SWFT Corp Partner Estates Trusts

42nd Edition

ISBN: 9780357161548

Author: Raabe

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

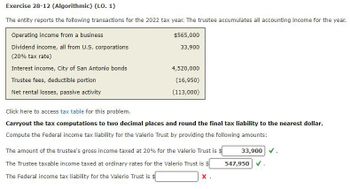

Transcribed Image Text:Exercise 28-12 (Algorithmic) (LO. 1)

The entity reports the following transactions for the 2022 tax year. The trustee accumulates all accounting income for the year.

Operating income from a business

$565,000

33,900

Dividend income, all from U.S. corporations

(20% tax rate)

Interest income, City of San Antonio bonds

4,520,000

Trustee fees, deductible portion

(16,950)

Net rental losses, passive activity

(113,000)

Click here to access tax table for this problem.

Carryout the tax computations to two decimal places and round the final tax liability to the nearest dollar.

Compute the Federal income tax liability for the Valerio Trust by providing the following amounts:

The amount of the trustee's gross income taxed at 20% for the Valerio Trust is $

33,900 V.

The Trustee taxable income taxed at ordinary rates for the Valerio Trust is $

547,950 V.

The Federal income tax liability for the Valerio Trust is $

x.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Havaharrow_forwardExercise 28-12 (Algorithmic) (LO. 1) The entity reports the following transactions for the 2021 tax year. The trustee accumulates all accounting income for the year. Operating income from a business Dividend income, all from U.S. corporations (20% tax rate) Interest income, City of San Antonio bonds Trustee fees, deductible portion Net rental losses, passive activity $795,000 47,700 6,360,000 (23,850) (159,000) Click here to access tax table for this problem. Carryout the tax computations to two decimal places and round the final tax liability to the nearest dollar. Compute the Federal income tax liability for the Valerio Trust by providing the following amounts: The amount of the trustee's gross income taxed at 20% for the Valerio Trust is $ The Trustee taxable income taxed at ordinary rates for the Valerio Trust is $ The Federal income tax liability for the Valerio Trust is $ x.arrow_forwardshow calculationsarrow_forward

- Exercise 30-12 (Algorithmic) (LO. 1) The entity reports the following transactions for the 2023 tax year. The trustee accumulates all accounting income for the year. Operating income from a business $675,000 40,500 Dividend income, all from U.S. corporations (20% tax rate) Interest income, City of San Antonio bonds 5,400,000 Trustee fees, deductible portion (20,250) (135,000) Net rental losses, passive activity Click here to access tax table for this problem. Carryout the tax computations to two decimal places and round the final tax liability to the nearest dollar. Compute the Federal income tax liability for the Valerio Trust by providing the following amounts: The amount of the trustee's gross income taxed at 20% for the Valerio Trust is $ 40,500 The Trustee taxable income taxed at ordinary rates for the Valerio Trust is s The Federal income tax liability for the Valerio Trust is $ 654,650 x Feedback ▼ Check My Work Congress's desire to stop trusts from being used as income-shifting…arrow_forwardAn entity reports the following transactions for the 2021 tax year. The trustee accumulates all accounting income for the year. Operating income from a business $665,000 39,900 Dividend income, all from U.S. corporations (20% tax rate) Interest income, City of San Antonio bonds 5,320,000 Trustee fees, deductible portion (19,950) Net rental losses, passive activity (133,000) Income Tax Rates-Estates and Trusts Tax Year 2021 Taxable Income The Tax Is: Of the But not Amount Over- Over- Over- $ 0 $ 2,650 10% $ 0 2,650 9,550 $ 265.00 +24% 2,650 9,550 13,050 1,921.00 + 35% 9,550 13,050 3,146.00 + 37% 13,050 Income Tax Rates-C Corporations, 2018 and after For all income levels, the tax rate is 21%. Question: The Federal income tax liability for the Valerio Trust isarrow_forwardQ1.arrow_forward

- The entity reports the following transactions for the 2022 tax year. The trustee accumulates all accounting income for the year. Operating income from a business $855,000 Dividend income, all from U.S. corporations(20% tax rate) 51,300 Interest income, City of San Antonio bonds 6,840,000 Trustee fees, deductible portion (25,650) Net rental losses, passive activity (171,000) Compute the Federal income tax liability for the Valerio Trust by providing the following amounts: The amount of the trustee's gross income taxed at 20% for the Valerio Trust is $fill in the blank 1.The Trustee taxable income taxed at ordinary rates for the Valerio Trust is $fill in the blank 2.The Federal income tax liability for the Valerio Trust is $fill in the blank 3.arrow_forwardebook Exercise 20-12 (Algorithmic) (LO. 1) The entity reports the following transactions for the 2021 tax year. The trustee accumulates all accounting income for the year. Operating income from a business Dividend income, all from U.S. corporations (20% tax rate) Interest income, City of San Antonio bonds Trustee fees, deductible portion Net rental losses, passive activity $785,000 47,100 6,280,000 (23,550) (157,000) Click here to access tax table for this problem. Carryout the tax computations to two decimal places and round the final tax liability to the nearest dollar. Compute the Federal income tax liability for the Valerio Trust by providing the following amounts: The amount of the trustee's gross income taxed at 20% for the Valerio Trust is $ The Trustee taxable income taxed at ordinary rates for the Valerio Trust is $ The Federal income tax liability for the Valerio Trust is $ 47,100 761,350arrow_forwardTransactions Affecting E&P. For each of the following transactions, indicate whether a special adjustment must be made in computing R Corporation's current E&P. Answer assuming that E&P has already been adjusted for current taxable income. a. During the year, the corporation paid estimated Federal income taxes of $25,000 and estimated state income taxes of $10,000. b. The corporation received $5,000 of interest income from its investment in tax-exempt bonds. c. The corporation received a $10,000 dividend from General Motors Corporation. d. The corporation purchased machinery for $9,000 and expensed the entire amount in accordance with Code § 179. e. The corporation reported a § 1245 gain of $20,000. f. The corporation had a capital loss carryover of $7,000 from the previous year. This year the corporation had capital gains before consideration of the loss of $10,000.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you