Concept explainers

EXERCISE 8–7 Cash Budget [LO8–8]

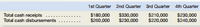

Garden Depot is a retailer that is preparing its budget for the upcoming fiscal year. Management

has prepared the following summary of its budgeted

[picture]

The company’s beginning cash balance for the upcoming fiscal year will be $20,000. The company requires a minimum cash balance of $10,000 and may borrow any amount needed from a local bank at a quarterly interest rate of 3%. The company may borrow any amount at the beginning of any quarter and may repay its loans, or any part of its loans, at the end of any quarter. Interest payments are due on any principal at the time it is repaid. For simplicity, assume that interest is not compounded.

Required:

Prepare the company’s cash budget for the upcoming fiscal year

| Particulars | 1Q | 2Q | 3Q | 4Q | Year |

| Cash balance. Beginning | |||||

| Add:Collection from customer | |||||

| Total cash available | |||||

| Less:Disbursement | |||||

| Purchase of inventory | |||||

| Selling and administrative expense | |||||

| Equipment purchase | |||||

| Dividends | |||||

| Total disbursements | |||||

| Excess/(Deficiency): | |||||

| Over disbursement | |||||

| Financing Borrowing | |||||

| Repayment | |||||

| Total financing | |||||

| Cash Balance,ending |

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

- PROBLEM 9-23 Schedule of Expected Cash Collections; Cash Budget [LO2, LO8] Herbal Care Corp., a distributor of herb-based sunscreens, is ready to begin its third quarter, in which peak sales occur. The company has requested a $40,000, 90-day loan from its bank to help meet cash requirements during the quarter. Since Herbal Care has experienced difficulty in paying off its loans in the past, the loan officer at the bank has asked the company to prepare a cash budget for the quarter. In response to this request, the following data have been assembled: On July 1, the beginning of the third quarter, the company will have a cash balance of $44,500. a. b. Actual sales for the last two months and budgeted sales for the third quarter follow (all sales are on account): $250,000 May (actual). June (actual) July (budgeted) August (budgeted). September (budgeted) $300,000 $400,000 ৪600,000 $320,000 Past experience shows that 25% of a month's sales are collected in the month of sale, 70% in the…arrow_forwardDinesh bhaiarrow_forwardesc QUESTION 33 Leaning Tower of Pizza, Inc. is preparing its master budget for its first year of business. It expects to sell 5,000 pizzas at $11 per pizza per month. It expects to collect 90% of the sales revenue in the month of the sale and 10% in the following month. Calculate its accounts receivable balance at the end of its first year. Click Save and Submit to save and submit. Click Save All Answers to save all answers. 2 A ! 1 Q A J2₂² N 2 W S #3 X E D $ 4 R с 07 dº % 5 F MacBook Pro T 6 V G & Y 7 H B * 00 8 U J N 6arrow_forward

- Exercise 20-19 (Algo) Schedule of cash payments LO P2 Zisk Company purchases direct materials on credit. Budgeted purchases are April, $89,000; May, $119,000; and June, $129,000. Cash payments for purchases are: 70% in the month of purchase and 30% in the first month after purchase. Purchases for March are $79,000. Prepare a schedule of cash payments for direct materials for April, May, and June. ZISK COMPANY Schedule of Cash Payments for Direct Materials Materials purchases Cash payments for: Total cash payments April May Junearrow_forwardHelparrow_forwardNonearrow_forward

- 3.3 Tutorial Questions 3.3.1 Cash Budget 1. A firm reported actual sales of RM65,000 in the month of June and RM70,000 in July. The sales forecasts indicate that sales are expected to be RM85,000, RM92,000 and RM95,750 for the months of August, September and October, respectively. Sales are 60% cash and 40% credit and credit sales are collected evenly over the following 2 month. No other cash receipts were received. What are the firm's expected cash receipts for the month August, September and October? . compile a cash disbursementarrow_forwardVaibhavarrow_forwardProblem 8-23 Schedule of Expected Cash Collections; Cash Budget [LO8-2, LO8-8] The president of the retailer Prime Products has just approached the company’s bank with a request for a $51,000, 90-day loan. The purpose of the loan is to assist the company in acquiring inventories. Because the company has had some difficulty in paying off its loans in the past, the loan officer has asked for a cash budget to help determine whether the loan should be made. The following data are available for the months April through June, during which the loan will be used: On April 1, the start of the loan period, the cash balance will be $24,400. Accounts receivable on April 1 will total $151,200, of which $129,600 will be collected during April and $17,280 will be collected during May. The remainder will be uncollectible. Past experience shows that 30% of a month’s sales are collected in the month of sale, 60% in the month following sale, and 8% in the second month following sale. The other 2%…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education