FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

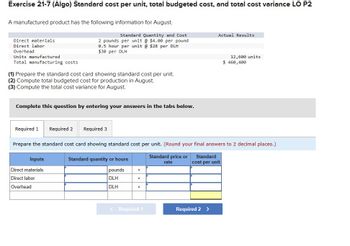

Transcribed Image Text:Exercise 21-7 (Algo) Standard cost per unit, total budgeted cost, and total cost variance LO P2

A manufactured product has the following information for August.

Direct materials

Direct labor

Overhead

Units manufactured

Total manufacturing costs

Standard Quantity and Cost

2 pounds per unit @ $4.00 per pound

0.5 hour per unit @ $28 per DLH

$30 per DLH

Actual Results

12,600 units

$ 460,400

(1) Prepare the standard cost card showing standard cost per unit.

(2) Compute total budgeted cost for production in August.

(3) Compute the total cost variance for August.

Complete this question by entering your answers in the tabs below.

Required 1 Required 2 Required 3

Prepare the standard cost card showing standard cost per unit. (Round your final answers to 2 decimal places.)

Inputs

Direct materials

Standard quantity or hours

pounds

x

Standard price or

rate

Standard

cost per unit

Direct labor

Overhead

DLH

×

DLH

×

< Required 1

Required 2 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please do not give solution in image format thankuarrow_forwardRequired information Use the following information for the Exercises below. (Algo) [The following information applies to the questions displayed below.] A manufactured product has the following information for June. Direct materials Direct labor Overhead Units manufactured Exercise 21-9 (Algo) Direct materials variances LO P3 Standard Quantity and Cost 6 pounds @ $9 per pound 3 DLH @ $17 per DLH 3 DLH @ $11 per DLH AQ = Actual Quantity SQ = Standard Quantity AP = Actual Price SP = Standard Price Actual Cost Actual Results 45,500 pounds @ $9.20 per pound 22,300 hours @ $17.50 per hour $ 254,300 Compute the (1) direct materials price variance and (2) direct materials quantity variance. (Indicate the effect of each variance by selecting favorable, unfavorable, or no variance. Round "Cost per unit" answers to 2 decimal places.) 7,500 units Standard Costarrow_forwardDirect materials Direct labor Variable overhead 6.5 ounces 0.2 hours 0.2 hours The company reported the following results concerning this product in June. Originally budgeted output Actual output Raw materials used in production Purchases of raw materials Actual direct labor-hours Actual cost of raw materials purchases Actual direct labor cost Actual variable overhead cost ➡ 2,700 2,800 19,380 21,400 x 500 $ 40,660 $ 12,050 $3,100 The variable overhead Efficiency variance for June is: $360 F $360 U $372 U $372 F $ 2.00 per ounce $23.00 per hour $6.00 per hour The company applies variable overhead on the basis of direct labor-hours. units units ounces ounces hours $ 13.00 $4.60 $1.20arrow_forward

- #3 Required information [The following information applies to the questions displayed below.] A manufactured product has the following information for June. Direct materials Direct labor Overhead Units manufactured Standard Quantity and Cost 6 pounds @ $9 per pound 2 DLH @ $17 per DLH 2 DLH @ $12 per DLH Total budgeted (standard) cost Actual Results (1) Prepare the standard cost card showing standard cost per unit. (2) Compute total budgeted cost for June production. (3) Compute total actual cost for June production. (4) Compute total cost variance for June.arrow_forwardExercise 17-15 (Algo) Computing activity rates, overhead allocation, and cost per unit LO P3 Lucern Company reports the following for its overhead cost for the year. Activity Budgeted Cost Budgeted Activity Usage Engineering support $ 34,300 70 design changes Electricity 35,400 3,540 machine hours Setup 58,800 490 setups 1. Compute the activity rate for each activity using activity-based costing.2. The company’s Pro model used these activities to produce 1,200 units during the year: 2 design changes, 130 machine hours, and 10 setups. Allocate overhead cost to the Pro model and compute its overhead cost per unit using activity-based costing.arrow_forwardMC Qu. 10-65 Assume that... Cost standards for one unit of product no. C77: Direct material Direct labor 3 pounds at $2.70 per pound 7 hours at $7.50 per hour Actual results: Units produced 5,900 units Direct material purchased Direct material used 27,000 pounds at $2.90 17,400 pounds at $2.90 41,500 hours at $7.30 Direct labor Assume that the company computes variances at the earliest point in time. The standard hours allowed for the work performed are: Multiple Choice O 40,250. 41,450. 41,300. 41,200. None of the answers is correct. O $ 8.10 52.50 $ 78,300 50,460 302,950arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education