FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

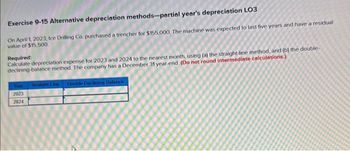

Transcribed Image Text:Exercise 9-15 Alternative depreciation methods-partial year's depreciation LO3

On April 1, 2023, Ice Drilling Co. purchased a trencher for $155,000. The machine was expected to last five years and have a residual

value of $15,500.

Required:

Calculate depreciation expense for 2023 and 2024 to the nearest month, using (a) the straight-line method, and (b) the double-

declining balance method. The company has a December 31 year-end. (Do not round intermediate calculations.)

Year Straight Line Double Declining Balance

2023

2024

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 11-31 A small used delivery van can be purchased for $20,000. At the end of its useful life (8 years), the van can be sold for $3000. Determine the PW of the depreciation schedule based on 15% interest using: (a) Straight-line depreciation (b) Sum-of-years'-digits depreciation (c) MACRS depreciation (d) Double declining balance depreciationarrow_forward4arrow_forwardrmn.3arrow_forward

- Exercise 10-13 (Algo) Revising depreciation LO C2 Apex Fitness Club uses straight-line depreciation for a machine costing $21,050, with an estimated four-year life and a $2,250 salvage value. At the beginning of the third year, Apex determines that the machine has three more years of remaining useful life, after which it will have an estimated $1,800 salvage value. 1. Compute the machine's book value at the end of its second year. 2. Compute the amount of depreciation for each of the final three years given the revised estimates. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the machine's book value at the end of its second year. Note: Do not round intermediate calculations. Round your final answers to the nearest whole dollar. Book Value at the End of Year 2: Cost Accumulated depreciation 2 years Book value at point of revision $ 0arrow_forwardchapter 9 question 5 fill in all the blanks that need to be filledarrow_forwardProblem 6-25 (Algo) Identify depreciation methods used LO 3 Grove Co. acquired a production machine on January 1, 2019, at a cost of $495,000. The machine is expected to have a four-year useful life, with a salvage value of $86,000. The machine is capable of producing 56,000 units of product in its lifetime. Actual production was as follows: 12,320 units in 2019; 17,920 units in 2020; 15,680 units in 2021; 10,080 units in 2022. Following is the comparative balance sheet presentation of the net book value of the production machine at December 31 for each year of the asset’s life, using three alternative depreciation methods (items a–c): Required: Identify the depreciation method used for each of the following comparative balance sheet presentations (items a–c). If a declining-balance method is used, be sure to indicate the percentage (150% or 200%). (Hint: Read the balance sheet from right to left to determine how much has been depreciated each year. Remember that December 31, 2019, is…arrow_forward

- 8arrow_forwardPlease answer question correctlyarrow_forwardProblem 8-5: The Volga Corporation On January 1, 2021 the Volga Corporation purchased a new machine for $3240 cash. The machine has an estimated useful life of 3 years and a salvage value of $324. The following data are also available: Estimated Unit Output over Life of Equipment 30000 Unit Production in 2021 12000 Unit Production in 2022 6000 Unit Production in 2023 and following years 12000 Required: Prepare journal entries to record depreciation expense (rounding all amounts to the nearest $) for each December year end for the 3 year life of the machine using: 1. Straight Line Depreciation 2. Double Declining Balance Depreciation 3. Units of Production 4. Compute the net book value at the end of 2023 using straight line depreciation. 5. Compute the net book value at the end of 2023 using double declining balance depreciation. 6. Compute the net book value at the end of 2023 using units of production depreciation. Upon completion, enter the following data here: Deprec. Method 2021…arrow_forward

- Revision of Depreciation On January 2, 2012, Mosler, Inc., purchased equipment for $85,000. The equipment was expected to have a $10,000 salvage value at the end of its estimated six-year useful life. Straight-line depreciation has been recorded. Before adjusting the accounts for 2016, Mosler decided that the useful life of the equipment should be extended by three years and the salvage value decreased to $8,000. a. Prepare a journal entry to record depreciation expense on the equipment for 2016. Round your answer to the nearest dollar. Dec. 31 General Journal Debit To record depreciation expense. 0 Credit 0 0 0 b. What is the book value of the equipment at the end of 2016 (after recording the depreciation expense for 2016)? Book Value at year ended December 31, 2016: $ 0arrow_forwardQUESTION 12 Kansas Enterprises purchased equipment for $79,500 on January 1, 2024. The equipment is expected to have a five-year service life, with a residual value of $7,950 at the end of five years. Using the double-declining balance method, depreciation expense for 2025 would be: (Do not round your intermediate calculations) O $19,080. O $28,620. O $31,800. $17,172. O None of the abovearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education