FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

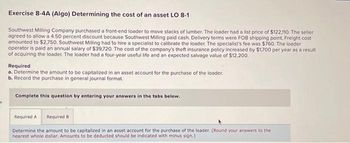

Transcribed Image Text:Exercise 8-4A (Algo) Determining the cost of an asset LO 8-1

Southwest Milling Company purchased a front-end loader to move stacks of lumber. The loader had a list price of $122,110. The seller

agreed to allow a 4.50 percent discount because Southwest Milling paid cash. Delivery terms were FOB shipping point. Freight cost

amounted to $2,750. Southwest Milling had to hire a specialist to calibrate the loader. The specialist's fee was $760. The loader

operator is paid an annual salary of $39,720. The cost of the company's theft insurance policy increased by $1,700 per year as a result

of acquiring the loader. The loader had a four-year useful life and an expected salvage value of $12,200.

Required

a. Determine the amount to be capitalized in an asset account for the purchase of the loader.

b. Record the purchase in general journal format.

Complete this question by entering your answers in the tabs below.

Required A

Required B

Determine the amount to be capitalized in an asset account for the purchase of the loader. (Round your answers to the

nearest whole dollar, Amounts to be deducted should be indicated with minus sign.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Required information Problem 8-6A Disposal of plant assets LO C1, P1, P2 Onslow Co. purchased a used machine for $240,000 cash on January 2. On January 3, Onslow paid $8,000 to wire electricity to the machine and an additional $1,600 to secure it in place. The machine will be used for six years and have a $28,800 salvage value. Straight-line depreciation is used. On December 31, at the end of its fifth year in operations, it is disposed of.arrow_forwardQd 119.arrow_forwardDon't provide answers in image formatarrow_forward

- MODULE 5 8-7 DISPOSAL OF ASSET Please read the problem below and provide the correct answer along with an explanation of the answer. Thank you! Dump It is selling a machine that no longer is large enough for the production requirements. Dump It has had the machien for 3 years and has depreicated it using the straightline method. Original cost had been $98,000 and salvage was estimated at $6000. The machine has a life of 8 years. a) Journalize the sale of the imagine $70,000 b) Journalize teh sale of the machine for $50,000arrow_forwardMini-Exercise 6-3 (Static) Capitalizing versus expensing LO 6-2 Stucki Holdings Corporation incurred the following expenditures: $5,700 cost to replace the transmission in a company-owned vehicle; $19,300 cost of annual property insurance on the company's production facilities; $15,100 cost to develop and register a design patent; $25,400 cost to add a security and monitoring system to the company's distribution center; $700 cost to repair paint damage on a company-owned vehicle caused by normal wear and tear. Required: Which, if any, of these expenditures should be capitalized? Note: Select all that apply. Check All That Apply $5,700 $15,100 $25,400 $19,300arrow_forwardQuestion 15arrow_forward

- answer plsarrow_forwardExercise 10-17 (Algo) Disposal of assets LO P2 Diaz Company owns a machine that cost $127,000 and has accumulated depreciation of $93,500. Prepare the entry to record the disposal of the machine on January 1 in each separate situation. 1. The machine needed extensive repairs and was not worth repairing. Diaz disposed of the machine, receiving nothing in return.2. Diaz sold the machine for $16,000 cash.3. Diaz sold the machine for $33,500 cash.4. Diaz sold the machine for $41,000 cash.arrow_forwardExercise 8-4A (Algo) Determining the cost of an asset LO 8-1 Southwest Milling Company purchased a front-end loader to move stacks of lumber. The loader had a list price of $120,090. The seller agreed to allow a 4.75 percent discount because Southwest Milling paid cash. Delivery terms were FOB shipping point. Transportation cost amounted to $2,500. Southwest Milling had to hire a specialist to calibrate the loader. The specialist's fee was $1,100. The loader operator is paid an annual salary of $27,380. The cost of the company's theft insurance policy increased by $1,560 per year as a result of acquiring the loader. The loader had a four-year useful life and an expected salvage value of $5,100. Required: Determine the amount to be capitalized in an asset account for the purchase of the front-end loader. Note: Round your answers to the nearest whole dollar. Amounts to be deducted should be indicated with minus sign. Costs that are to be capitalized: List price Total costsarrow_forward

- %24 Determining Cost of Land On-Time Delivery Company acquired an adjacent lot to construct a new warehouse, paying $30,000 in cash and giving a short-term note for $276,000. Legal fees paid were $2,435, delinquent taxes assumed were $12,400, and fees paid to remove an old building from the land were $18,200. Materials salvaged from the demolition of the building were sold for $4,600. A contractor was paid $930,200 to construct a new warehouse Determine the cost of the land to be reported on the balance sheet. ( Previous Next Check My Work Save and Exit Submit Assignment for Graearrow_forwardEXERCISE/TUTORIAL12. 1 A 2 Rubicon Limited purchased machinery on 1 January 20.1 at a cost of R70 000. It has an expected useful life of ten (10) years with no residual value. REQUIRED 1. Calculate the Depreciation on machinery for 20.1 and 20.2 if: a. The straight-line method is used. b. The diminishing amount method is used (rate 20%). c. Sum-of-the-years-digit method is used. 2. Discuss the effect of a change in the method of depreciation from the straight- line method in 20.1 to the diminishing amount method in 20.2.arrow_forwardBrief Exercise 8-5 (Algo) Effect of the disposal of plant assets on the financial statements LO 8-5 Mix & Match Company sold office equipment with a cost of $48,600 and accumulated depreciation of $33,000 for $28,000 cash. Required: a. What is the amount of gain or loss on the disposal? b. How would the sale affect net income (increase, decrease, no effect)? c. How would the sale affect the amount of total assets shown on the balance sheet (increase, decrease, no effect)? d. How would the event affect the statement of cash flows (inflow, outflow, no effect)? a. b. Effect of sale on net income c. Effect of sale on total assets d. Effect of sale on statement of cash flowsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education