FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

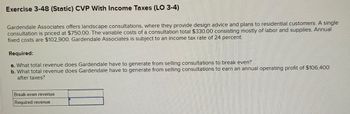

Transcribed Image Text:Exercise 3-48 (Static) CVP With Income Taxes (LO 3-4)

Gardendale Associates offers landscape consultations, where they provide design advice and plans to residential customers. A single

consultation is priced at $750.00. The variable costs of a consultation total $330.00 consisting mostly of labor and supplies. Annual

fixed costs are $102,900. Gardendale Associates is subject to an income tax rate of 24 percent.

Required:

a. What total revenue does Gardendale have to generate from selling consultations to break even?

b. What total revenue does Gardendale have to generate from selling consultations to earn an annual operating profit of $106,400

after taxes?

Break-even revenue

Required revenue

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Please do not give solution in image format thankuarrow_forwardCan you please help find the solution for A)arrow_forwardANSWER QUESTIONS 3&4 ONLY!!! Vandenberg, Inc., produces and sells two products: a ceiling fan and a table fan. Vandenberg plans to sell 40,000 ceiling fans and 60,000 table fans in the coming year. Product price and cost information includes: Ceiling Fan Table Fan Price $54 $12 Unit variable cost $11 $9 Direct fixed cost $20,800 $41,000 Common fixed selling and administrative expenses total $84,000. Required: 1. What is the sales mix estimated for next year (calculated to the lowest whole number for each product)?Sales mix of ceiling fans to table fans = ____2___ : ____3______ 2. Using the sales mix from Requirement 1, form a package of ceiling fans and table fans. How many ceiling fans and table fans are sold at break-even? Round your intermediate calculations and final answers to the nearest whole number. Break-even ceiling fans 3070 Break-even table fans 4605 3. Prepare a contribution-margin-based income statement for Vandenberg, Inc.,…arrow_forward

- EX 7-24 (Algo) Pizza Delivery Business; Basic CVP Analysis (LO 7-1, 7-2, 7-4) College Pizza delivers pizzas to the dormitories and apartments near a major state university. The company's annual fixed expenses are $63,000. The sales price of a pizza is $20, and it costs the company $10 to make and deliver each pizza. (In the following requirements, ignore income taxes.) Required: 1. Using the contribution-margin approach, compute the company's break-even point in units (pizzas). 2. What is the contribution-margin ratio? Note: Enter your answer as a decimal. 3. Compute the break-even sales revenue. Use the contribution-margin ratio in your calculation. 4. How many pizzas must the company sell to earn a target profit of $69,000? Use the equation method. 1. Break-even point 2. Contribution-margin ratio 3. Break-even point sales dollars 4. Number of pizzas pizzasarrow_forwardsolve questions a and barrow_forwardNonearrow_forward

- 3-27 CVP analysis, income taxes. The Home Style Eats has two restaurants that are open 24 hours aday. Fixed costs for the two restaurants together total $430,500 per year. Service varies from a cup of coffeeto full meals. The average sales check per customer is $8.75. The average cost of food and other variablecosts for each customer is $3.50. The income tax rate is 36%. Target net income is $117,600.1. Compute the revenues needed to earn the target net income.2. How many customers are needed to break even? To earn net income of $117,600?3. Compute net income if the number of customers is 170,000.arrow_forwardHomework Saved Help Stuart Company makes a product that sells for $33 per unit. The company pays $13 per unit for the variable costs of the product and incurs annual fixed costs of $184,000. Stuart expects to sell 22,200 units of product. Required Determine Stuart's margin of safety expressed as a percentage. (Round your percentage answers to 2 decimal places (i.e., 0.2345 should be entered as 23.45).) Margin of safetyarrow_forwarddarrow_forward

- ces Exercise 2-17 (Algo) Break-Even and Target Profit Analysis [LO2-4, LO2-5, LO2-6] Outback Outfitters sells recreational equipment. One of the company's products, a small camp stove, sells for $120 per unit. Variable expenses are $84 per stove, and fixed expenses associated with the stove total $162,000 per month. Required: 1. What is the break-even point in unit sales and in dollar sales? 2. If the variable expenses per stove increase as a percentage of the selling price, will it result in a higher or a lower break-even point? (Assume that the fixed expenses remain unchanged.) 3. At present, the company is selling 15,000 stoves per month. The sales manager is convinced that a 10% reduction in the selling price would result in a 25% increase in monthly sales of stoves. Prepare two contribution format income statements, one under present operating conditions, and one as operations would appear after the proposed changes. 4. Refer to the data in Required 3. How many stoves would have…arrow_forwardparts d, earrow_forwardCan you solve #2 a-d pleasearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education