ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

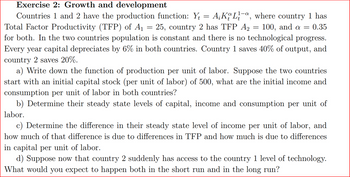

Transcribed Image Text:Exercise 2: Growth and development

Countries 1 and 2 have the production function: Y = AKL-a, where country 1 has

Total Factor Productivity (TFP) of A₁ = 25, country 2 has TFP A₂ = 100, and a = 0.35

A2

for both. In the two countries population is constant and there is no technological progress.

Every year capital depreciates by 6% in both countries. Country 1 saves 40% of output, and

country 2 saves 20%.

a) Write down the function of production per unit of labor. Suppose the two countries

start with an initial capital stock (per unit of labor) of 500, what are the initial income and

consumption per unit of labor in both countries?

b) Determine their steady state levels of capital, income and consumption per unit of

labor.

c) Determine the difference in their steady state level of income per unit of labor, and

how much of that difference is due to differences in TFP and how much is due to differences

in capital per unit of labor.

d) Suppose now that country 2 suddenly has access to the country 1 level of technology.

What would you expect to happen both in the short run and in the long run?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Consider a numerical example using the Solow Growth Model, for 2 countries. Country A: d=0.1, s=0.3, n=0.01, z=1, F(K,L)=K0.3n0.7 Country B: d=0.1, s=0.2, n=0.01, z=1.5, F(K,L)=K0.4N0.6 Which Country has a higher level of GDP per capita in steady state? O Country A O Country B Not enough informationarrow_forwardCapital per person in France is about 81 percent of the U.S. level and per capita income is about 79 percent of the U.S. level. Given that per capita income y = Ak0.3, calculate the level of total factor productivity (A), relative to the U.S. level, that would be needed for France to match the U.S. level of per capita income. Round your answer to 2 decimal places.arrow_forward3). Let's consider the Solow Model without technology advancement. Y(t)=2K(t)^(1/2)*L(t)^(1/2) The population growth rate=0.02 Capital accumulation is s*Y(t)-d*K s=0.2, d=0.03 d is the capital depreciation rate. In the steady state, please calculate the following measurements. (a)Capital per capita A. 16 В. 24 С. 36 D. 48 Е. 64 F. None of the above (b)Marginal product of capital (Hint: The first derivative of Y with respect to K) А. 1 В. 1/2 С. 1/4 D. 1/8 E. 1/16 F. None of the abovearrow_forward

- = 2. Consider a Solow growth model in which the production function is Yt AK²N₁¹/2, where A = 1. Moreover, assume that the depreciation rate is d = 0.02, the rate of population growth is n = 0.02, and the saving rate is s = = 0.2. a. Compute the value of the capital stock per worker in steady state. b. Draw a graph that represents the steady-state equilibrium of the model. c. Suppose that the capital-labor ration in year t is 90. What will the level of the capital- labor ratio be in year t+1? Will it increase or decrease in future periods? Explain. d. Compute the rate of change of the capital labor ratio between time t and t + 1. How does it compare to the rate of growth of the capital-labor ratio in steady state?arrow_forwardCountry A and Country B both have the production function Y = F(K,L) = K¹/32/3 neither country experiences population growth or technological progress and that 20 percent of capital depreciates each year. Assume further that country A saves 10 percent of output each year and country B saves 30 percent of output each year. Now suppose that both countries start in year 1 with a capital stock per worker of 1. In what year will consumption in country B be higher than consumption in Country A? An excel spreadsheet may help simplify your calculation. You will need to round your calculations to 3 decimal places. O O O 5 6 4 Assume that 07arrow_forwardConsider a country with a nominal gross domestic product (GDP) of $1.0, trillion in 2013 and $1.1 trillion in 2018. In the same period the population decreased by 2% and price levels increased by 4%. What is the economic growth rate for this country? Ⓒ2% Ⓒ4% Ⓒ6% Ⓒ8% 10% Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education