FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

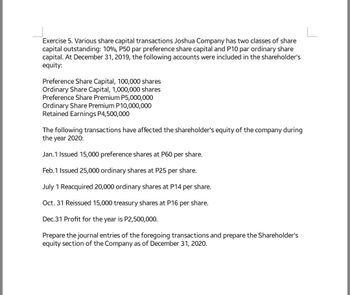

Transcribed Image Text:Exercise 5. Various share capital transactions Joshua Company has two classes of share

capital outstanding: 10%, P50 par preference share capital and P10 par ordinary share

capital. At December 31, 2019, the following accounts were included in the shareholder's

equity:

Preference Share Capital, 100,000 shares

Ordinary Share Capital, 1,000,000 shares

Preference Share Premium P5,000,000

Ordinary Share Premium P10,000,000

Retained Earnings P4,500,000

The following transactions have affected the shareholder's equity of the company during

the year 2020:

Jan. 1 Issued 15,000 preference shares at P60 per share.

Feb.1 Issued 25,000 ordinary shares at P25 per share.

July 1 Reacquired 20,000 ordinary shares at P14 per share.

Oct. 31 Reissued 15,000 treasury shares at P16 per share.

Dec.31 Profit for the year is P2,500,000.

Prepare the journal entries of the foregoing transactions and prepare the Shareholder's

equity section of the Company as of December 31, 2020.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Question 2The equity accounts of Marvell Ltd. on January 1, 2020, were as follows.Share Capital—Preference (9%, $50 par, cumulative,10,000 sharesauthorized, 8,000 shares issued)?Share Capital—Ordinary ($1 stated value, 2,000,000 shares authorized,1,000,000 shares issued)?Share Premium—Preference 100,000Share Premium—Ordinary 1,450,000Retained Earnings 1,816,000During 2020, the corporation had the following transactions and events pertaining to its equity.Jan 25 Purchased 20,000 ordinary shares for the treasury at a cost of $2.5 per share.Feb. 1 Issued 50,000 ordinary shares for $152,000.Apr. 14 Reissued 10,000 treasury shares—ordinary for $42,000.Nov. 10 Purchased 1,000 ordinary shares for the treasury at a cost of $6 per share.Dec. 31 Determined that net income for the year was $452,000. Close the income summaryaccount.Dec. 31 Declared a dividend of $0.5 per ordinary share, to be payable in April 2021. Dividendfor the preference shares was not paid in 2019.Instructions(a.) Journalize…arrow_forwardWalking Bear Resources Inc. Equity Section of the Balance Sheet March 31, 2023 Contributed capital: Preferred shares, $17 cumulative, 3,500 shares authorized, issued, and outstanding Common shares, unlimited shares authorized, se,000 shares issued and outstanding Total contributed capital Retained earnings Total equity 1,190,000 1,200,000 2,390,000 472,000 2,062,000 Required: a. Refer to the equity section above. Assume that the preferred are convertible into common at a rate of eight common shares for each share of preferred. if 1000 shares of the preferred are converted into common on April 1, 2023, prepare the journal entryarrow_forwardProblem 3: Carr Company reported the following shareholders' equity on January 1, 2021: Preference share capital Share premium – preference Ordinary share capital Share premium – ordinary Retained earnings Treasury shares – ordinary 1,800,000 90,000 5,150,000 3,500,000 4,000,000 270,000 On January 1, 2021, Carr Company had 100,000 authorized shares of P100 par, 10% cumulative preference share capital and 3,000,000 authorized shares of no-par ordinary share capital with a stated value of P5 per share. On January 10, 2021, Carr formally retired all the 30,000 ordinary shares of treasury. The treasury shares had been acquired in the previous year and were originally issued at P10 per share. Carr owned 10,000 ordinary shares of Bush Company purchased several years ago for P600,000. On February 15, Carr declared and paid a dividend in kind of one share of Bush for every hundred ordinary shares of Carr held by a shareholder of record on February 28, 2021. The market price of Bush share was…arrow_forward

- Hh1.arrow_forwardInformation concerning the capital structure of Catan Corporation follows Dec. 31, 2019 Dec. 31, 2020 100,000 shares 100,000 shares 10,000 shares $ 2,000,000 Common shares outstanding Convertible preferred shares outstanding 9% convertible bonds 10,000 shares Select one: a. $ 3.65 b. $ 4.75 c. $ 3.33 d. $ 5.00 $ 2,000,000 During 2020, Catan paid dividends of $ 1.00 per common share and $2.50 per preferred share. The preferred shares are non-cumulative, and convertible into 20,000 common shares. The 9% convertible bonds are convertible into 50,000 common shares. Net income for calendar 2020 was $500,000. Assume the income tax rate is 30%. Basic earnings per share for 2020 isarrow_forward2. Following in the Balance Sheet of Navrang Co. Ltd., as on 31st December 2020. Share Capital: 3000 5% pref. shares of *100 each 6000 Equity shares of 100 each 6% Debentures Bank Overdraft Creditors Goodwill Land & Buildings 3,00,000 Machinery 22,500 3,00,000 4,50,000 Stock 65,000 6,00,000 Debtors 70,000 1,50,000 Cash 7,500 1,50,000 Profit and Loss Account 75,000 Preliminary expenses 3,50,000 10,000 1275000 1275000 On the above date the company adopted the following scheme of reconstruction. i) The preference shares are to be reduced to fully paid shares of *75 each and equity shares are to be reduced to shares of 40 each fully paid. ii) The Debenture holders took over stock and debtors in full satisfaction of their claims. iii) The fictitious assets are to be eliminated. iv) The land and buildings to be appreciated by 40% and machinery to be depreciated by 30%. Give Journal entries incorporating the above scheme of reconstruction and prepare the reconstructed balance sheet. 20 was as…arrow_forward

- A-7arrow_forwardPART 1 EQUITY At 30 June 2021, the equity of Bourne Ltd comprised share capital of $29,880,000 (comprising 5,000,000 ordinary shares issued and paid to $6.00 per share, less share issue costs of $120,000), general reserve of $250,000, retained earnings of $2,500,000. The following transactions and events occurred during the year ending 30 June 2022: ● On 6 July 2021 a dividend of $420,000 was paid. This dividend had been declared on 29 March 2021 by the Directors from retained earnings (and had not required any further approval/authorisation). ● On 1 August 2021 the directors made a bonus share issue of 1 ordinary share issued and paid to $6.00 for every 100 shares held. This was made using the total amount in the general reserve, with the remainder from retained earnings. ● On 2 February 2022, the Directors declared and paid an interim dividend of $320,000 from retaining earnings. . On 29 June 2022, the Directors declared a dividend of 8 cents per share from retained earnings. This…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education