MATLAB: An Introduction with Applications

6th Edition

ISBN: 9781119256830

Author: Amos Gilat

Publisher: John Wiley & Sons Inc

expand_more

expand_more

format_list_bulleted

Question

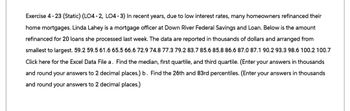

Transcribed Image Text:Exercise 4-23 (Static) (LO4-2, LO4-3) In recent years, due to low interest rates, many homeowners refinanced their

home mortgages. Linda Lahey is a mortgage officer at Down River Federal Savings and Loan. Below is the amount

refinanced for 20 loans she processed last week. The data are reported in thousands of dollars and arranged from

smallest to largest. 59.2 59.5 61.6 65.5 66.6 72.9 74.8 77.3 79.2 83.7 85.6 85.8 86.6 87.0 87.1 90.2 93.3 98.6 100.2 100.7

Click here for the Excel Data File a. Find the median, first quartile, and third quartile. (Enter your answers in thousands

and round your answers to 2 decimal places.) b. Find the 26th and 83rd percentiles. (Enter your answers in thousands

and round your answers to 2 decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 5 images

Knowledge Booster

Similar questions

- es There are some excellent free personal finance apps available: Mint.com, GoodBudget, Mvelopes, BillGuard, PocketExpense, HomeBudget, and Expensify. After using Mint.com, you realize you need to pay off one of your high interest loans to reduce your interest expense. You decide to discount a $6,200, 335-day note at 2% to your bank at a discount rate of 3.0% on day 210. What are your proceeds? (Round your final answer to the nearest whole number.) Proceedsarrow_forwardCalculate the missing information for the purchase. Item SellingPrice(in $) SalesTaxRate SalesTax(in $) ExciseTax Rate ExciseTax TotalPurchase Price book 8 0 0 $11.88arrow_forwardAs one of the loan officers for Grove Gate Bank, calculate the monthly principal and interest, PI (in $), using this table and the monthly PITI (in $) for the mortgage. (Round dollars to the nearest cent.) AmountFinanced InterestRate Termof Loan(years) MonthlyPI AnnualPropertyTax AnnualInsurance MonthlyPITI $230,000 9.50% 25 $ $6,573 $2,126 $arrow_forward

- You take out a $200 loan that charges 6.8% simple interest. How much will you owe, including interest, after 4 years? Round to 2 decimal places, if needed. Do NOT use the dollar sign in the answer box. You will owe $ Blank 1. Calculate the answer by read surrounding text.arrow_forwardCalculate the accrued interest (in $) and the total purchase price (in $) of the bond purchase. (Round your answers to the nearest cent.) Company CouponRate MarketPrice TimeSince LastInterest AccruedInterest Commissionper Bond BondsPurchased TotalPrice Company 2 9.2 79.75 23 days $ $9.35 15arrow_forwardWorksheet 3.5 5. Find the total monthly payment for a $225,000 mortgage loan at 4.25% for 30 years. The assessed value of the home is $240,000. The annual taxes on the home are 1.1% of the assessed value and the insurance on the home costs $950 per year. Round your answer to the nearest whole dollar.arrow_forward

- Susan has a 25-year home mortgage of $213,570 at 4.75% interest and will pay $1,727 annual insurance premium. Her annual property tax will be $2,173. Find her monthly PITI payment. (Round to the nearest cent as needed.) Data table Years Annual interest rate financed 3.00% 3.25% 3.50% 3.75% 4.00% 4.25% 4.50% 4.75% 5.00% 5.25% 5.50% 5.75% 6.00% 6.25% 6.50% 6.75% 10 9.66 9.77 9.89 10.01 10.12 10.24 10.36 10.48 10.61 10.73 10.85 10.98 11.10 11.23 11.35 11.48 12 8.28 8.40 8.51 8.63 8.76 8.88 9.00 9.12 9.25 9.37 9.50 9.63 9.76 9.89 10.02 10.15 15 6.91 7.03 7.15 7.27 7.40 7.52 7.65 7.78 7.91 8.04 8.17 8.30 8.44 8.57 8.71 8.85 17 6.26 6.39 6.51 6.64 6.76 6.89 7.02 7.15 7.29 7.42 7.56 7.69 7.83 7.97 8.11 8.25 20 5.55 5.67 5.80 5.93 6.06 6.19 6.33 6.46 6.60 6.74…arrow_forwardUse PMT = . Round to the nearest dollar. Suppose that you borrow $10,000 for four years at 7% toward the purchase of a car. Find the monthly payments and the total interest for the loan. A.$281; $13,488 B.$239; $1472 C.$624; $19,952 D.$239; $11,472arrow_forwardCalculate the missing information for the stock. (Round current yield to the nearest tenth of a percent.) Company Earningsper Share AnnualDividend Current Priceper Share CurrentYield(as a %) Price-EarningsRatio a medical case management company $6.69 $1.30 $53.52 %arrow_forward

- In April 2014, you could buy a 10-year U.S. Treasury note (“T-note,” a kind of bond) for $10,000 that pays 2.726% simple interest every year through April 4, 2024. How much total interest would it earn by then?$__________. Give your answer to the nearest whole number.arrow_forwardASAParrow_forwardYou own a home that was recently appraised for $310,000. The balance on your existing mortgage is $125,350. If your bank is willing to loan up to 70% of the appraised value, what is the potential amount (in $) of credit available on a home equity loan? Need Help? Read It Watch It Master Itarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning

Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning

Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON

Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman

The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman

Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman

MATLAB: An Introduction with Applications

Statistics

ISBN:9781119256830

Author:Amos Gilat

Publisher:John Wiley & Sons Inc

Probability and Statistics for Engineering and th...

Statistics

ISBN:9781305251809

Author:Jay L. Devore

Publisher:Cengage Learning

Statistics for The Behavioral Sciences (MindTap C...

Statistics

ISBN:9781305504912

Author:Frederick J Gravetter, Larry B. Wallnau

Publisher:Cengage Learning

Elementary Statistics: Picturing the World (7th E...

Statistics

ISBN:9780134683416

Author:Ron Larson, Betsy Farber

Publisher:PEARSON

The Basic Practice of Statistics

Statistics

ISBN:9781319042578

Author:David S. Moore, William I. Notz, Michael A. Fligner

Publisher:W. H. Freeman

Introduction to the Practice of Statistics

Statistics

ISBN:9781319013387

Author:David S. Moore, George P. McCabe, Bruce A. Craig

Publisher:W. H. Freeman