days 8 3 20-Oct 8,000 4% 45 days 9. 10 Required: 11 12 (Use cells A5 to F8 from the given information to complete this question.) 13 14 Note Contract Date Maturity Date Interest Expense 15 16 17 3 18arrow_forward

- Required information Exercise 7-5 (Algo) Notes payable—discount basis LO 2 Skip to question [The following information applies to the questions displayed below.] On April 15, 2019, Powell Inc. obtained a six-month working capital loan from its bank. The face amount of the note signed by the treasurer was $255,400. The interest rate charged by the bank was 5.00%. The bank made the loan on a discount basis. Exercise 7-5 (Algo) Part a Required:a-1. Calculate the loan proceeds made available to Powell.arrow_forwardExercise 9-3 Accounting for note payable LO P1 Sylvestor Systems borrows $63,000 cash on May 15 by signing a 120-day, 6%, $63,000 note. 1. On what date does this note mature? 2-a. Prepare the entry to record issuance of the note. 2-b. First, complete the table below to calculate the interest expense at maturity. Use those calculated values to prepare your entry to record payment of the note at maturity. Complete this question by entering your answers in the tabs below. Required 2B Interest at Required 2B General Required 1 Required 2A Maturity Journal On what date does this note mature? On what date does this note mature? < Required 1 Required 2Aarrow_forwardExercise 9-3 Accounting for note payable LO P1 Sylvestor Systems borrows $181,000 cash on May 15 by signing a 180-day, 6%, $181,000 note. 1. On what date does this note mature? 2-a. Prepare the entry to record issuance of the note. 2-b. First, complete the table below to calculate the interest expense at maturity. Use those calculated values to prepare your entry to record payment of the note at maturity. Complete this question by entering your answers in the tabs below. es Required 28 Required 28 General Interest at Maturity Required 1 Required 2A Journal Use those calculated values to prepare your entry to record payment of the note at maturity. (Uee 360 days a year Round final answers to the nearest whole dallar.) View transaction llst View journal entry worksheet Debit Credit General Journal No Event A Interest expense Interest payable < Required 2B Interest at Maturity < Prey 2 of 2 Nextarrow_forward

- Please answerarrow_forwardProblem 1 Kecord the transactions in the general Journal of Martin Tool Company. Martin closes its books on December 31 2021 Martin Tool Company received a $14,000, 12-month 12% note receivable in exchange for an outstanding account from John Glenn. May 1 Dec. 31 Accrued interest revenue on the note fort the 8 months (May 1- Dec. 31, 2021) 2022 May 1 Received principal plus interest on the John Glenn note. (No interest revenue has been recorded for the 4 months (January 1- Mayl, 2022) Мay 1. 2021. 6, Jets Company re et the 20 of the erchand ed $47,000. Dec. 31. 2021. May 1. 2022 Company recei ceived the alcearrow_forwardProceeds journal entryarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education